Value Motion Chart Patterns Cheat Sheet: Mastering the Visible Language of the Market

Associated Articles: Value Motion Chart Patterns Cheat Sheet: Mastering the Visible Language of the Market

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Value Motion Chart Patterns Cheat Sheet: Mastering the Visible Language of the Market. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Value Motion Chart Patterns Cheat Sheet: Mastering the Visible Language of the Market

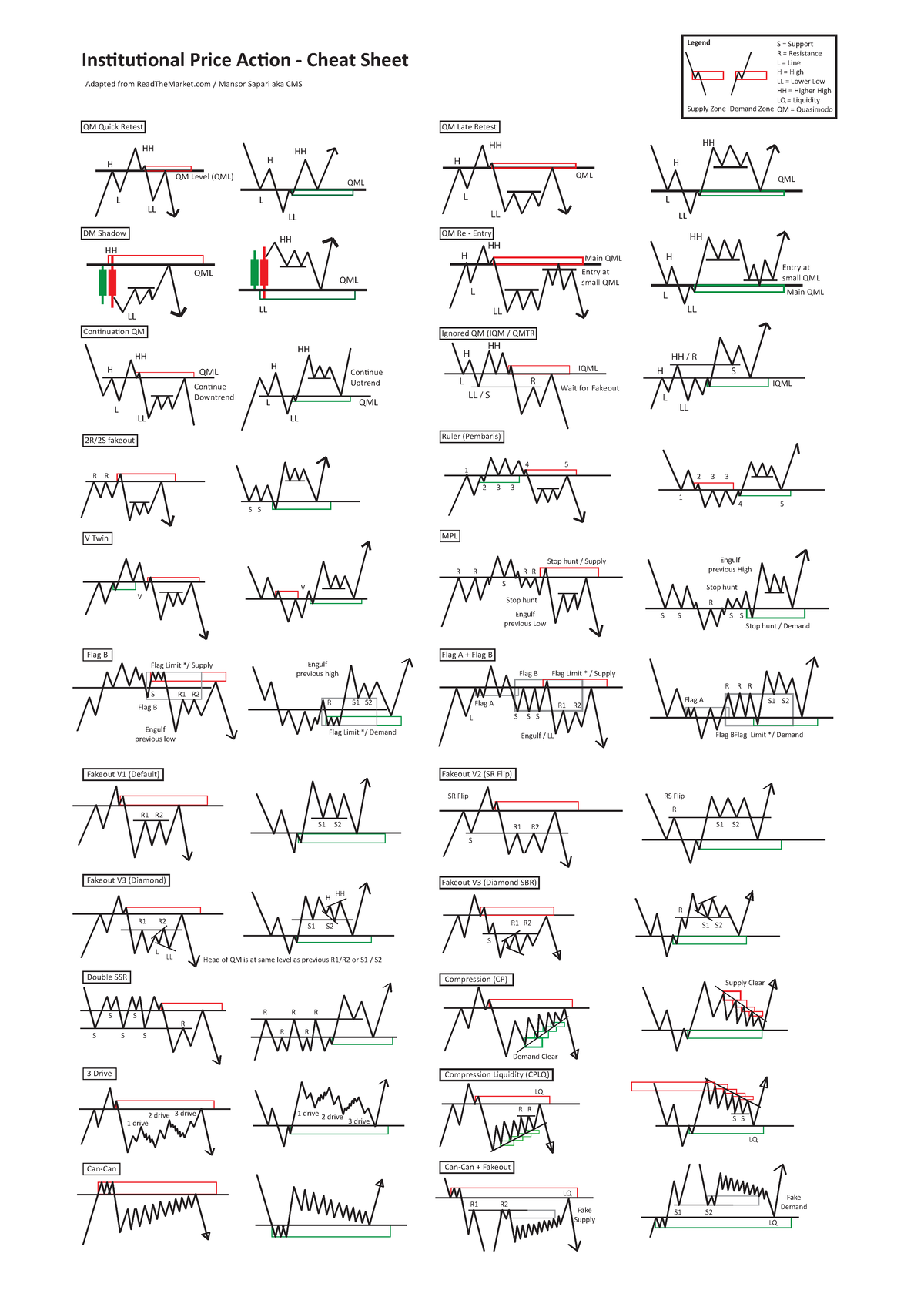

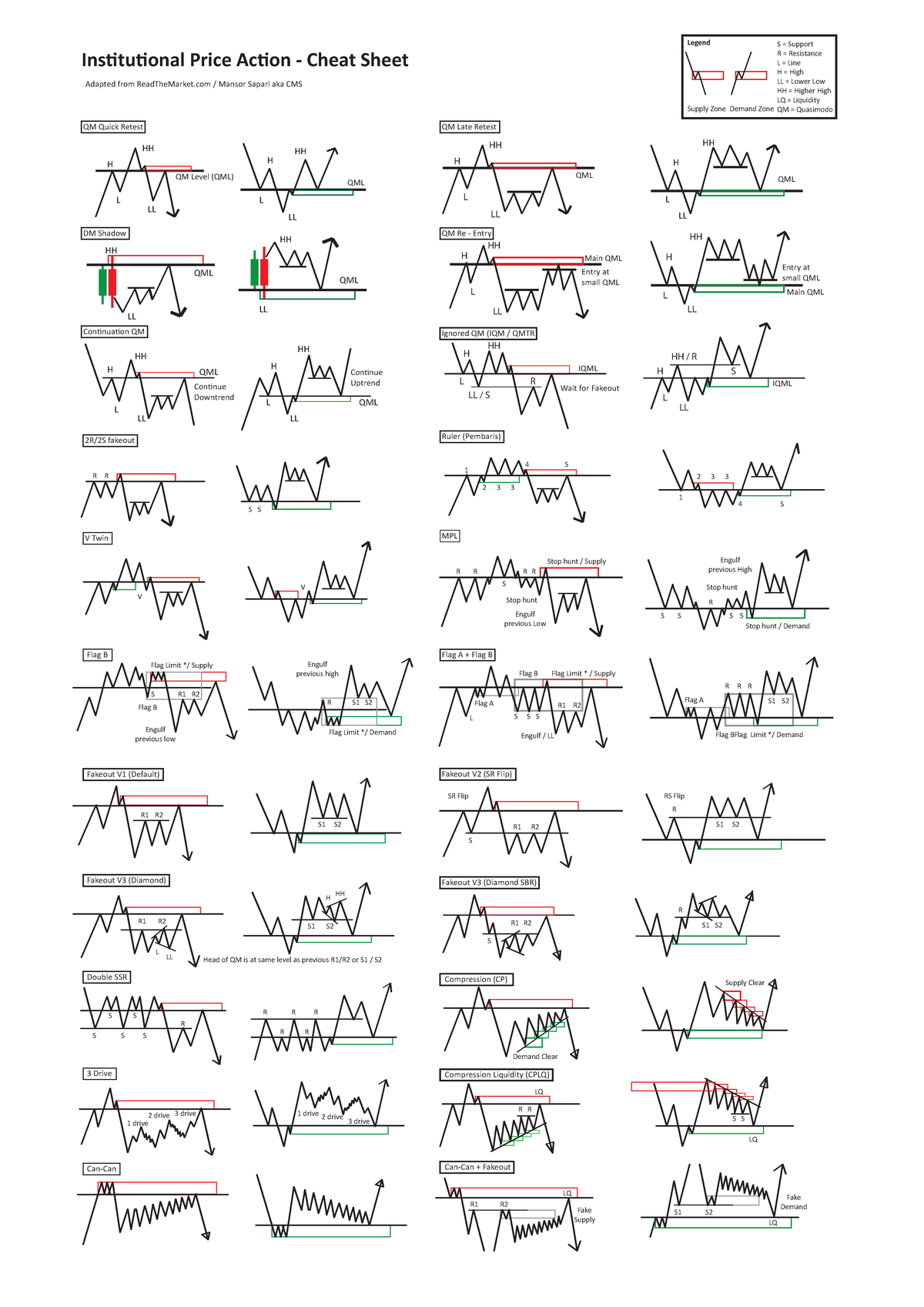

Value motion buying and selling, at its core, is about decoding the uncooked value actions of an asset with out relying closely on indicators. It focuses on understanding the psychology of market contributors as mirrored within the chart’s visible patterns. Whereas indicators can supply affirmation or add context, value motion merchants imagine that the chart itself holds probably the most priceless data. This text serves as a complete cheat sheet, detailing among the commonest and dependable value motion chart patterns, their traits, and easy methods to commerce them. Understanding these patterns can considerably improve your buying and selling prowess and enhance your means to foretell future value actions.

I. Candlestick Patterns:

Candlestick patterns are arguably probably the most basic constructing blocks of value motion evaluation. They supply a visible illustration of the opening, closing, excessive, and low costs of an asset over a selected interval. Their interpretation depends on the interaction of those 4 value factors, creating distinct shapes that sign potential shifts in market sentiment.

