Understanding and Using T-Chart Accounting: A Complete Information

Associated Articles: Understanding and Using T-Chart Accounting: A Complete Information

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Understanding and Using T-Chart Accounting: A Complete Information. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Understanding and Using T-Chart Accounting: A Complete Information

The T-chart, a easy but highly effective instrument, kinds the bedrock of primary accounting ideas. Its simple design belies its significance, serving as a basic visible illustration of the double-entry bookkeeping system. Whereas seemingly elementary, mastering the T-chart is essential for comprehending extra complicated accounting ideas and practices. This text delves deep into the world of T-chart accounting, exploring its construction, functions, limitations, and its function in constructing a powerful basis in monetary record-keeping.

The Anatomy of a T-Chart:

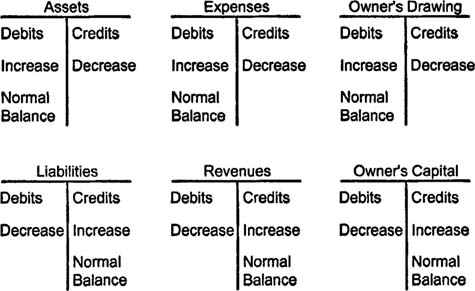

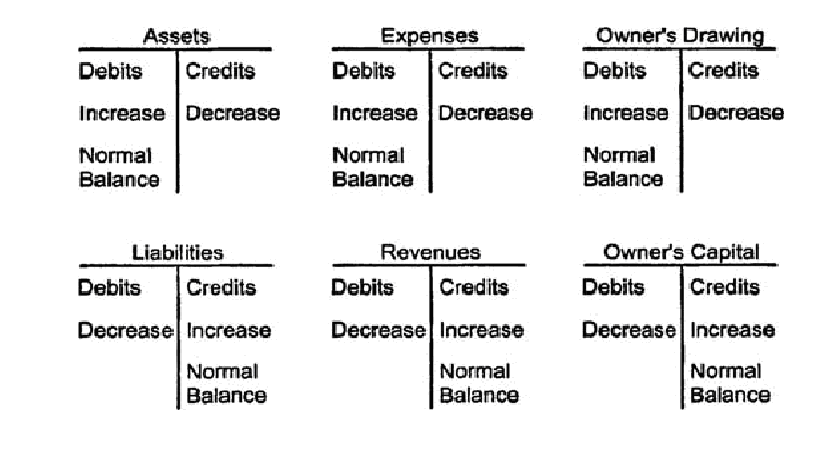

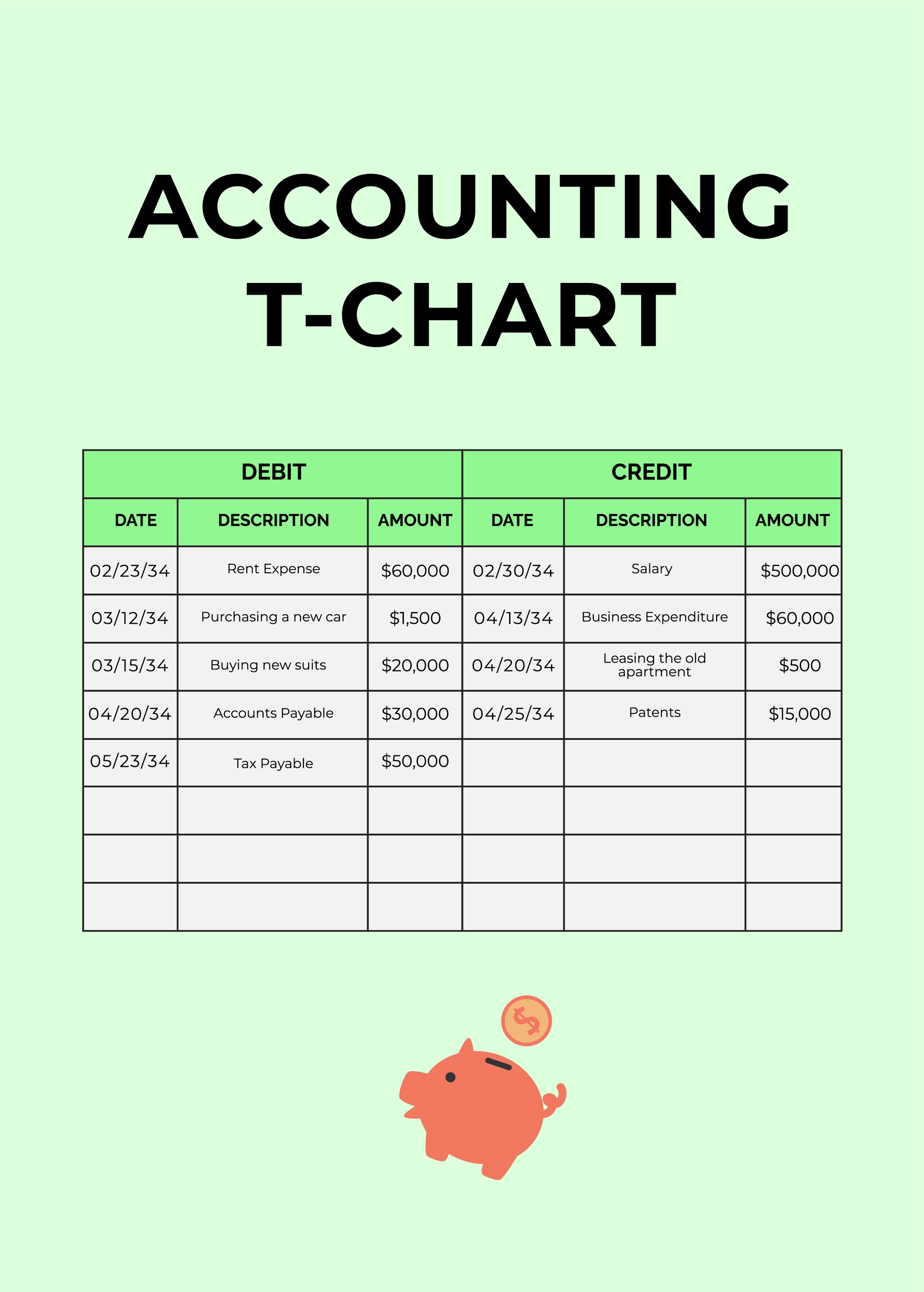

The T-chart, aptly named for its resemblance to the letter "T," is a two-column desk used to report debits and credit for particular person accounts. The vertical line acts because the dividing line between these two essential parts of double-entry bookkeeping.

-

Debits (Left Aspect): Debits signify will increase in belongings, bills, and dividend funds. Conversely, they signify decreases in liabilities, proprietor’s fairness, and revenues. The mnemonic gadget "DEAD CLIC" may be useful: Debits improve Expenses, Assets, and Dividends; Credits improve Liabilities, Income, and Capital.

