Decoding Amazon’s Inventory Value: A Deep Dive into At present’s Chart and Market Dynamics

Associated Articles: Decoding Amazon’s Inventory Value: A Deep Dive into At present’s Chart and Market Dynamics

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding Amazon’s Inventory Value: A Deep Dive into At present’s Chart and Market Dynamics. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding Amazon’s Inventory Value: A Deep Dive into At present’s Chart and Market Dynamics

Amazon (AMZN), a titan of e-commerce, cloud computing, and digital promoting, continues to captivate traders with its fluctuating inventory value. Understanding the intricacies behind immediately’s share value requires analyzing a large number of things, from macroeconomic developments and firm efficiency to investor sentiment and geopolitical occasions. This text will dissect Amazon’s present inventory value, offering context via an in depth evaluation of its latest efficiency and future prospects, all whereas acknowledging the inherent unpredictability of the inventory market. (Observe: Since inventory costs fluctuate continuously, any particular value talked about here’s a snapshot in time and will not replicate the present market worth. Confer with a dwell monetary chart for essentially the most up-to-date data.)

At present’s Amazon Inventory Value: A Snapshot

To start, let’s acknowledge the elephant within the room: the precise numerical worth of Amazon’s inventory value per share immediately is dynamic and requires real-time knowledge from a good monetary supply. As an alternative of offering a doubtlessly outdated determine, we’ll give attention to the broader context surrounding the worth motion. A typical chart displaying Amazon’s inventory value will present the next data:

- Opening Value: The value at which the inventory started buying and selling for the day.

- Excessive/Low: The best and lowest costs reached in the course of the buying and selling day.

- Closing Value: The ultimate value on the finish of the buying and selling session.

- Quantity: The variety of shares traded all through the day, indicating buying and selling exercise.

- Value Change: The distinction between the closing value and the day before today’s closing value, typically expressed as a proportion.

Observing these knowledge factors over time reveals developments and patterns, serving to traders gauge the general market sentiment in the direction of Amazon. A big enhance in quantity alongside a value surge typically suggests sturdy shopping for stress, whereas a excessive quantity with a value drop signifies potential promoting stress.

Components Influencing Amazon’s Inventory Value:

Quite a few intertwined components contribute to the day by day fluctuations in Amazon’s inventory value. These will be broadly categorized as:

1. Firm Efficiency:

- Income and Earnings: Amazon’s quarterly and annual monetary stories are essential. Exceeding or falling wanting analysts’ expectations considerably impacts the inventory value. Sturdy income development in key segments like AWS (Amazon Internet Providers), e-commerce, and promoting fuels optimistic investor sentiment. Conversely, disappointing outcomes can set off a sell-off.

- Operational Effectivity: Traders scrutinize Amazon’s operational metrics, together with success prices, transport effectivity, and stock administration. Enhancements in these areas sign higher profitability and contribute to a better inventory valuation.

- New Product Launches and Initiatives: Profitable introductions of recent services or products, like new Alexa units, expansions into new markets, or strategic acquisitions, can enhance investor confidence and drive up the inventory value. Failures, nevertheless, can have the alternative impact.

- Competitors: Amazon faces intense competitors in varied sectors. The efficiency of rivals like Walmart, Goal, and different e-commerce platforms immediately influences Amazon’s market share and, consequently, its inventory value. Aggressive aggressive strikes by rivals can put stress on AMZN shares.

2. Macroeconomic Components:

- Inflation and Curiosity Charges: Excessive inflation and rising rates of interest usually negatively affect development shares like Amazon. Elevated borrowing prices can dampen funding and client spending, affecting Amazon’s income and profitability.

- Financial Progress: A sturdy economic system sometimes advantages Amazon, as client spending will increase. Recessions or intervals of gradual financial development can harm the corporate’s efficiency and result in a decline in its inventory value.

- Forex Fluctuations: Amazon operates globally, making it inclined to foreign money alternate charge fluctuations. A powerful US greenback can negatively affect worldwide gross sales, doubtlessly affecting its total monetary efficiency.

3. Investor Sentiment and Market Circumstances:

- Analyst Scores and Suggestions: Brokerage companies repeatedly challenge scores and value targets for Amazon’s inventory. Optimistic scores and upward revisions of value targets can enhance investor confidence and drive the worth increased. Detrimental scores can have the alternative impact.

- Total Market Sentiment: The broader market’s efficiency considerably influences particular person inventory costs. A basic market downturn can drag down even sturdy corporations like Amazon, whereas a bullish market can carry its inventory value no matter its particular efficiency.

- Information and Media Protection: Optimistic or unfavorable information tales about Amazon can sway investor sentiment. Controversies, regulatory scrutiny, or unfavorable publicity can set off sell-offs, whereas optimistic information about new initiatives or sturdy earnings can enhance the inventory value.

