Chart of Accounts Updates: Two Approaches for Streamlined Monetary Administration

Associated Articles: Chart of Accounts Updates: Two Approaches for Streamlined Monetary Administration

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Chart of Accounts Updates: Two Approaches for Streamlined Monetary Administration. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Chart of Accounts Updates: Two Approaches for Streamlined Monetary Administration

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

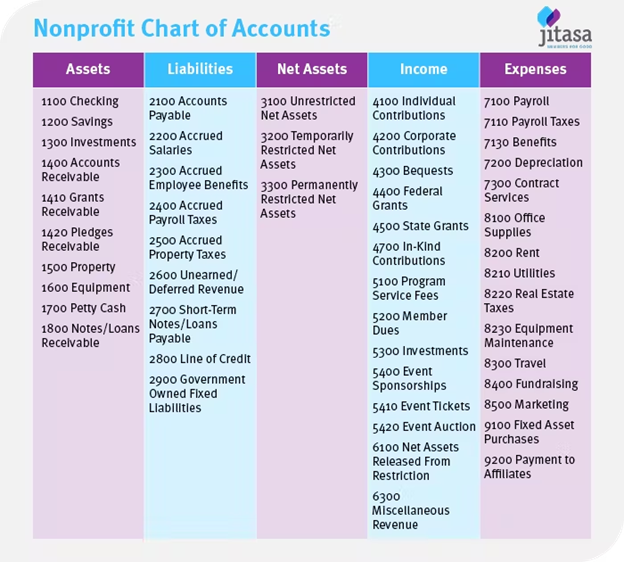

The chart of accounts (COA) is the spine of any group’s monetary reporting system. It is a structured checklist of all accounts used to report monetary transactions, offering a transparent and constant framework for monitoring revenue, bills, belongings, liabilities, and fairness. As a enterprise grows, evolves, or implements new accounting requirements, updating the COA turns into essential. Failing to keep up an correct and up-to-date chart of accounts can result in inaccurate monetary reporting, compliance points, and difficulties in making knowledgeable enterprise choices. This text explores two distinct approaches to updating a chart of accounts: a phased, incremental method and a complete overhaul. Every methodology has its personal benefits and downsides, and your best option relies upon closely on the scale and complexity of the group and the character of the required modifications.

Technique 1: Phased, Incremental Updates

This method is right for organizations that require comparatively minor updates or people who choose a much less disruptive, extra manageable course of. It includes making modifications to the COA in levels, minimizing the chance of errors and making certain a smoother transition.

Part 1: Planning and Evaluation

Earlier than implementing any modifications, an intensive evaluation of the present COA is important. This includes:

- Figuring out the necessity for change: What particular points necessitate a COA replace? Are new accounting requirements being carried out? Are new services or products being provided? Has the organizational construction modified? Understanding the "why" behind the replace is essential for centered motion.

- Analyzing the present COA: An in depth evaluation of the present COA helps determine outdated, unused, or inefficient accounts. This includes analyzing the account construction, numbering system, and the general readability and consistency of the chart.

- Defining the scope of modifications: Primarily based on the evaluation, the precise accounts requiring modification or addition needs to be clearly outlined. This helps to create a centered plan and keep away from pointless complexity.

- Creating an in depth replace plan: This plan ought to define the precise modifications to be made, the timeline for implementation, the people accountable for every process, and the sources required. It also needs to embody a danger evaluation and mitigation plan to handle potential issues.

- Communication Technique: A transparent communication plan is crucial to tell all stakeholders, together with accounting workers, administration, and exterior auditors, in regards to the upcoming modifications and their impression. It will reduce confusion and guarantee everybody is ready for the transition.

Part 2: Implementation

As soon as the planning part is full, the precise implementation can start. This includes:

- Testing the modifications: Earlier than implementing the updates within the dwell system, it is essential to check them in a sandbox or growth surroundings. This helps determine and resolve any potential errors or inconsistencies earlier than they have an effect on the precise monetary information.

- Implementing the modifications in levels: As a substitute of creating all modifications without delay, it is advisable to implement them in levels. This permits for simpler monitoring, problem-solving, and minimizes disruption to ongoing operations. For instance, you would possibly replace one phase of the chart (e.g., expense accounts) earlier than transferring to a different (e.g., asset accounts).

- Knowledge migration: If modifications contain account renumbering or restructuring, cautious information migration is crucial. This will require specialised software program or guide changes to make sure information integrity and accuracy.

- Reconciliation: After every stage of implementation, thorough reconciliation is important to make sure that the info is correct and constant. This would possibly contain evaluating balances earlier than and after the replace to determine any discrepancies.

Part 3: Monitoring and Evaluate

After the updates are carried out, ongoing monitoring and evaluation are essential to make sure the effectiveness and accuracy of the COA. This contains:

- Common audits: Common inner audits assist determine any points or inconsistencies within the COA.