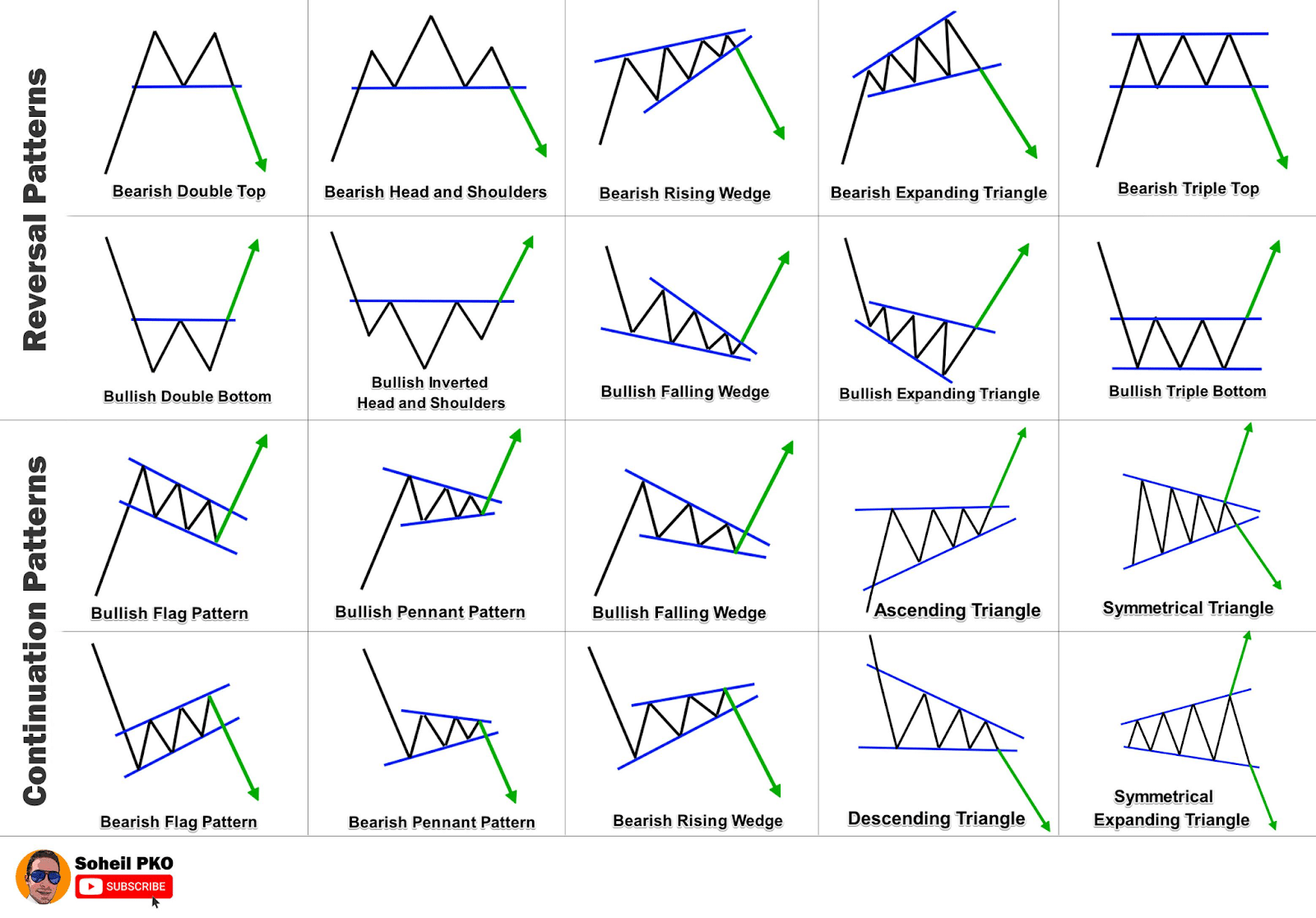

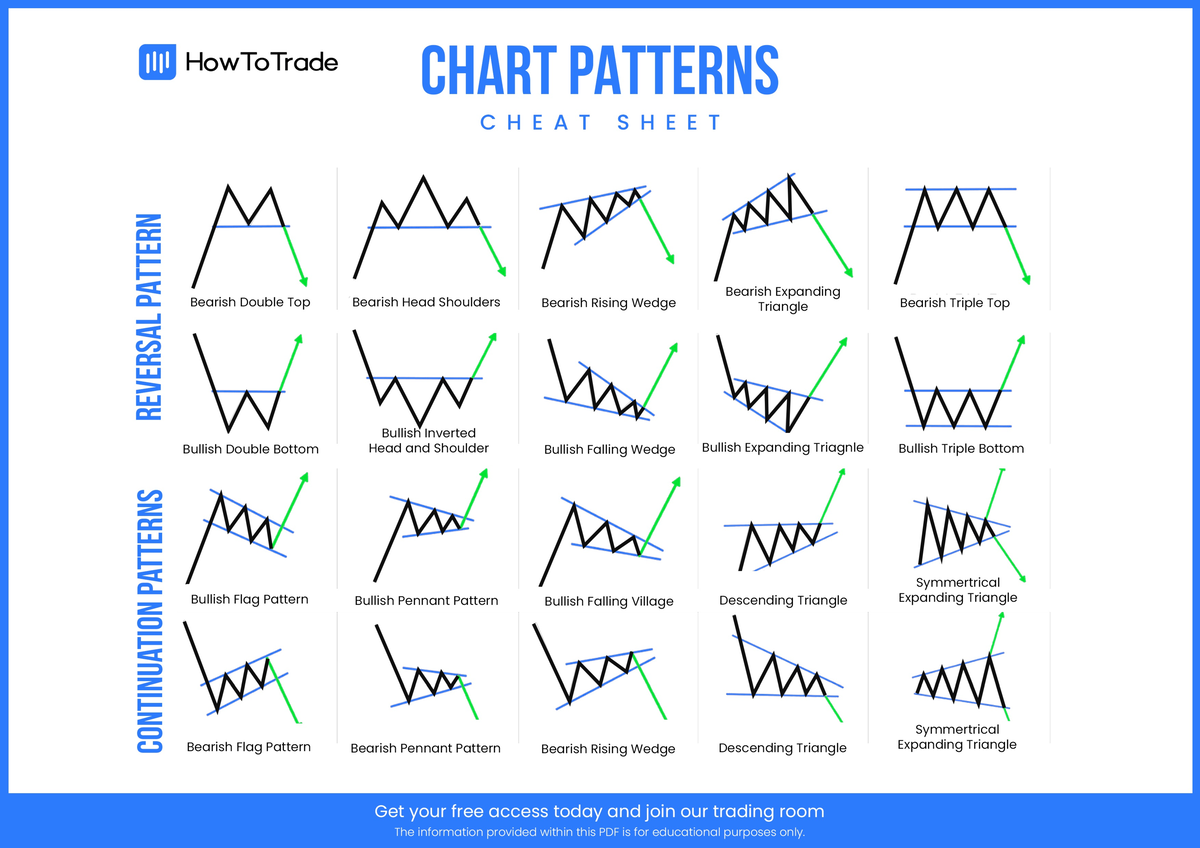

A. Reversal Patterns:

These patterns recommend a possible change within the prevailing pattern.

-

Head and Shoulders (H&S): This can be a basic reversal sample. It consists of three distinct peaks, with the center peak (the "head") being the very best. The 2 outer peaks (the "shoulders") are roughly equal in top. A neckline connects the troughs between the peaks. A break under the neckline confirms the sample and alerts a possible bearish reversal.

- Buying and selling Technique: Brief the asset upon affirmation of the neckline breakout. Place a stop-loss order barely above the very best peak (the pinnacle). The goal value may be calculated utilizing the peak of the pinnacle measured from the neckline.

-

Inverse Head and Shoulders (IH&S): That is the bullish counterpart of the H&S sample. It options three distinct troughs, with the center trough being the bottom. A neckline connects the peaks between the troughs. A break above the neckline confirms the sample and alerts a possible bullish reversal.

- Buying and selling Technique: Purchase the asset upon affirmation of the neckline breakout. Place a stop-loss order barely under the bottom trough. The goal value may be calculated utilizing the peak of the pinnacle measured from the neckline.

-

Double Prime: This sample exhibits two consecutive peaks at roughly the identical value degree, adopted by a decline. The neckline is usually fashioned by connecting the troughs between the peaks. A break under the neckline confirms the sample.

- Buying and selling Technique: Brief the asset upon affirmation of the neckline breakout. Place a stop-loss order barely above the very best peak. The goal value may be calculated utilizing the space between the neckline and the very best peak.

