Chart Patterns with Retests: A Deeper Dive into Dependable Buying and selling Indicators

Associated Articles: Chart Patterns with Retests: A Deeper Dive into Dependable Buying and selling Indicators

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Chart Patterns with Retests: A Deeper Dive into Dependable Buying and selling Indicators. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Chart Patterns with Retests: A Deeper Dive into Dependable Buying and selling Indicators

Chart patterns are visible representations of value motion on a chart, providing merchants worthwhile insights into potential future value actions. Whereas quite a few patterns exist, their effectiveness hinges on affirmation, and some of the sturdy confirmations is a retest. A retest happens when the worth returns to a beforehand damaged help or resistance degree, offering a possible entry level for merchants aligned with the sample’s predicted course. This text delves into the importance of retests in varied chart patterns, exploring their mechanics, implications, and the best way to successfully make the most of them in buying and selling methods.

Understanding Chart Patterns and Their Implications

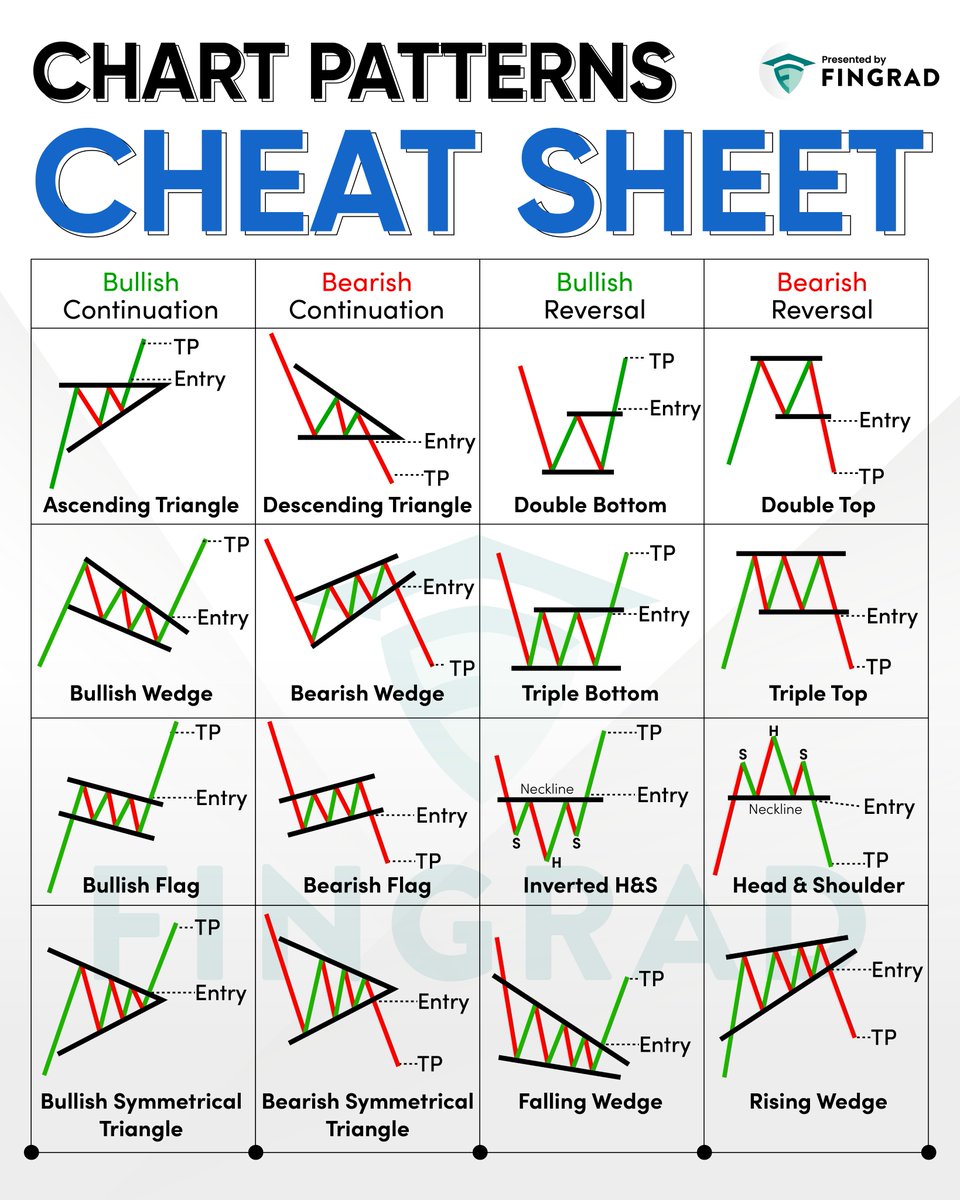

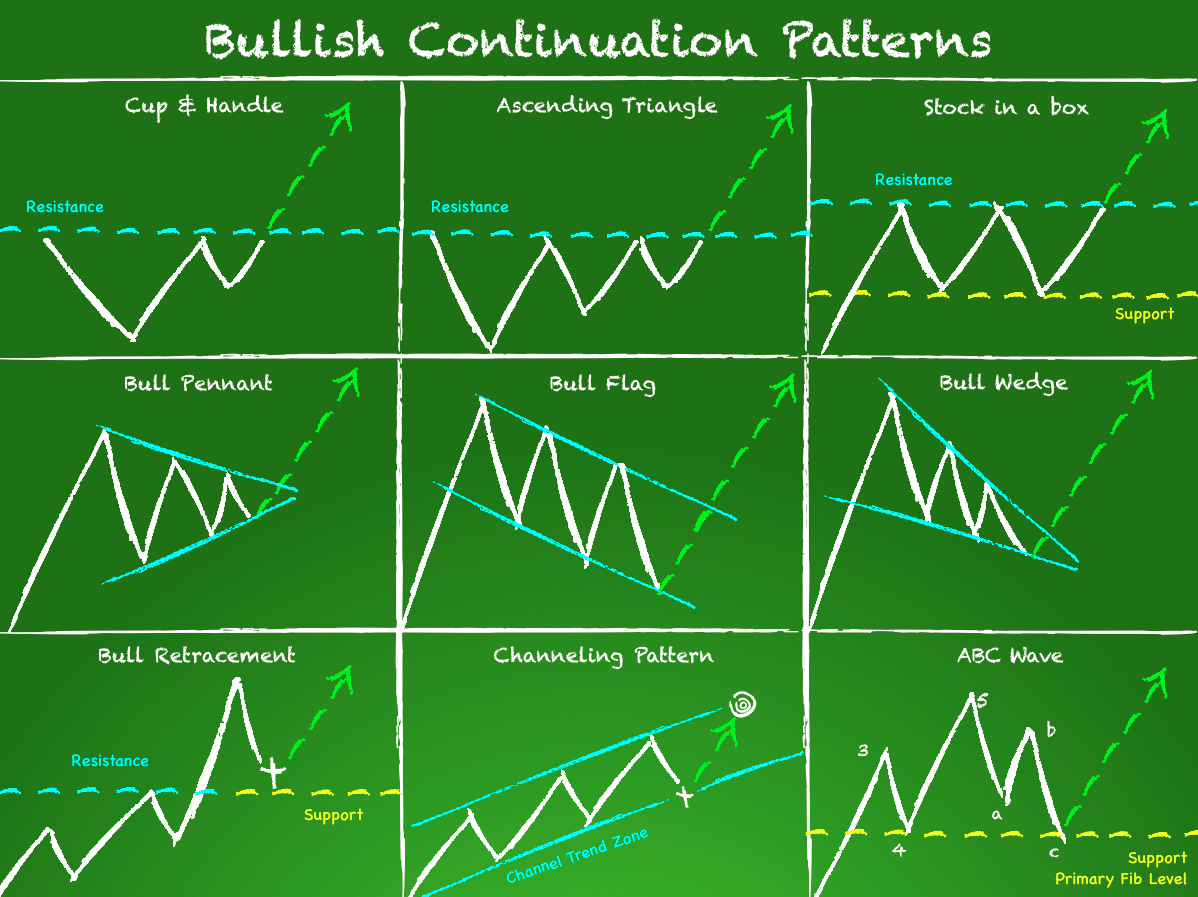

Earlier than diving into retests, let’s briefly assessment some widespread chart patterns. These patterns emerge from the interaction of provide and demand, reflecting shifts in market sentiment and potential value reversals or continuations. Key patterns embody:

-

Head and Shoulders (H&S): A bearish reversal sample characterised by three peaks, with the center peak (the top) being the very best. A neckline connects the troughs of the left and proper shoulders. A breakdown under the neckline alerts a possible bearish development.

-

Inverse Head and Shoulders (IH&S): The bullish counterpart of the H&S sample. It options three troughs, with the center trough being the bottom. A breakout above the neckline suggests a possible bullish development.

-

Double Tops/Bottoms: These patterns signify a brief pause in a development. A double high signifies a possible bearish reversal after two comparable value highs, whereas a double backside suggests a bullish reversal after two comparable value lows.

-

Triangles (Ascending, Descending, Symmetrical): Triangles are continuation patterns shaped by converging trendlines. Ascending triangles are bullish, descending triangles are bearish, and symmetrical triangles provide much less directional bias. Breakouts from these patterns usually sign continuation of the prevailing development.

