Decoding Right now’s 30-12 months Mortgage Charges: A Complete Information with Charts and Evaluation

Associated Articles: Decoding Right now’s 30-12 months Mortgage Charges: A Complete Information with Charts and Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding Right now’s 30-12 months Mortgage Charges: A Complete Information with Charts and Evaluation. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Decoding Right now’s 30-12 months Mortgage Charges: A Complete Information with Charts and Evaluation

The 30-year fixed-rate mortgage stays the gold customary for homebuyers, providing predictable month-to-month funds and long-term stability. Nonetheless, navigating the ever-shifting panorama of mortgage charges can really feel overwhelming. This text will delve into understanding at present’s 30-year mortgage charges, offering an in depth evaluation supported by illustrative charts, and providing insights into components influencing these charges. We’ll additionally discover learn how to discover the very best fee on your particular person circumstances.

Understanding the Present 30-12 months Mortgage Fee Panorama:

(Observe: As a result of dynamic nature of mortgage charges, offering a selected chart with real-time knowledge inside this textual content is inconceivable. The next sections will talk about learn how to discover up-to-date data and interpret the info offered on these sources.)

To seek out essentially the most present 30-year mortgage charges, it is best to seek the advice of respected monetary web sites and mortgage lenders. These sources sometimes present charts displaying common charges from numerous lenders throughout the nation, typically damaged down by credit score rating and mortgage kind. Search for websites that clearly point out the date of the info, as charges can fluctuate each day, even hourly.

When inspecting these charts, pay shut consideration to the next:

-

Common Fee: This represents the common fee supplied by a spread of lenders. Take into account that that is a median, and your particular person fee could also be larger or decrease relying in your creditworthiness and different components.

-

Fee Vary: The vary signifies the variation in charges supplied. A variety suggests a extra aggressive market, whereas a slender vary may point out much less competitors.

-

Credit score Rating Impression: Charges are often categorized by credit score rating ranges (e.g., 620-659, 660-699, 700-759, 760+). A better credit score rating sometimes qualifies you for a decrease rate of interest.

-

Mortgage Kind: The chart could differentiate charges for standard loans, FHA loans, VA loans, and USDA loans. Every mortgage kind has its personal eligibility necessities and fee construction.

-

Factors: Some lenders could provide decrease charges in alternate for "factors," that are upfront charges paid to cut back the rate of interest. The chart may present charges with and with out factors, permitting you to check the general value.

Elements Influencing 30-12 months Mortgage Charges:

A number of interconnected components affect the prevailing 30-year mortgage charges:

-

Federal Reserve Coverage: The Federal Reserve (the Fed) performs an important position in setting rates of interest. When the Fed raises its benchmark rate of interest (the federal funds fee), borrowing prices usually improve, resulting in larger mortgage charges. Conversely, decrease federal funds charges often translate to decrease mortgage charges.

-

Inflation: Excessive inflation erodes the buying energy of cash, prompting the Fed to lift rates of interest to curb inflation. This, in flip, impacts mortgage charges.

-

Financial Development: Sturdy financial development can result in larger rates of interest as traders anticipate elevated demand for loans. Conversely, weak financial development may end in decrease charges.

-

Authorities Bond Yields: Mortgage charges are sometimes tied to the yields on authorities bonds, significantly 10-year Treasury notes. When bond yields rise, mortgage charges are likely to comply with go well with.

-

Provide and Demand: The general demand for mortgages and the provision of funds from lenders additionally influence charges. Excessive demand with restricted provide can push charges larger.

-

World Financial Circumstances: Worldwide occasions and financial developments also can affect US mortgage charges. For instance, international uncertainty may result in larger charges as traders search safer investments.

Deciphering Charts and Making Knowledgeable Choices:

When analyzing charts displaying 30-year mortgage charges, take into account the next:

-

Knowledge Supply Reliability: Make sure the supply is respected and supplies clear methodology for knowledge assortment.

