Decoding the Chart of Accounts: The Spine of Monetary Reporting

Associated Articles: Decoding the Chart of Accounts: The Spine of Monetary Reporting

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Decoding the Chart of Accounts: The Spine of Monetary Reporting. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Decoding the Chart of Accounts: The Spine of Monetary Reporting

/Financial%20Statements%20Decoding%20the%20Backbone%20of%20Business.webp)

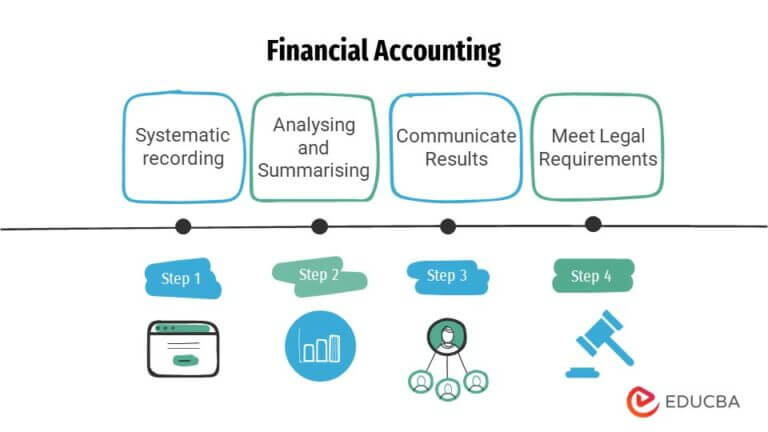

The chart of accounts (COA) is a cornerstone of any group’s monetary administration system. It is greater than only a record; it is a meticulously structured framework that categorizes each monetary transaction, offering a transparent and constant view of a company’s monetary well being. Understanding the chart of accounts is essential for correct bookkeeping, monetary reporting, and knowledgeable decision-making. This text delves deep into the intricacies of the chart of accounts, explaining its function, construction, design issues, and its important position in numerous accounting processes.

What’s a Chart of Accounts?

Merely put, a chart of accounts is a complete record of all of the accounts utilized by a company to document its monetary transactions. Every account represents a particular component of the group’s monetary actions, comparable to belongings, liabilities, fairness, revenues, and bills. These accounts are organized in a hierarchical construction, permitting for detailed monitoring and evaluation of economic knowledge. Consider it as an in depth index for all of the monetary actions of a enterprise. Each transaction is assigned to a number of accounts inside this construction, guaranteeing that each one monetary data is categorized and readily accessible.

The Function of a Chart of Accounts:

The first function of a chart of accounts is to supply a standardized and constant technique for recording and classifying monetary transactions. This consistency is significant for a number of causes:

-

Correct Monetary Reporting: A well-designed COA ensures that each one monetary knowledge is precisely categorized, enabling the era of correct and dependable monetary statements, such because the steadiness sheet, revenue assertion, and money stream assertion. Inaccurate categorization can result in misstated monetary outcomes, probably impacting essential enterprise choices.

-

Simplified Bookkeeping: By offering a transparent framework for classifying transactions, the COA simplifies the bookkeeping course of. It streamlines knowledge entry, reduces errors, and makes it simpler to find and analyze particular monetary data.

-

Enhanced Monetary Evaluation: The structured nature of the COA facilitates detailed monetary evaluation. By categorizing transactions into particular accounts, companies can observe efficiency metrics, establish developments, and make knowledgeable choices about useful resource allocation, value administration, and future investments.

-

Improved Inside Controls: A well-defined COA contributes to a strong inside management system. By assigning particular duties for managing completely different accounts, companies can improve accountability and cut back the chance of fraud or errors.

-

Compliance with Accounting Requirements: The COA should adjust to usually accepted accounting rules (GAAP) or Worldwide Monetary Reporting Requirements (IFRS), relying on the group’s location and reporting necessities. This ensures that monetary statements are ready in accordance with established accounting requirements.

-

Facilitating Budgeting and Forecasting: The COA gives the framework for creating budgets and forecasts. By utilizing the identical account construction for each precise transactions and price range projections, companies can simply examine precise efficiency towards deliberate targets.

Construction and Parts of a Chart of Accounts:

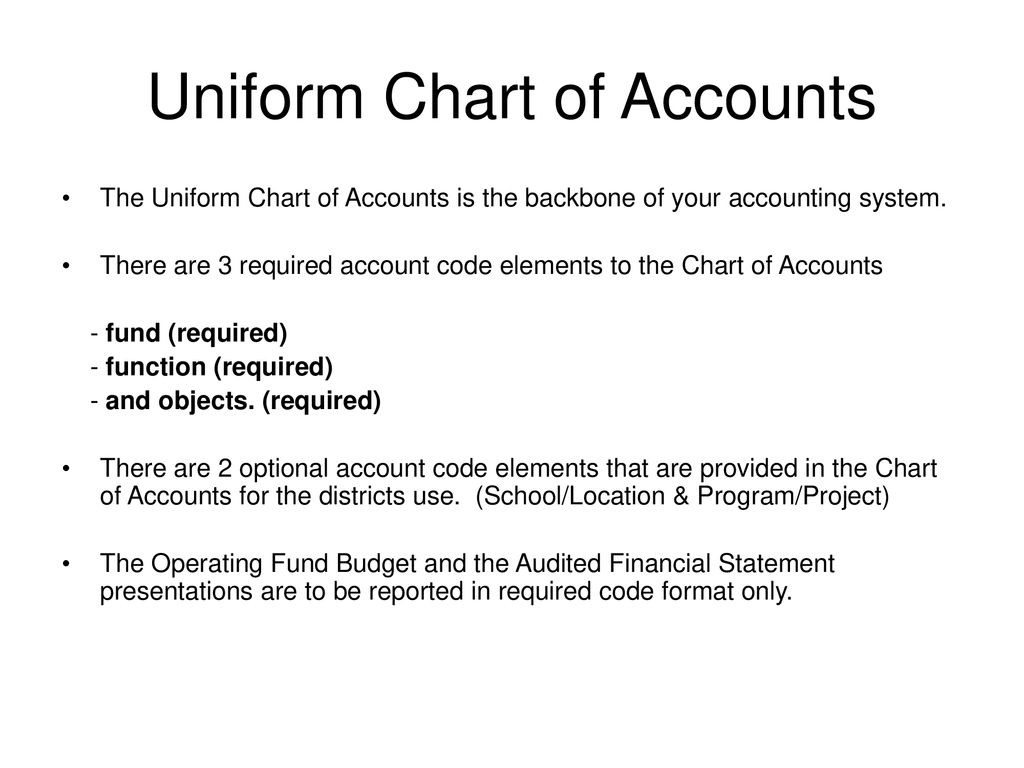

The construction of a COA can range relying on the scale and complexity of the group, nevertheless it sometimes follows a hierarchical format, typically utilizing a numbering system to establish and categorize accounts. The most typical construction relies on the accounting equation: Belongings = Liabilities + Fairness.

-

Belongings: These symbolize sources owned by the group, together with money, accounts receivable, stock, property, plant, and gear (PP&E). These are normally numbered within the decrease ranges of the chart.

-

Liabilities: These symbolize the group’s obligations to others, together with accounts payable, loans payable, and deferred income. These accounts are sometimes numbered increased than asset accounts.

-

Fairness: This represents the proprietor’s or shareholders’ funding within the group, together with retained earnings and contributed capital. These accounts are sometimes numbered after liabilities.

-

Revenues: These symbolize the inflows of sources from the group’s major operations, comparable to gross sales income, service income, and curiosity income. These are sometimes assigned increased numbers than legal responsibility accounts.

-

Bills: These symbolize the outflows of sources incurred in producing revenues, comparable to value of products offered, salaries expense, hire expense, and utilities expense. These accounts are normally numbered after income accounts.

Inside every of those fundamental classes, sub-accounts will be created to supply extra granular element. For instance, inside the "Bills" class, there may be sub-accounts for "Salaries Expense," "Lease Expense," "Utilities Expense," and so forth. This hierarchical construction permits for detailed monitoring and evaluation of economic knowledge. The numbering system facilitates fast identification and categorization of transactions.

Designing a Chart of Accounts:

Designing an efficient chart of accounts requires cautious planning and consideration of the group’s particular wants. A number of components must be taken under consideration:

-

Trade-Particular Necessities: Sure industries have particular accounting necessities that have to be mirrored within the COA. For instance, a producing firm will want accounts for uncooked supplies, work-in-progress, and completed items, whereas a service firm may not.

-

Measurement and Complexity of the Group: A small enterprise may require a less complicated COA than a big multinational company. The extent of element wanted will rely upon the group’s measurement and complexity.

-

Future Progress and Growth: The COA must be designed to accommodate future progress and growth. It must be versatile sufficient to deal with new merchandise, providers, and enterprise segments.

-

Administration Data Wants: The COA must be designed to supply the knowledge wanted by administration for decision-making. This may contain creating particular accounts to trace key efficiency indicators (KPIs).

-

Software program Compatibility: The COA must be suitable with the group’s accounting software program. This ensures that knowledge will be simply imported, exported, and analyzed.

Sustaining and Updating the Chart of Accounts:

The chart of accounts isn’t a static doc. It must be frequently reviewed and up to date to replicate modifications within the group’s operations, accounting requirements, and administration data wants. Common updates make sure the COA stays related and efficient in supporting the group’s monetary reporting and decision-making processes. Adjustments must be documented and communicated to all related personnel to take care of consistency and accuracy.

Conclusion:

The chart of accounts is a important part of any group’s monetary administration system. It gives a structured framework for recording and classifying monetary transactions, enabling correct monetary reporting, simplified bookkeeping, enhanced monetary evaluation, and improved inside controls. Designing and sustaining a well-structured and frequently up to date chart of accounts is important for efficient monetary administration and knowledgeable decision-making. By understanding the rules outlined on this article, companies can leverage the ability of their chart of accounts to achieve a transparent and complete understanding of their monetary efficiency.

Closure

Thus, we hope this text has supplied priceless insights into Decoding the Chart of Accounts: The Spine of Monetary Reporting. We hope you discover this text informative and helpful. See you in our subsequent article!