Deciphering the WTI Crude Oil Chart on TradingView: A Complete Information

Associated Articles: Deciphering the WTI Crude Oil Chart on TradingView: A Complete Information

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Deciphering the WTI Crude Oil Chart on TradingView: A Complete Information. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Deciphering the WTI Crude Oil Chart on TradingView: A Complete Information

West Texas Intermediate (WTI) crude oil is a globally acknowledged benchmark for pricing oil, influencing power markets worldwide. Understanding its value actions is essential for merchants and buyers alike. TradingView, a preferred charting platform, gives a robust device for analyzing WTI’s value motion, providing a wealth of indicators and drawing instruments. This text will delve into efficient methods for using TradingView’s WTI crude oil chart, exploring technical evaluation strategies and danger administration ideas.

Understanding the WTI Crude Oil Market:

Earlier than diving into chart evaluation, it is important to understand the components influencing WTI costs. These embrace:

- Geopolitical Occasions: Conflicts, political instability, and sanctions in main oil-producing areas considerably impression provide and, consequently, value.

- OPEC+ Choices: The Group of the Petroleum Exporting Nations (OPEC) and its allies (OPEC+) affect world provide by means of manufacturing quotas, impacting WTI costs.

- Financial Development: Robust world financial progress typically results in elevated oil demand, driving costs greater. Conversely, financial slowdowns or recessions can depress demand and costs.

- US Greenback Power: WTI is priced in US {dollars}. A stronger greenback makes oil costlier for patrons utilizing different currencies, probably decreasing demand and decreasing costs.

- Stock Ranges: Modifications in crude oil inventories in america, a significant oil shopper, affect market sentiment and value. Excessive inventories can recommend oversupply, placing downward stress on costs.

- Technological Developments: Developments in renewable power and power effectivity can impression long-term oil demand.

- Hypothesis and Sentiment: Market sentiment, pushed by information and hypothesis, can considerably affect short-term value volatility.

Navigating the TradingView WTI Crude Oil Chart:

TradingView gives a user-friendly interface with customizable charts, quite a few indicators, and drawing instruments. When analyzing the WTI chart, think about the next:

-

Selecting the Proper Timeframe: Deciding on the suitable timeframe is essential. Quick-term timeframes (e.g., 1-minute, 5-minute, 1-hour) are appropriate for day buying and selling and scalping, specializing in short-term value fluctuations. Longer timeframes (e.g., each day, weekly, month-to-month) are higher suited to swing buying and selling and longer-term funding methods, concentrating on broader tendencies.

-

Using Technical Indicators: TradingView gives an unlimited library of technical indicators. Some generally used indicators for WTI evaluation embrace:

-

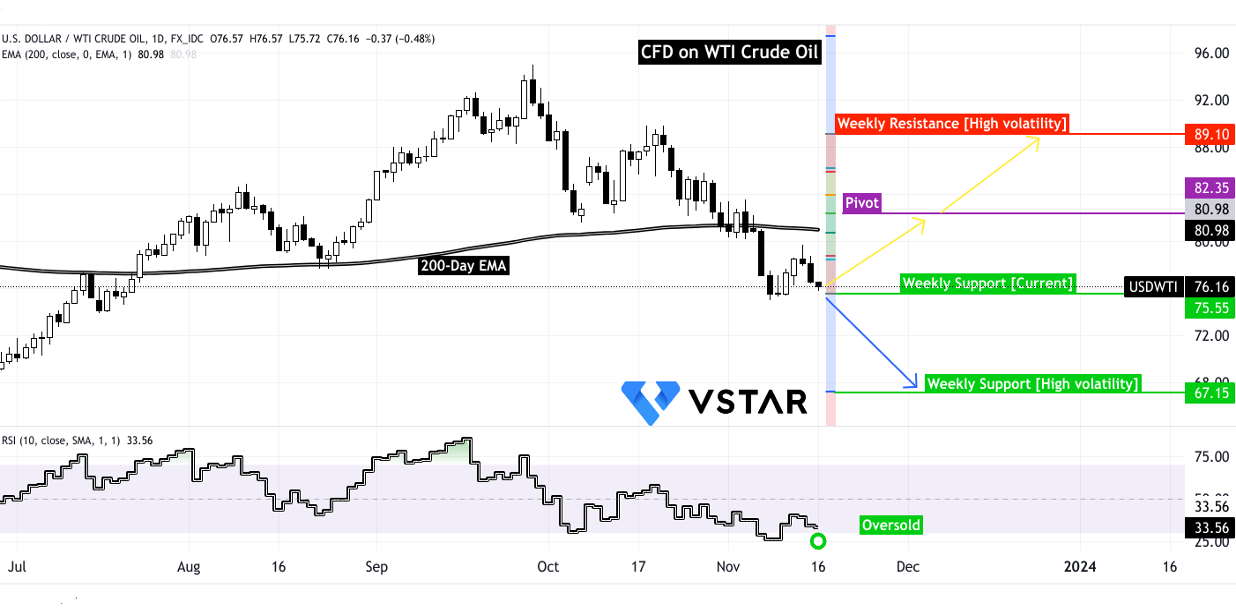

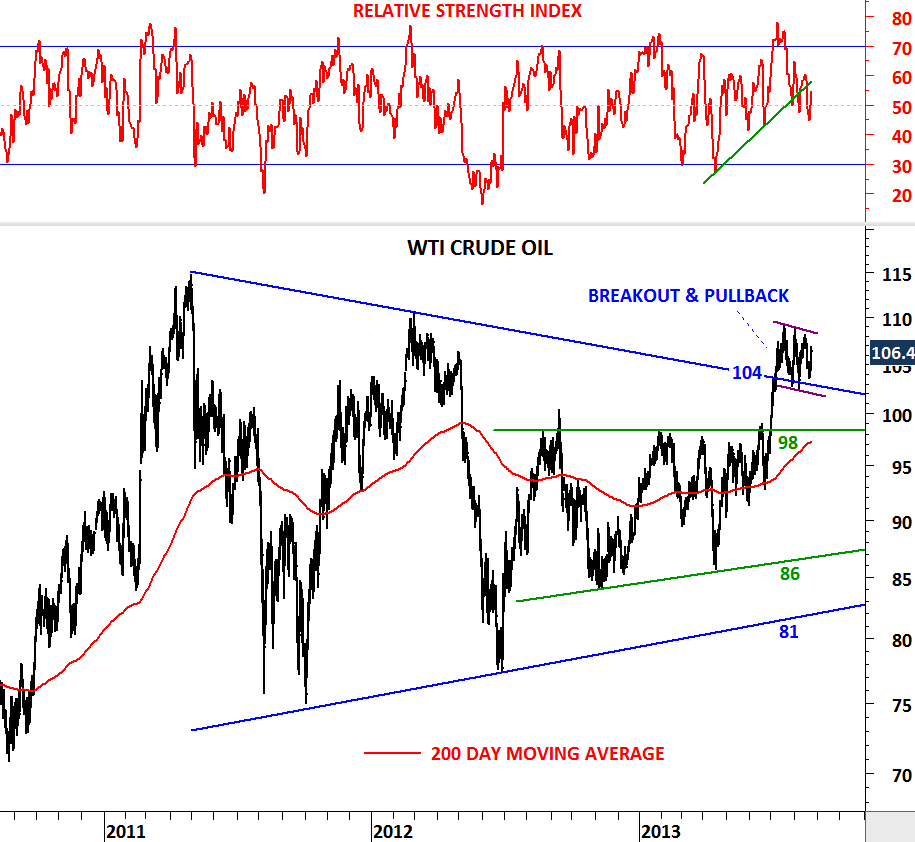

Transferring Averages (MA): Easy Transferring Common (SMA) and Exponential Transferring Common (EMA) assist establish tendencies and potential help/resistance ranges. Crossovers between totally different MAs can sign potential purchase or promote alerts.

