Chart Industries: A Deep Dive into the LNG Chilly Chain

Associated Articles: Chart Industries: A Deep Dive into the LNG Chilly Chain

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Chart Industries: A Deep Dive into the LNG Chilly Chain. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Chart Industries: A Deep Dive into the LNG Chilly Chain

Chart Industries, Inc. (GTLS) is a worldwide chief within the design, manufacture, and repair of extremely engineered gear for the liquefied pure gasoline (LNG), hydrogen, and different cryogenic industries. The corporate’s place on the forefront of those burgeoning vitality sectors makes it a compelling topic for buyers and business observers alike. This text will delve into Chart Industries’ operations, market place, monetary efficiency, and future prospects, offering a complete overview of this vital participant within the evolving vitality panorama.

Chart Industries’ Core Enterprise: Mastering the Chilly Chain

Chart Industries’ core competency lies in its capability to deal with extraordinarily low temperatures, a vital requirement for the liquefaction, storage, and transportation of gases like LNG and hydrogen. The corporate’s product portfolio is various and caters to varied phases of the cryogenic provide chain, together with:

-

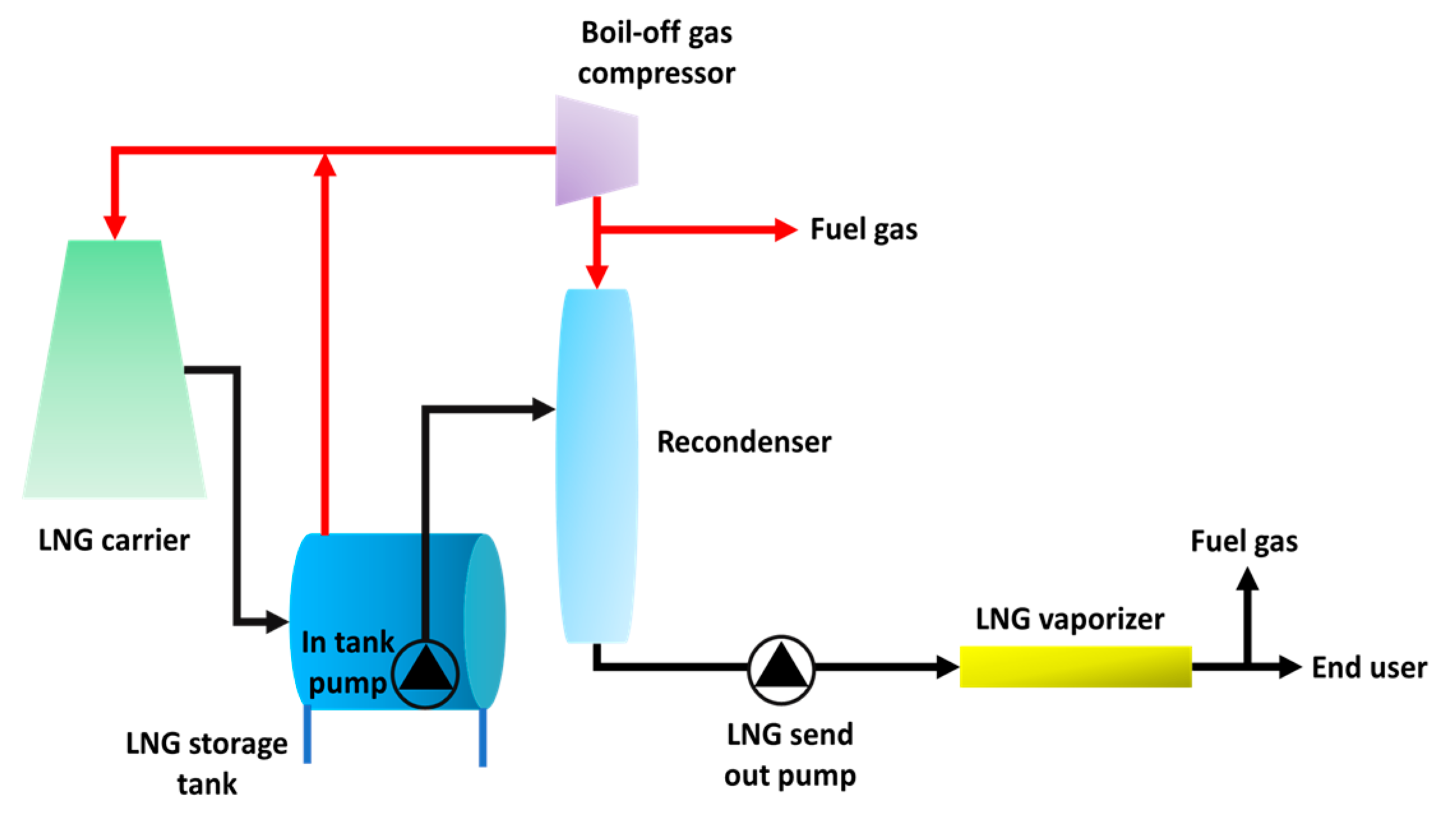

Liquefaction Tools: Chart designs and manufactures key elements for LNG liquefaction crops, together with warmth exchangers, vaporizers, and different crucial gear mandatory for changing pure gasoline into its liquid type. This section is essential for the growth of LNG manufacturing globally.

