A Decade of Gold: Analyzing the Worth Chart from 2014 to 2024 (Hypothetical)

Associated Articles: A Decade of Gold: Analyzing the Worth Chart from 2014 to 2024 (Hypothetical)

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to A Decade of Gold: Analyzing the Worth Chart from 2014 to 2024 (Hypothetical). Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

A Decade of Gold: Analyzing the Worth Chart from 2014 to 2024 (Hypothetical)

This text analyzes a hypothetical ten-year gold worth chart, spanning from 2014 to 2024. Whereas we can not predict the longer term with certainty, inspecting previous traits and influencing elements permits us to assemble a believable situation and perceive the potential drivers behind gold’s worth actions. This hypothetical chart will illustrate key worth ranges, vital occasions, and their impression on investor sentiment and market dynamics. Keep in mind, this can be a speculative train; precise costs could differ considerably.

The Hypothetical Gold Worth Chart (2014-2024): A Narrative

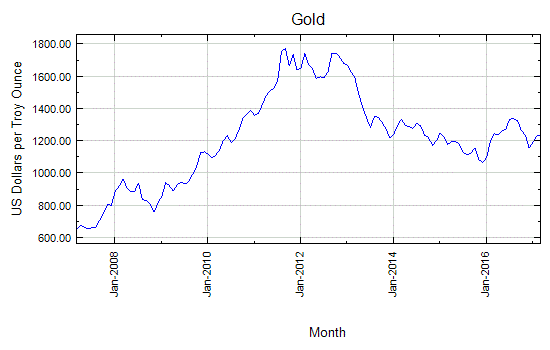

Our hypothetical chart begins in 2014 with gold buying and selling round $1,250 per ounce, reflecting a interval of relative stability following a major bull run within the earlier decade. The preliminary years (2014-2016) present a sideways development, fluctuating between $1,100 and $1,350. This era is characterised by a strengthening US greenback and rising rates of interest, making non-yielding belongings like gold much less engaging. Geopolitical uncertainty, nonetheless, offers some assist, stopping a serious worth collapse.

2017-2019: A Gradual Ascent

From 2017 onwards, we see a gradual upward development. A number of elements contribute to this:

- Elevated World Uncertainty: Rising commerce tensions between the US and China, coupled with Brexit and different geopolitical occasions, gasoline investor demand for safe-haven belongings like gold.

- Inflationary Pressures: Slowly rising inflation in a number of main economies begins to erode the buying energy of fiat currencies, making gold a hedge in opposition to inflation.

- Central Financial institution Shopping for: Central banks world wide, significantly these in rising markets, improve their gold reserves, reflecting a rising perception in gold’s position as a strategic asset.

Our hypothetical chart reveals gold reaching $1,400 by the tip of 2017 and steadily climbing to $1,600 by the tip of 2019. This era demonstrates the rising affect of macroeconomic elements and geopolitical dangers on gold’s worth.

2020-2022: The Pandemic and its Aftermath

The yr 2020 marks a major turning level. The COVID-19 pandemic triggers unprecedented market volatility. Initially, there’s a sharp drop in gold costs as traders liquidate belongings to fulfill speedy wants. Nonetheless, that is short-lived. The large authorities stimulus packages, quantitative easing measures, and the ensuing surge in cash provide gasoline inflationary fears. This, coupled with the uncertainty surrounding the pandemic’s financial impression, results in a dramatic surge in gold costs.

Our hypothetical chart displays this, displaying gold reaching $2,000 per ounce by the tip of 2020. The next years (2021-2022) see some consolidation, with costs fluctuating between $1,800 and $2,200, reflecting the continued financial restoration and the gradual tapering of stimulus measures.

2023-2024: Navigating a New Panorama

The ultimate two years of our hypothetical chart depict a extra complicated situation. Whereas inflation stays a priority, central banks start to aggressively increase rates of interest to fight it. This results in a interval of relative worth stability, with gold buying and selling inside a narrower vary, maybe between $1,700 and $2,000.

A number of elements affect this era:

- Curiosity Fee Hikes: Larger rates of interest make holding non-yielding belongings like gold much less engaging in comparison with interest-bearing devices.

- Financial Development: The tempo of financial restoration influences investor sentiment and gold’s enchantment as a safe-haven asset. Stronger progress would possibly result in decrease demand for gold.

- Geopolitical Developments: Ongoing geopolitical tensions, potential conflicts, and world political instability proceed to play a major position in influencing gold costs.

- Technological Developments: Improvements within the mining and refining sectors would possibly impression the provision facet of the market, affecting costs.

Components Influencing the Hypothetical Chart

This hypothetical chart illustrates the interaction of assorted elements influencing gold’s worth:

- US Greenback Power: An inverse relationship exists between the US greenback and gold costs. A robust greenback sometimes places downward strain on gold costs, whereas a weak greenback tends to assist larger gold costs.