-

Credit (Proper Aspect): Credit signify will increase in liabilities, proprietor’s fairness, and revenues. Conversely, they signify decreases in belongings, bills, and dividend funds.

The Precept of Double-Entry Bookkeeping:

The T-chart is intrinsically linked to the basic precept of double-entry bookkeeping. This precept mandates that each monetary transaction impacts at the very least two accounts. For each debit entry, there have to be a corresponding credit score entry, and vice versa. This ensures that the accounting equation – Belongings = Liabilities + Fairness – at all times stays balanced. The T-chart visually demonstrates this steadiness.

Sensible Purposes of T-Charts:

T-charts are invaluable for numerous accounting duties, notably on the introductory stage. Listed below are some key functions:

-

Recording Particular person Transactions: Every transaction is meticulously recorded in a separate T-chart for the precise account(s) concerned. For instance, if an organization purchases tools with money, the "Tools" account would obtain a debit entry (improve in belongings), and the "Money" account would obtain a credit score entry (lower in belongings).

-

Illustrating Account Balances: After recording a number of transactions, the T-chart clearly shows the web steadiness for every account. The steadiness is calculated by subtracting the entire credit from the entire debits. A constructive steadiness signifies a debit steadiness, whereas a unfavorable steadiness signifies a credit score steadiness.