-

Double Backside: That is the bullish counterpart of the double high. It options two consecutive troughs at roughly the identical value degree, adopted by a rise. The neckline is fashioned by connecting the peaks between the troughs. A break above the neckline confirms the sample.

- Buying and selling Technique: Purchase the asset upon affirmation of the neckline breakout. Place a stop-loss order barely under the bottom trough. The goal value may be calculated utilizing the space between the neckline and the bottom trough.

-

Triple Prime/Backside: Just like double tops/bottoms however with three peaks/troughs at roughly the identical value degree. These patterns usually exhibit stronger reversal alerts as a result of elevated affirmation.

- Buying and selling Technique: Just like double tops/bottoms, however with probably greater confidence within the reversal.

B. Continuation Patterns:

These patterns recommend that the prevailing pattern is more likely to proceed.

-

Flags: These are characterised by a interval of consolidation inside a trending market, usually showing as an oblong or barely angled field. The flag’s breakout confirms the continuation of the previous pattern.

- Buying and selling Technique: Purchase breakouts from bullish flags and promote breakouts from bearish flags. Place stop-loss orders exterior the flag’s boundaries.

-

Pennants: Just like flags, however the consolidation interval is characterised by converging trendlines, forming a triangular form. The pennant’s breakout confirms the continuation of the previous pattern.

- Buying and selling Technique: Just like flags, purchase breakouts from bullish pennants and promote breakouts from bearish pennants. Place stop-loss orders exterior the pennant’s boundaries.

-

Wedges (Ascending and Descending): Wedges are characterised by converging trendlines. Ascending wedges are bearish continuation patterns, whereas descending wedges are bullish continuation patterns.

- Buying and selling Technique: For ascending wedges, promote on a break under the decrease trendline. For descending wedges, purchase on a break above the higher trendline. Place stop-loss orders exterior the wedge’s boundaries.

II. Help and Resistance Ranges:

Help and resistance ranges are essential parts in value motion buying and selling. Help represents a value degree the place patrons are more likely to step in, stopping additional declines. Resistance represents a value degree the place sellers are more likely to step in, stopping additional advances.

-

Figuring out Help and Resistance: Horizontal strains drawn at earlier value highs (resistance) and lows (help) are sometimes used to determine these ranges. A number of touches at a selected degree strengthen its significance.

-

Buying and selling Technique: Purchase close to help ranges, anticipating a bounce. Promote close to resistance ranges, anticipating a reversal. Place stop-loss orders barely under help (for lengthy positions) or barely above resistance (for brief positions).

III. Trendlines:

Trendlines are strains drawn connecting a sequence of upper lows (uptrend) or decrease highs (downtrend). They symbolize the general path of the value motion.

-

Drawing Trendlines: Draw trendlines by connecting no less than two important swing lows or highs. The extra factors a trendline connects, the stronger it’s.

-

Buying and selling Technique: Purchase breakouts above uptrend strains and promote breakouts under downtrend strains. Place stop-loss orders barely under the uptrend line (for lengthy positions) or barely above the downtrend line (for brief positions).

IV. Different Essential Issues:

-

Quantity: Quantity evaluation can present priceless affirmation for value motion patterns. Excessive quantity throughout breakouts strengthens the sign.

-

Timeframes: Analyzing value motion throughout a number of timeframes (e.g., day by day, hourly, 15-minute) can present a extra complete view of the market.

-

Danger Administration: All the time use acceptable danger administration strategies, equivalent to stop-loss orders and place sizing, to guard your capital.

-

Affirmation: Whereas value motion patterns may be extremely predictive, it is essential to hunt affirmation from different indicators or components earlier than getting into a commerce.

V. Conclusion:

This cheat sheet supplies a foundational understanding of frequent value motion chart patterns. Mastering these patterns requires constant follow and remark. By diligently learning charts and analyzing value actions, you’ll be able to develop a eager eye for figuring out these patterns and utilizing them to enhance your buying and selling choices. Keep in mind that value motion buying and selling is a ability that develops over time, requiring persistence, self-discipline, and a dedication to steady studying. All the time follow danger administration and by no means make investments greater than you’ll be able to afford to lose. The knowledge offered right here is for academic functions solely and shouldn’t be thought-about monetary recommendation. Seek the advice of with a professional monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered priceless insights into Value Motion Chart Patterns Cheat Sheet: Mastering the Visible Language of the Market. We thanks for taking the time to learn this text. See you in our subsequent article!