- Suggestions mechanisms: Establishing suggestions mechanisms permits for steady enchancment and addresses any issues that will come up after implementation.

- Periodic evaluations: Periodic evaluations of the COA assist determine areas for enchancment and guarantee it stays related and environment friendly.

Technique 2: Complete Overhaul

This method is greatest fitted to organizations present process important restructuring, implementing new accounting software program, or adopting new accounting requirements (e.g., IFRS). It includes an entire redesign and re-implementation of the COA.

Part 1: Wants Evaluation and Design

This part includes a extra in-depth evaluation of the group’s monetary wants and the event of a very new COA construction.

- Detailed Enterprise Course of Mapping: Perceive the whole circulate of economic transactions inside the group to determine the suitable accounts wanted.

- Chart of Accounts Design: Develop a brand new COA construction that aligns with the group’s particular wants, trade greatest practices, and related accounting requirements. Think about using a standardized chart of accounts framework if applicable.

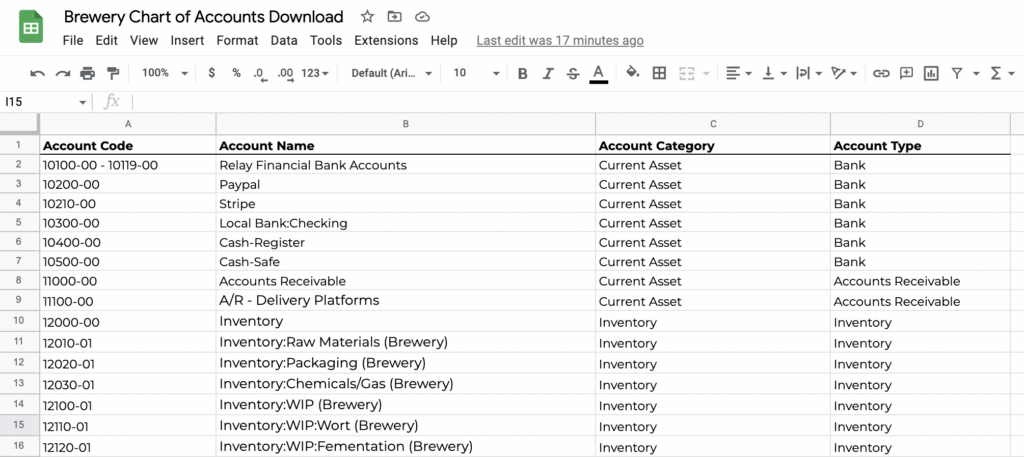

- Account Numbering System: Implement a logical and constant account numbering system that enables for straightforward categorization and reporting.

- Know-how Concerns: Choose accounting software program that’s appropriate with the brand new COA construction and affords the required reporting functionalities.

Part 2: Implementation and Knowledge Migration

This part includes the implementation of the brand new COA and the migration of knowledge from the previous system.

- Knowledge Cleaning: Totally cleanse the present information to make sure accuracy and consistency earlier than migrating it to the brand new system.

- Knowledge Mapping: Develop an in depth mapping between the previous and new COA accounts to make sure correct information migration.

- Parallel Processing: Contemplate operating each the previous and new programs in parallel for a interval to permit for comparability and validation of the info.

- Testing: Rigorous testing is essential to make sure the accuracy and completeness of the info migration.

Part 3: Coaching and Go-Reside

This part includes coaching workers on the brand new COA and the transition to the brand new system.

- Workers Coaching: Present complete coaching to all related workers on the brand new COA construction and using the brand new accounting software program.

- Go-Reside Assist: Present ongoing assist to workers through the transition to the brand new system.

- Publish-Implementation Evaluate: Conduct a post-implementation evaluation to determine any points or areas for enchancment.

Selecting the Proper Strategy

The selection between a phased, incremental replace and a complete overhaul is determined by a number of components:

- Scale of Modifications: For minor changes, a phased method is ample. For important restructuring or new software program implementations, a complete overhaul is important.

- Organizational Sources: A complete overhaul requires extra important sources (time, personnel, and funds) than a phased method.

- Threat Tolerance: A phased method minimizes disruption and danger, whereas a complete overhaul carries a better danger of errors and delays.

- System Complexity: For organizations with complicated accounting programs, a phased method is perhaps extra manageable.

Whatever the chosen methodology, cautious planning, meticulous execution, and ongoing monitoring are important for profitable chart of accounts updates. An correct and well-maintained COA is essential for producing dependable monetary studies, complying with laws, and making sound enterprise choices. Investing the required time and sources on this course of will yield important advantages in the long term.

Closure

Thus, we hope this text has supplied precious insights into Chart of Accounts Updates: Two Approaches for Streamlined Monetary Administration. We respect your consideration to our article. See you in our subsequent article!