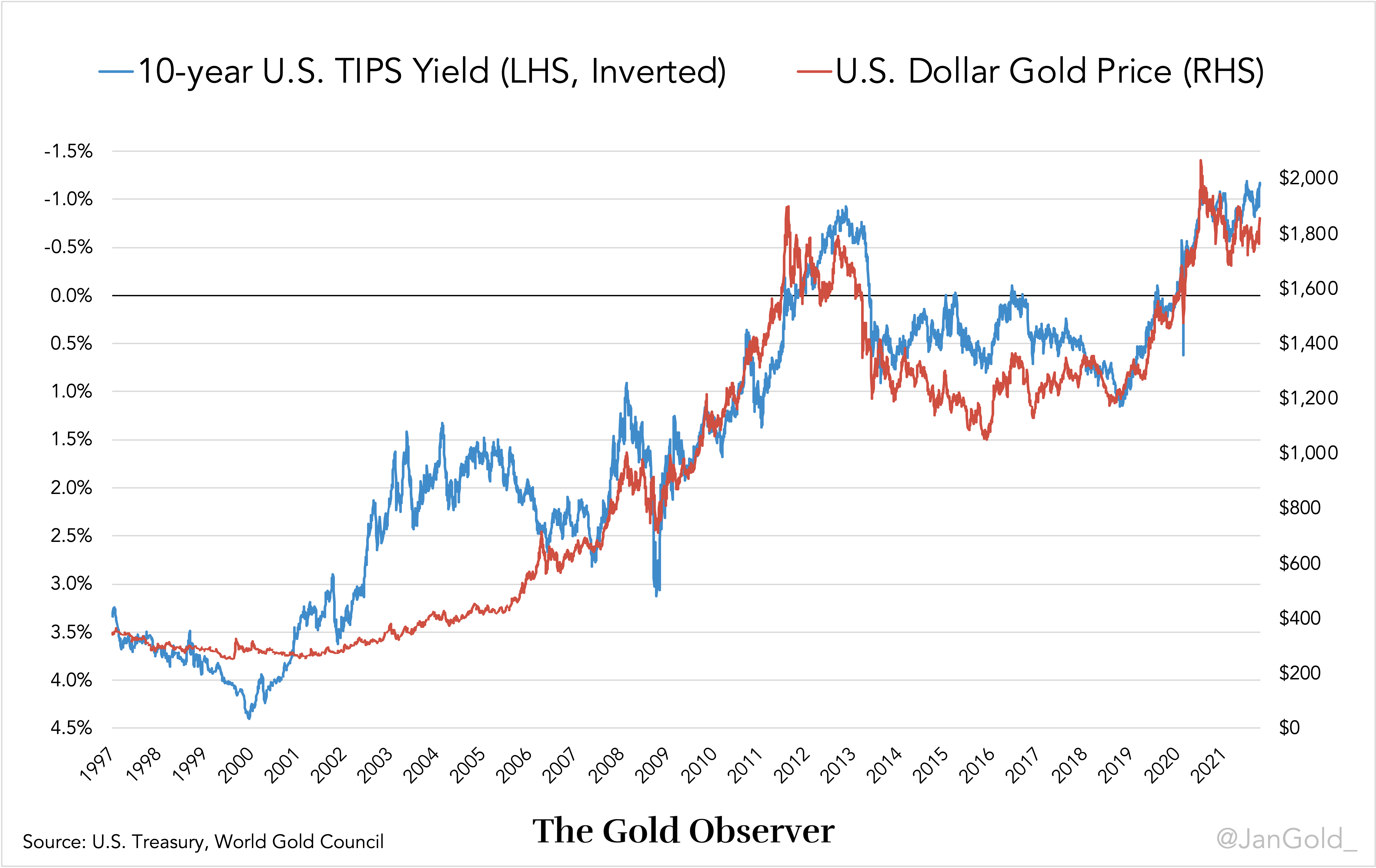

- Curiosity Charges: Larger rates of interest typically cut back the attractiveness of gold, as traders can earn larger returns on interest-bearing belongings.

- Inflation: Gold is commonly thought-about a hedge in opposition to inflation. Rising inflation tends to extend demand for gold, pushing costs larger.

- Geopolitical Uncertainty: Intervals of political instability, wars, or financial crises usually result in elevated demand for gold as a safe-haven asset.

- Provide and Demand: The interaction between gold provide (mining manufacturing) and demand (funding, jewellery, industrial use) considerably influences costs.

- Investor Sentiment: Market psychology and investor expectations play a vital position in driving gold worth fluctuations.

Conclusion: A Speculative Outlook

The hypothetical gold worth chart offered right here affords a believable, but speculative, view of the valuable metallic’s worth actions over a ten-year interval. It underscores the complicated interaction of macroeconomic elements, geopolitical occasions, and investor sentiment that form gold’s efficiency. Whereas this evaluation offers a framework for understanding potential worth drivers, it is essential to keep in mind that the precise gold worth trajectory might differ considerably. Thorough analysis, diversification, and a long-term perspective are important for navigating the gold market successfully. This evaluation shouldn’t be thought-about monetary recommendation, and readers are inspired to conduct their very own analysis earlier than making any funding choices. The way forward for gold costs stays unsure, however by understanding the important thing influencing elements, traders can higher place themselves to navigate the market’s complexities.

:max_bytes(150000):strip_icc()/GOLD_2023-05-17_09-51-04-aea62500f1a249748eb923dbc1b6993b.png)

:max_bytes(150000):strip_icc()/Goldchart-997cf958e5b941a79e319b82a078283f.jpg)

Closure

Thus, we hope this text has offered useful insights into A Decade of Gold: Analyzing the Worth Chart from 2014 to 2024 (Hypothetical). We thanks for taking the time to learn this text. See you in our subsequent article!