-

Flags and Pennants: These patterns are short-term continuation patterns resembling flags or pennants connected to a pole (the previous development). They usually point out a brief pause earlier than the resumption of the principle development.

-

Rectangles: These patterns signify a interval of consolidation, with value bouncing between horizontal help and resistance ranges. Breakouts above or under the rectangle usually sign continuation of the previous development.

The Essential Position of Retests

Whereas the formation of those patterns supplies preliminary indications of potential value actions, retests considerably improve their reliability. A retest happens when the worth, after breaking a key degree (just like the neckline in an H&S or the resistance line in a rectangle), retraces again to that degree. This retracement presents a number of essential advantages:

-

Affirmation of the Breakout: A retest acts as affirmation that the preliminary breakout was not a false sign. A profitable retest, the place the worth bounces off the earlier resistance/help, reinforces the validity of the sample and the anticipated development.

-

Improved Danger-Reward Ratio: Coming into a commerce after a retest usually improves the risk-reward ratio. Merchants can place their stop-loss order slightly below the retest degree (for lengthy positions) or above it (for brief positions), minimizing potential losses whereas aiming for a bigger revenue goal based mostly on the sample’s projected transfer.

-

Improved Entry Level: Retests present a extra favorable entry level in comparison with coming into instantly after the preliminary breakout. The preliminary breakout may be unstable, and a retest permits merchants to enter at a probably higher value, lowering the danger of rapid drawdown.

-

Identification of Weak Breakouts: If the worth fails to carry above or under the retest degree, it means that the preliminary breakout may need been weak or a false sign. This permits merchants to keep away from probably shedding trades.

Forms of Retests and Their Significance

Retests can manifest in varied methods, every carrying completely different implications:

-

Clear Retest: A clear retest happens when the worth briefly touches the earlier help/resistance degree and bounces again decisively, displaying sturdy rejection. That is the best situation for a assured commerce entry.

-

A number of Retests: Typically, the worth may retest the extent a number of occasions. Whereas this will improve the boldness within the sample, it additionally will increase the danger of a false breakout if the worth finally breaks via the extent.

-

Shallow Retest: A shallow retest includes a minimal value retracement to the earlier help/resistance degree. Whereas it nonetheless supplies affirmation, the energy of the affirmation may be weaker than a deeper retest.

-

Failed Retest: A failed retest happens when the worth breaks via the earlier help/resistance degree, invalidating the sample and suggesting a possible reversal of the anticipated development. This highlights the significance of stop-loss orders.

Methods for Buying and selling with Retests

Successfully using retests in buying and selling requires a disciplined strategy:

-

Sample Identification: Precisely determine the chart sample. Make sure the sample meets the particular standards for the chosen sample (e.g., clear neckline in H&S, converging trendlines in triangles).

-

Breakout Affirmation: Look ahead to a transparent breakout of the important thing degree (e.g., neckline, trendline). Keep away from coming into trades on marginal breakouts.

-

Retest Identification: Observe the worth motion after the breakout. Search for a retracement again to the beforehand damaged help or resistance degree.

-

Entry Level: Enter a protracted place after a bullish retest (bounce off help) or a brief place after a bearish retest (bounce off resistance).

-

Cease-Loss Placement: Place your stop-loss order slightly below the retest degree for lengthy positions or simply above it for brief positions.

-

Revenue Goal: Decide your revenue goal based mostly on the sample’s projected transfer. This may be calculated utilizing varied strategies, together with measuring the sample’s peak or utilizing Fibonacci retracements.

-

Danger Administration: All the time follow correct danger administration by solely risking a small proportion of your buying and selling capital on every commerce.

Conclusion:

Chart patterns with retests provide a robust mixture for figuring out high-probability buying and selling alternatives. By understanding the mechanics of varied chart patterns and the importance of retests, merchants can enhance their buying and selling accuracy and danger administration. Keep in mind that no buying and selling technique is foolproof, and correct danger administration, thorough evaluation, and steady studying are essential for long-term success. Whereas this text supplies a complete overview, additional analysis and sensible expertise are important for mastering this worthwhile buying and selling approach. All the time backtest your methods and adapt your strategy based mostly on market circumstances and your private danger tolerance. The mix of sample recognition and the affirmation offered by a retest considerably will increase the chance of profitable buying and selling, however diligent commentary and disciplined execution stay paramount.

Closure

Thus, we hope this text has offered worthwhile insights into Chart Patterns with Retests: A Deeper Dive into Dependable Buying and selling Indicators. We hope you discover this text informative and useful. See you in our subsequent article!