-

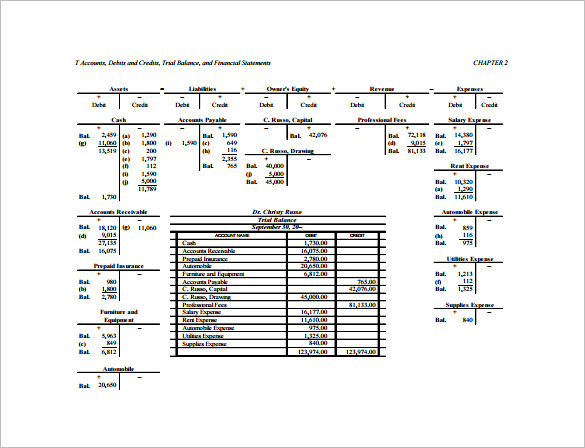

Getting ready Trial Balances: T-charts present the uncooked information obligatory for making ready a trial steadiness. A trial steadiness is a abstract of all account balances at a selected time limit. It verifies that the entire debits equal the entire credit, making certain the accounting equation stays balanced.

-

Simplifying Advanced Transactions: Even complicated transactions, involving a number of accounts, may be damaged down and recorded systematically utilizing a number of T-charts. This simplifies the method and minimizes errors.

-

Instructional Instrument: T-charts are extensively utilized in accounting schooling to show the basics of double-entry bookkeeping. Their simplicity makes them a great instrument for newcomers to know the core ideas earlier than shifting on to extra refined accounting software program.