-

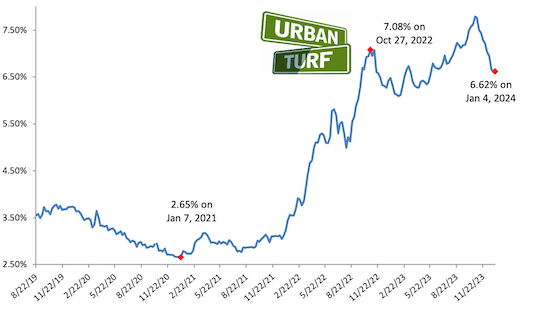

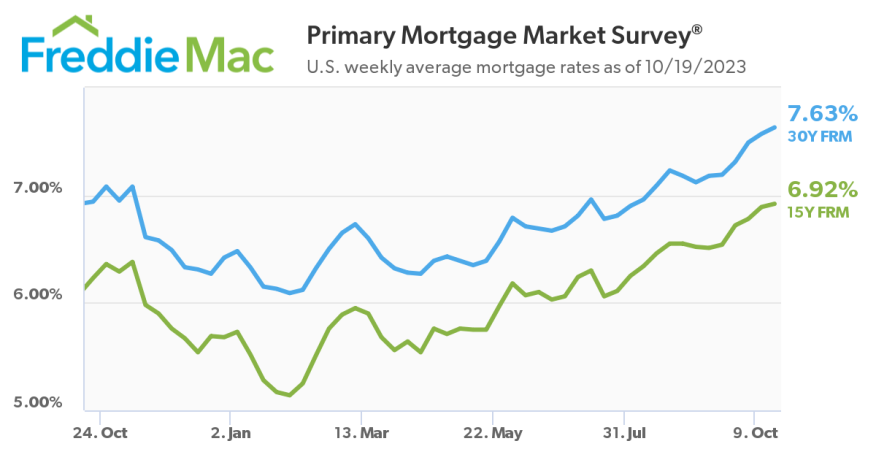

Historic Context: Evaluate present charges to historic averages to know the present market place. A easy line chart displaying the historic pattern of 30-year mortgage charges can present invaluable perspective.

-

Private Circumstances: Your particular person monetary profile considerably impacts the speed you qualify for. A better credit score rating, bigger down fee, and decrease debt-to-income ratio will usually end in a extra favorable fee.

-

Closing Prices: Do not solely concentrate on the rate of interest. Think about the full closing prices related to the mortgage, which might range considerably between lenders.

-

Mortgage Phrases: Fastidiously evaluate all mortgage phrases and situations earlier than signing any mortgage settlement.

Discovering the Greatest Fee for You:

Securing the very best 30-year mortgage fee requires proactive steps:

-

Store Round: Evaluate charges from a number of lenders, together with banks, credit score unions, and on-line mortgage brokers.

-

Enhance Your Credit score Rating: A better credit score rating considerably improves your probabilities of getting a decrease fee. Test your credit score report for errors and take steps to enhance your creditworthiness.

-

Improve Your Down Fee: A bigger down fee reduces the lender’s danger, probably resulting in a greater fee.

-

Negotiate: Do not be afraid to barter with lenders to try to safe a extra favorable fee or phrases.

-

Think about Factors: Consider whether or not paying factors to cut back your rate of interest makes monetary sense in the long term. This typically depends upon how lengthy you intend to remain within the dwelling.

-

Perceive Your Monetary State of affairs: Precisely assess your debt-to-income ratio and different monetary components to find out your affordability and eligibility for various mortgage sorts.

Conclusion:

Navigating the world of 30-year mortgage charges requires cautious evaluation and understanding of the influencing components. By using respected knowledge sources, evaluating charges from a number of lenders, and understanding your individual monetary profile, you may considerably enhance your probabilities of securing the absolute best fee on your dwelling buy. Keep in mind that the data offered right here is for normal steerage solely and shouldn’t be thought of monetary recommendation. At all times seek the advice of with a professional monetary advisor or mortgage skilled earlier than making any main monetary choices. Recurrently monitoring fee developments and staying knowledgeable about financial developments will allow you to make knowledgeable selections when securing your mortgage.

:max_bytes(150000):strip_icc()/12-13-23-last-120-days-of-30-year-mortgage-rate-average-dec-13-2023-4b916fe38b9140f6b6d57a0968bd5b31.png)

Closure

Thus, we hope this text has offered invaluable insights into Decoding Right now’s 30-12 months Mortgage Charges: A Complete Information with Charts and Evaluation. We hope you discover this text informative and helpful. See you in our subsequent article!