-

Relative Power Index (RSI): This momentum indicator helps establish overbought (above 70) and oversold (under 30) circumstances, probably indicating reversal factors.

-

MACD (Transferring Common Convergence Divergence): This trend-following momentum indicator identifies modifications in development energy and potential purchase/promote alerts by means of its histogram and sign line.

-

Bollinger Bands: These bands present value volatility and potential reversal factors when costs contact the higher or decrease bands.

-

Quantity Indicators: Analyzing quantity alongside value motion can verify development energy and potential breakouts. Excessive quantity throughout value will increase confirms a powerful uptrend, whereas excessive quantity throughout value decreases confirms a powerful downtrend.

-

-

Using Chart Patterns: Recognizing chart patterns can present insights into potential value actions. Frequent patterns embrace:

- Head and Shoulders: A reversal sample suggesting a possible development change.

- Double Tops/Bottoms: Reversal patterns indicating potential value reversals.

- Triangles: Continuation or reversal patterns relying on the kind of triangle.

- Flags and Pennants: Continuation patterns suggesting a continuation of the prevailing development.

-

Drawing Assist and Resistance Ranges: Figuring out help (value ranges the place shopping for stress outweighs promoting stress) and resistance (value ranges the place promoting stress outweighs shopping for stress) ranges is essential for figuring out potential entry and exit factors. These ranges might be drawn utilizing horizontal strains or trendlines.

-

Using Fibonacci Retracements: Fibonacci retracements can establish potential help and resistance ranges primarily based on Fibonacci ratios. These ranges may help merchants establish potential entry and exit factors inside a development.

Threat Administration Methods:

Profitable WTI buying and selling requires a sturdy danger administration plan. Key points embrace:

-

Place Sizing: By no means danger greater than a small proportion of your buying and selling capital on a single commerce. A typical rule of thumb is to danger not more than 1-2% per commerce.

-

Cease-Loss Orders: All the time use stop-loss orders to restrict potential losses. Place stop-loss orders under help ranges for lengthy positions and above resistance ranges for brief positions.

-

Take-Revenue Orders: Outline your revenue targets earlier than getting into a commerce. Take-profit orders assist lock in earnings and forestall potential reversals from eroding features.

-

Diversification: Do not put all of your eggs in a single basket. Diversify your buying and selling portfolio throughout totally different belongings to scale back general danger.

-

Backtesting: Earlier than implementing any buying and selling technique, backtest it utilizing historic knowledge to judge its efficiency and establish potential weaknesses.

Combining Elementary and Technical Evaluation:

Whereas this text focuses on technical evaluation utilizing TradingView, it is essential to contemplate elementary evaluation as nicely. Combining each approaches gives a extra holistic view of the market and improves buying and selling choices. Elementary evaluation entails assessing components like geopolitical occasions, financial knowledge, and OPEC+ choices, which might considerably affect WTI costs.

Conclusion:

TradingView’s WTI crude oil chart gives a complete platform for technical evaluation. By mastering using varied indicators, chart patterns, and danger administration strategies, merchants can enhance their understanding of WTI value actions and improve their buying and selling efficiency. Nonetheless, it is vital to do not forget that no buying and selling technique ensures earnings, and losses are an inherent a part of buying and selling. Steady studying, adaptation, and disciplined danger administration are essential for long-term success within the risky WTI crude oil market. All the time conduct thorough analysis and think about consulting with a monetary advisor earlier than making any funding choices. The knowledge supplied on this article is for instructional functions solely and doesn’t represent monetary recommendation.

Closure

Thus, we hope this text has supplied useful insights into Deciphering the WTI Crude Oil Chart on TradingView: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!