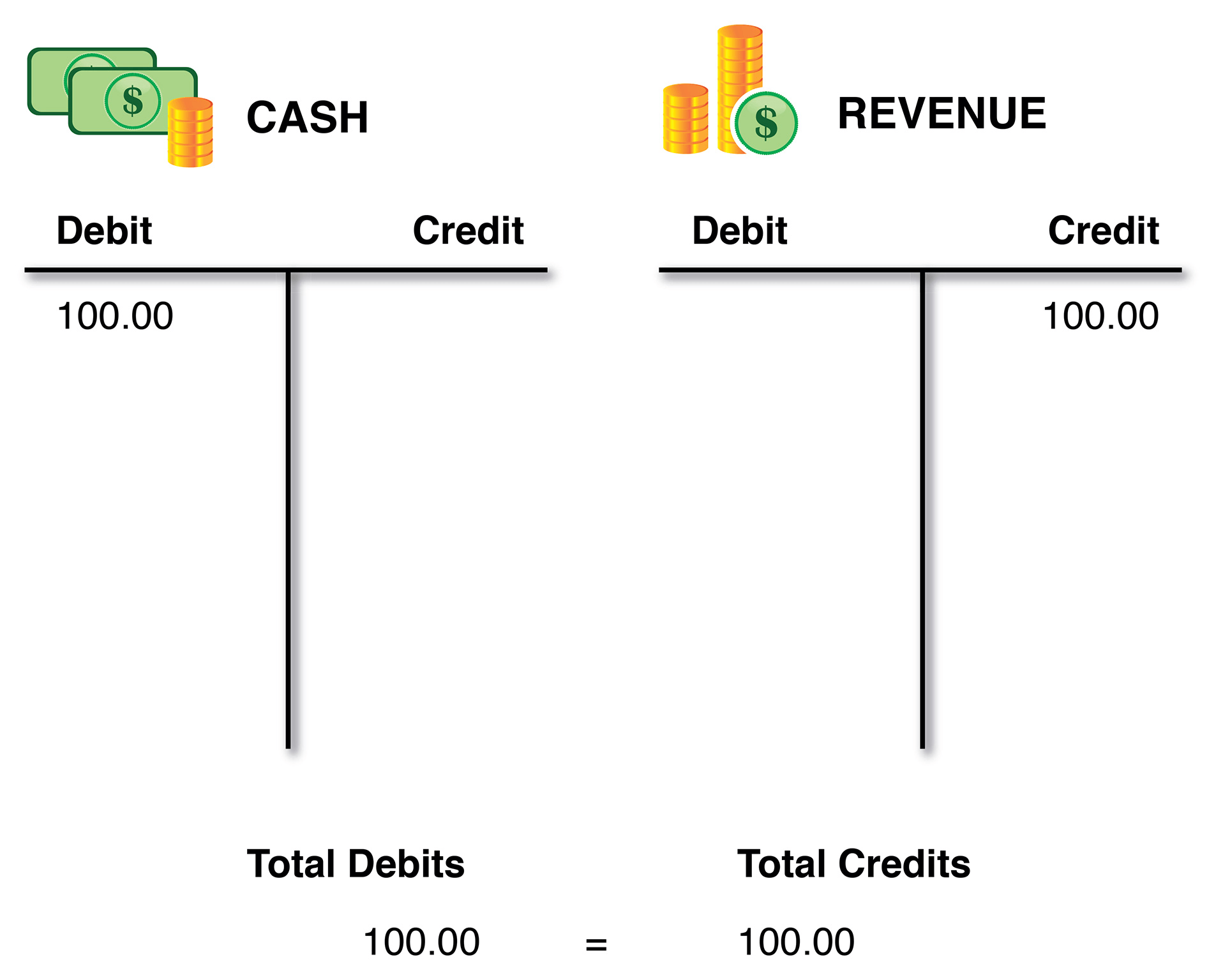

Instance: Recording a Easy Transaction

Let’s illustrate with a easy instance: An organization purchases workplace provides for $100 money.

Account: Workplace Provides

| Debit | Credit score |

|---|---|

| $100 | |

| Stability: $100 |

Account: Money

| Debit | Credit score |

|---|---|

| $100 | |

| Stability: -$100 |

On this instance, the acquisition of workplace provides will increase the "Workplace Provides" account (an asset), therefore the debit entry. Concurrently, the money used for the acquisition decreases the "Money" account (one other asset), leading to a credit score entry. The overall debits ($100) equal the entire credit ($100), sustaining the steadiness of the accounting equation.

Limitations of T-Charts:

Whereas T-charts are invaluable for understanding the fundamentals, they’ve limitations when coping with large-scale accounting operations:

-

Scalability: Managing quite a few accounts and transactions utilizing solely T-charts turns into cumbersome and impractical for companies with complicated monetary actions.

-

Lack of Summarization: T-charts do not routinely present summarized monetary statements like revenue statements or steadiness sheets. Further calculations and summarization are required.

-

Error Inclined: Handbook entry into T-charts will increase the danger of human error, particularly with a big quantity of transactions.

-

Restricted Evaluation: T-charts primarily concentrate on recording transactions; they provide restricted capabilities for superior monetary evaluation.

Transitioning from T-Charts to Superior Accounting Techniques:

As companies develop, they inevitably transition from guide T-chart bookkeeping to classy accounting software program. These techniques automate many duties, lowering errors and offering complete monetary stories. Nonetheless, understanding the ideas illustrated by T-charts stays essential. It gives a foundational understanding of how accounting software program capabilities at its core.

Conclusion:

The T-chart, although seemingly easy, is a robust instrument that kinds the cornerstone of basic accounting ideas. Its simple design permits for a transparent visualization of the double-entry bookkeeping system, making it a great studying instrument and an efficient methodology for managing small-scale accounting duties. Whereas its limitations develop into obvious in bigger, extra complicated companies, the data gained from mastering T-chart accounting gives a useful basis for understanding and using extra superior accounting techniques and strategies. It’s a essential stepping stone on the trail to changing into a proficient accountant or monetary supervisor. By understanding the basic ideas of debits and credit, and their software throughout the T-chart framework, one can construct a powerful understanding of the whole accounting course of and its significance within the monetary well being of any group.

Closure

Thus, we hope this text has supplied worthwhile insights into Understanding and Using T-Chart Accounting: A Complete Information. We recognize your consideration to our article. See you in our subsequent article!