-

Storage Tanks: Chart gives a variety of storage tanks for LNG, starting from small-scale tanks for localized purposes to large-scale storage amenities for main LNG terminals. These tanks make the most of superior insulation applied sciences to attenuate boil-off and keep the integrity of the LNG.

-

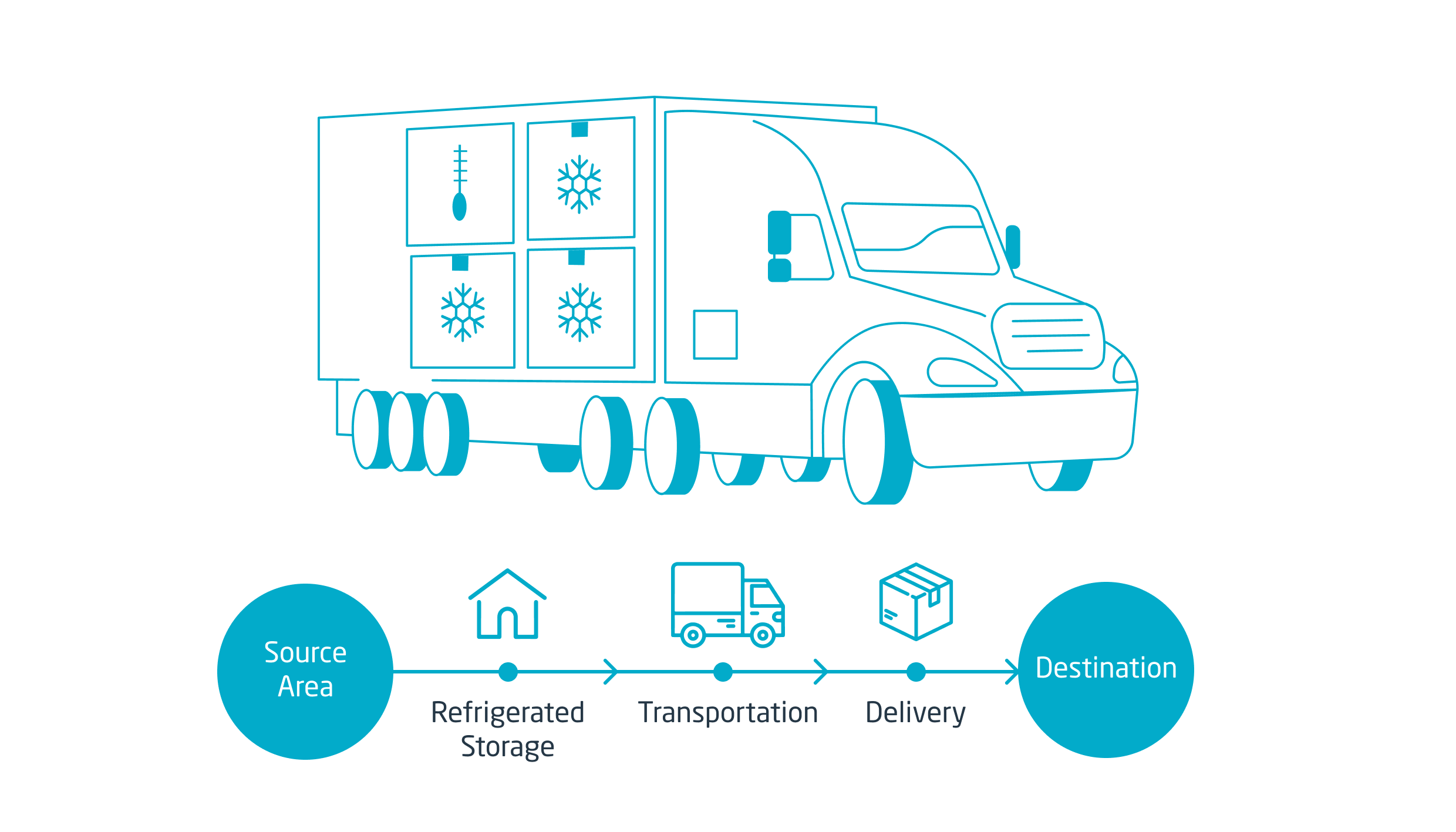

Transportation Tools: The corporate designs and manufactures specialised cryogenic trailers, ISO containers, and different transportation gear for the protected and environment friendly motion of LNG and different cryogenic fluids. That is crucial for the logistics of LNG supply to varied markets.