Analyzing Amazon’s Lengthy-Time period Chart:

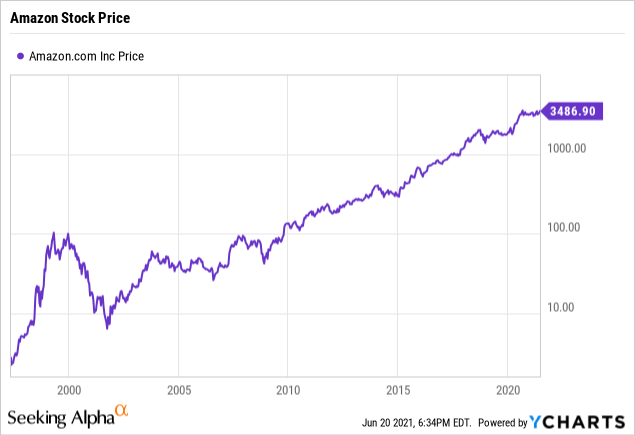

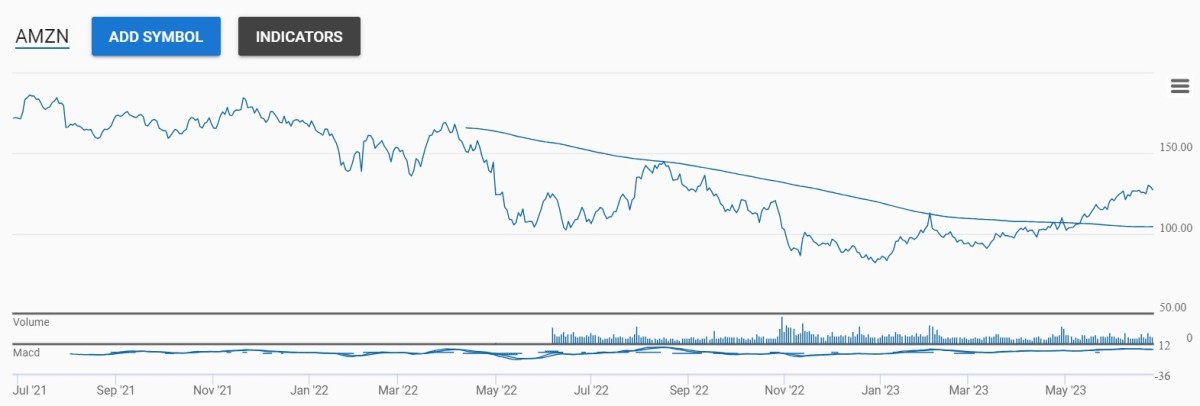

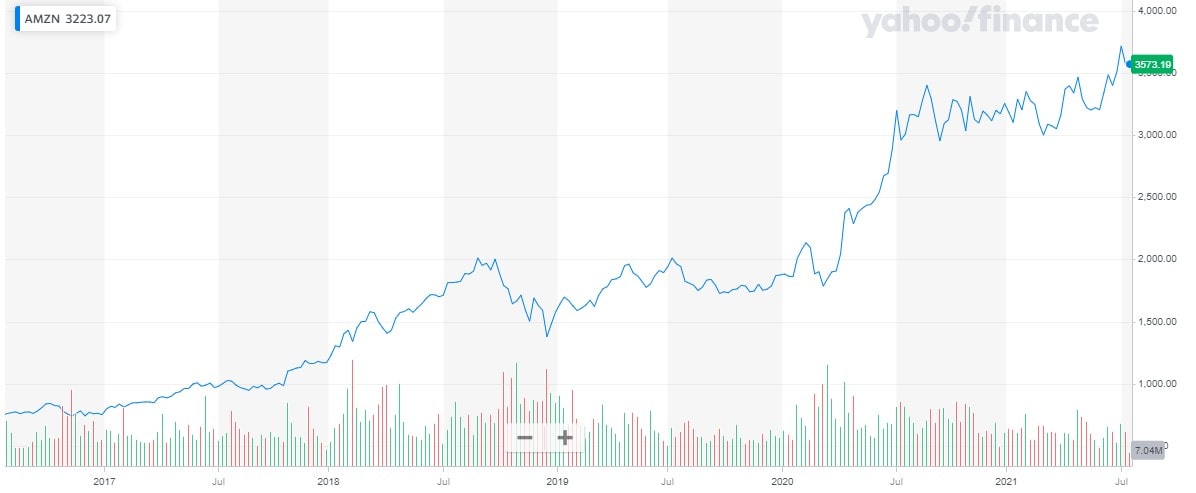

a long-term chart of Amazon’s inventory value reveals a outstanding development trajectory, punctuated by intervals of each vital good points and corrections. Analyzing this historic knowledge supplies useful insights into the corporate’s resilience and its potential to adapt to market adjustments. Key features to contemplate embrace:

- Progress Phases: Figuring out intervals of fast development and the components that contributed to them.

- Correction Durations: Understanding the causes of market corrections and the way rapidly the inventory recovered.

- Assist and Resistance Ranges: Figuring out value ranges the place the inventory has traditionally discovered help (resistance to falling costs) or resistance (resistance to rising costs). These ranges can present clues about potential future value actions.

Predicting Future Inventory Value Actions:

Predicting the longer term value of any inventory, together with Amazon, is inherently difficult. Nobody can definitively say the place the worth can be tomorrow, subsequent week, or subsequent yr. Nevertheless, by rigorously contemplating the components mentioned above – firm efficiency, macroeconomic situations, and investor sentiment – traders can develop knowledgeable opinions concerning the potential course of the inventory value.

Conclusion:

Understanding Amazon’s inventory value requires a multifaceted method, incorporating an evaluation of the corporate’s monetary efficiency, macroeconomic developments, and prevailing investor sentiment. Whereas previous efficiency will not be indicative of future outcomes, learning historic knowledge and present market situations supplies useful context. By diligently monitoring these components and staying knowledgeable about related information and occasions, traders could make extra knowledgeable selections concerning their funding in Amazon. Bear in mind to all the time conduct thorough due diligence and take into account consulting with a monetary advisor earlier than making any funding selections. The knowledge offered on this article is for academic functions solely and shouldn’t be thought of monetary recommendation.

Closure

Thus, we hope this text has offered useful insights into Decoding Amazon’s Inventory Value: A Deep Dive into At present’s Chart and Market Dynamics. We hope you discover this text informative and helpful. See you in our subsequent article!