Decoding the Reliance Industries Chart: A Deep Dive into India’s Power and Conglomerate Big

Associated Articles: Decoding the Reliance Industries Chart: A Deep Dive into India’s Power and Conglomerate Big

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the Reliance Industries Chart: A Deep Dive into India’s Power and Conglomerate Big. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Decoding the Reliance Industries Chart: A Deep Dive into India’s Power and Conglomerate Big

Reliance Industries Restricted (RIL), a behemoth within the Indian enterprise panorama, boasts a chart that displays its complicated and dynamic nature. Analyzing its historic efficiency, present traits, and future projections requires a multifaceted strategy, contemplating its various enterprise segments, macroeconomic elements, and international market influences. This text delves deep into the Reliance Industries chart, offering a complete understanding of its previous, current, and potential future trajectory.

Historic Efficiency: A Journey of Diversification and Progress

RIL’s chart, spanning many years, tells a narrative of outstanding progress fueled by strategic diversification and astute management. Its early years had been dominated by its petrochemical enterprise, a sector that offered the muse for its subsequent enlargement. The chart reveals intervals of speedy progress, typically correlated with elevated oil costs and increasing home demand. Nevertheless, it additionally shows intervals of consolidation and correction, reflecting international financial cycles and industry-specific challenges.

Analyzing the chart over completely different timeframes reveals a number of key traits:

-

Early Progress (Seventies-Nineteen Nineties): The preliminary part exhibits regular, albeit gradual, progress primarily pushed by the petrochemical enterprise. This era highlights the corporate’s capability to ascertain a powerful foothold in a nascent Indian market. The chart would possibly present comparatively decrease volatility in comparison with later intervals, reflecting a much less diversified portfolio and a extra predictable enterprise atmosphere.

-

Diversification and Growth (2000s): The chart dramatically modifications character within the early 2000s with the entry into telecom (Reliance Jio) and retail (Reliance Retail). This era demonstrates important enlargement, typically marked by sharp upward actions reflecting the success of those new ventures. The elevated volatility within the chart displays the upper danger related to getting into new, aggressive markets.

-

The Jio Revolution (2010s-Current): The launch of Reliance Jio Infocomm represents a pivotal second in RIL’s historical past and is clearly seen on the chart. The aggressive pricing technique and speedy subscriber acquisition led to a surge within the firm’s valuation, mirrored in a major upward development. This era additionally highlights the corporate’s capability to disrupt established industries and capitalize on rising technological traits.

-

Power Transition and Sustainability (Current Traits): The latest years showcase RIL’s give attention to renewable power and sustainability initiatives. The chart would possibly present a gradual shift in the direction of a extra steady, long-term progress trajectory as the corporate diversifies its income streams away from fossil fuels. This displays a proactive response to international environmental issues and evolving investor preferences.

Key Chart Patterns and Technical Indicators:

Analyzing the RIL chart utilizing technical evaluation instruments gives additional insights:

-

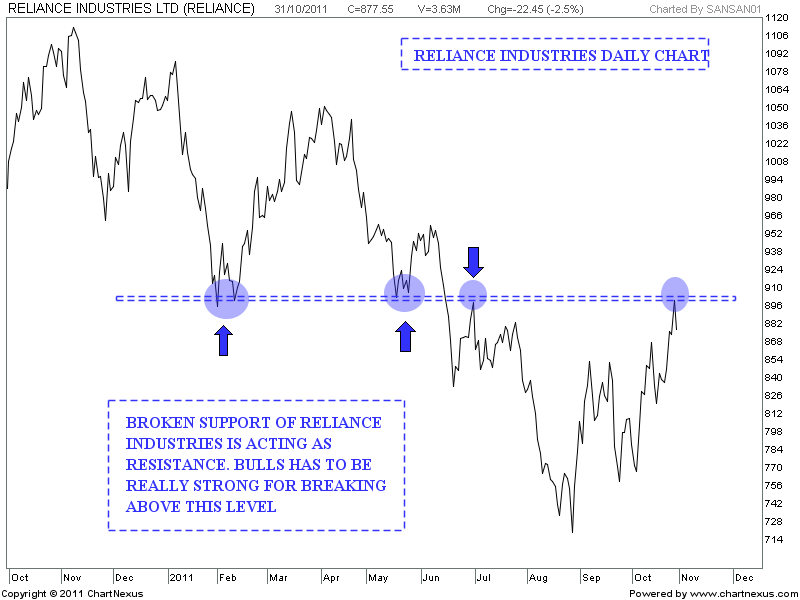

Assist and Resistance Ranges: Figuring out historic help and resistance ranges may help predict future value actions. These ranges signify value factors the place shopping for or promoting stress has been notably robust prior to now. Analyzing these ranges can present potential entry and exit factors for merchants.

-

Transferring Averages: Utilizing transferring averages (e.g., 50-day, 200-day) may help easy out value fluctuations and determine underlying traits. Crossovers between completely different transferring averages can be utilized as purchase or promote alerts.

-

Relative Power Index (RSI): The RSI is a momentum indicator that helps determine overbought and oversold circumstances. An RSI above 70 suggests the inventory is perhaps overbought, whereas an RSI beneath 30 suggests it is perhaps oversold.

-

Quantity Evaluation: Analyzing buying and selling quantity alongside value actions gives essential context. Excessive quantity throughout value will increase suggests robust shopping for stress, whereas excessive quantity throughout value decreases suggests robust promoting stress.

Elements Influencing the Reliance Industries Chart:

The RIL chart just isn’t solely decided by inside elements. A number of exterior forces considerably impression its efficiency:

-

World Crude Oil Costs: As a major participant within the power sector, RIL’s efficiency is intently tied to international crude oil costs. Rising oil costs typically profit the corporate’s refining and petrochemical companies, whereas falling costs can negatively impression profitability.

-

Indian Financial Progress: The general well being of the Indian economic system considerably influences RIL’s efficiency. Sturdy financial progress typically interprets into greater demand for RIL’s services and products throughout its numerous segments.

-

Authorities Insurance policies and Rules: Authorities insurance policies associated to power, telecom, and retail considerably have an effect on RIL’s operations. Adjustments in rules can create each alternatives and challenges for the corporate.

-

Competitors: RIL faces intense competitors throughout its numerous enterprise segments. The aggressive panorama considerably influences its market share and profitability.

-

Technological Developments: Technological disruptions can each create alternatives and pose threats to RIL’s companies. The corporate’s capability to adapt to technological modifications is essential for its long-term success.

Future Projections and Outlook:

Predicting the long run trajectory of the RIL chart is difficult however may be approached by contemplating a number of elements:

-

Continued Progress in Telecom and Retail: Reliance Jio and Reliance Retail are anticipated to proceed their progress trajectory, pushed by growing digital adoption and rising client spending in India.

-

Growth in Renewable Power: RIL’s investments in renewable power are more likely to play a major position in its future progress, aligning with international sustainability traits.

-

Geopolitical Elements: World geopolitical occasions and their impression on oil costs and worldwide commerce will proceed to affect RIL’s efficiency.

-

Technological Innovation: RIL’s capability to innovate and adapt to technological developments will probably be essential for sustaining its aggressive edge.

Conclusion:

The Reliance Industries chart is a fancy tapestry woven from many years of progress, diversification, and adaptation. Analyzing the chart requires a holistic strategy, contemplating each inside and exterior elements. Whereas predicting the long run is inherently unsure, understanding the historic traits, key drivers, and potential challenges gives priceless insights into the potential trajectory of this Indian large. By fastidiously contemplating the interaction of those elements, traders and analysts can higher interpret the RIL chart and make knowledgeable choices. The chart isn’t just a illustration of previous efficiency; it is a dynamic reflection of an organization continually evolving to fulfill the challenges and alternatives of a quickly altering world. Steady monitoring and evaluation are essential for understanding the continued narrative of this influential participant within the international market.

Closure

Thus, we hope this text has offered priceless insights into Decoding the Reliance Industries Chart: A Deep Dive into India’s Power and Conglomerate Big. We thanks for taking the time to learn this text. See you in our subsequent article!