-

Course of Tools: Chart gives a broad vary of course of gear for numerous cryogenic purposes, together with pumps, valves, and instrumentation. This complete providing permits the corporate to offer full options to its clients.

-

Service and Upkeep: Past gear gross sales, Chart gives complete service and upkeep packages to make sure the continued operation and effectivity of its put in base. This recurring income stream gives stability and predictability to the corporate’s monetary efficiency.

Market Positioning and Aggressive Benefits

Chart Industries enjoys a powerful market place resulting from a number of key aggressive benefits:

-

Technological Management: The corporate constantly invests in analysis and improvement, resulting in progressive and environment friendly cryogenic applied sciences. This technological edge permits Chart to supply superior merchandise and options to its clients.

-

World Attain: Chart has a major international presence, with manufacturing amenities and repair facilities strategically positioned around the globe. This permits the corporate to serve clients in key LNG markets effectively.

-

Sturdy Buyer Relationships: Chart has cultivated long-term relationships with main gamers within the LNG and cryogenic industries, establishing itself as a trusted companion.

-

Diversified Product Portfolio: The corporate’s diversified product portfolio reduces its dependence on any single product or market section, offering resilience towards market fluctuations.

-

Give attention to Sustainability: With the rising emphasis on cleaner vitality sources, Chart’s involvement within the LNG and hydrogen sectors aligns with international sustainability targets. LNG is taken into account a transitional gas, enjoying a vital function within the transition to a lower-carbon vitality future, whereas hydrogen is rising as a key participant in a future vitality combine.

Monetary Efficiency and Development Prospects

Chart Industries has demonstrated constant progress in recent times, pushed by the growing demand for LNG and the growth of the cryogenic business. The corporate’s monetary efficiency is influenced by a number of components, together with:

-

World LNG Demand: The rising international demand for pure gasoline, notably in Asia and Europe, is a significant driver of LNG demand and consequently, Chart’s income progress.

-

Hydrogen Economic system Development: The rising hydrogen economic system presents a major progress alternative for Chart. The corporate is actively concerned in creating and supplying gear for hydrogen manufacturing, storage, and transportation.

-

Funding in Renewable Vitality: Elevated funding in renewable vitality sources, reminiscent of wind and photo voltaic, is not directly benefiting Chart. These renewable vitality sources typically require vitality storage options, and cryogenic applied sciences play an important function on this space.

-

Geopolitical Components: Geopolitical occasions and vitality safety considerations can considerably affect LNG demand and, consequently, Chart’s monetary efficiency.

Analyzing Chart’s monetary statements reveals key efficiency indicators like income progress, profitability margins, and return on fairness. These metrics present useful insights into the corporate’s monetary well being and future potential. Buyers ought to rigorously analyze these metrics together with business traits and macroeconomic components to make knowledgeable funding choices.

Challenges and Dangers

Whereas Chart Industries enjoys a powerful market place, it faces a number of challenges and dangers:

-

Commodity Worth Volatility: The costs of uncooked supplies and vitality sources can fluctuate considerably, impacting the corporate’s manufacturing prices and profitability.

-

Geopolitical Instability: Geopolitical occasions and worldwide commerce insurance policies can disrupt provide chains and have an effect on market demand.

-

Competitors: Chart faces competitors from different corporations within the cryogenic gear market, requiring steady innovation and cost-effectiveness.

-

Technological Disruption: Developments in cryogenic applied sciences might render current gear out of date, requiring vital funding in analysis and improvement to keep up a aggressive edge.

Future Outlook and Funding Issues

The longer term outlook for Chart Industries seems promising, pushed by the long-term progress of the LNG and hydrogen markets. The corporate’s strategic investments in analysis and improvement, coupled with its robust international presence and buyer relationships, place it effectively for continued success. Nevertheless, buyers ought to rigorously contemplate the inherent dangers related to the business, together with commodity worth volatility and geopolitical uncertainty. An intensive due diligence course of, together with an evaluation of monetary statements and business traits, is important earlier than making any funding choices. The corporate’s dedication to sustainability and its diversification into the burgeoning hydrogen sector additional enhances its long-term prospects. The transition in direction of a lower-carbon vitality future presents a major alternative for Chart Industries to capitalize on its experience in cryogenic applied sciences. By rigorously navigating the challenges and leveraging its strengths, Chart Industries is well-positioned to keep up its management place within the international cryogenic marketplace for years to come back. Nevertheless, steady monitoring of market dynamics and geopolitical components is essential for buyers searching for publicity to this dynamic and evolving sector. The corporate’s monetary efficiency, coupled with its strategic initiatives, will finally decide its long-term success and supply useful insights for potential buyers.

Closure

Thus, we hope this text has offered useful insights into Chart Industries: A Deep Dive into the LNG Chilly Chain. We hope you discover this text informative and helpful. See you in our subsequent article!