Deciphering the Bullish Indicators: A Complete Information to Chart Patterns

Associated Articles: Deciphering the Bullish Indicators: A Complete Information to Chart Patterns

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Deciphering the Bullish Indicators: A Complete Information to Chart Patterns. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Deciphering the Bullish Indicators: A Complete Information to Chart Patterns

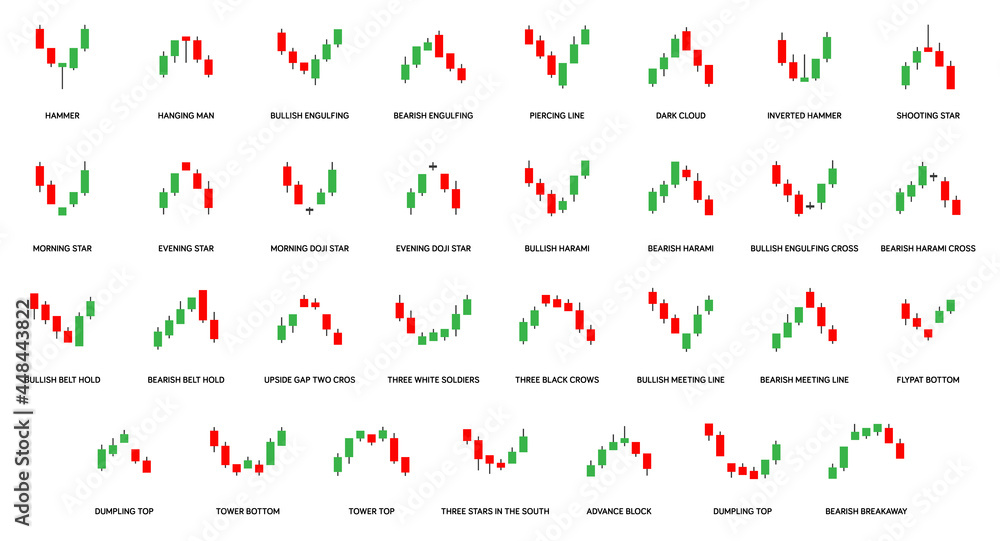

Technical evaluation, a cornerstone of buying and selling methods, depends closely on figuring out chart patterns to foretell future value actions. Whereas no sample ensures success, understanding bullish chart patterns can considerably improve your buying and selling decision-making course of. These patterns, fashioned by value motion and quantity, recommend a possible upward pattern, providing merchants alternatives to enter lengthy positions with the next likelihood of revenue. This text delves deep into varied bullish chart patterns, exploring their traits, identification strategies, and potential pitfalls.

Understanding the Fundamentals: Worth Motion and Quantity

Earlier than diving into particular patterns, it’s essential to grasp the elemental parts: value motion and quantity. Worth motion refers back to the motion of the asset’s value over time, visualized on a chart. Quantity, the variety of shares or contracts traded, offers context to cost actions. Excessive quantity confirms value motion, indicating robust conviction behind the transfer. Conversely, low quantity suggests weak momentum and potential for a reversal.

Key Bullish Chart Patterns:

A number of bullish chart patterns are well known and utilized by merchants. We’ll discover among the most outstanding ones:

1. Head and Shoulders Backside:

It is a traditional reversal sample signaling a possible shift from a downtrend to an uptrend. It’s characterised by three distinct troughs:

- Left Shoulder: A trough forming the preliminary low level.

- Head: A decrease trough than the left shoulder, representing a deeper value decline.

- Proper Shoulder: A trough roughly mirroring the left shoulder, however usually barely greater.

- Neckline: A trendline connecting the excessive factors of the left and proper shoulders.

A breakout above the neckline confirms the sample and alerts a possible bullish transfer. The goal value is usually estimated by measuring the space between the top and the neckline and including it to the breakout level. Excessive quantity accompanying the breakout strengthens the sign.

2. Inverse Head and Shoulders:

That is the mirror picture of the Head and Shoulders Backside, indicating a bullish reversal in an uptrend. It is fashioned with three peaks:

- Left Shoulder: A peak forming the preliminary excessive level.

- Head: The next peak than the left shoulder, representing a brief value peak.

- Proper Shoulder: A peak roughly mirroring the left shoulder, however usually barely decrease.

- Neckline: A trendline connecting the low factors of the left and proper shoulders.

A breakout above the neckline confirms the sample, suggesting additional value appreciation. The goal value is calculated equally to the Head and Shoulders Backside, measuring the space between the top and the neckline.

3. Double Backside:

This sample consists of two consecutive lows at roughly the identical value degree, adopted by a big upward value motion. The 2 lows characterize a interval of consolidation or non permanent weak spot earlier than a bullish resurgence. A breakout above the neckline (the excessive level connecting the 2 lows) confirms the sample. The goal value is estimated by including the space between the breakout level and the low level to the breakout level.

4. Triple Backside:

Just like the double backside, however with three consecutive lows at roughly the identical value degree. The triple backside sample usually signifies stronger help and elevated chance of a bullish reversal. The affirmation and goal value calculation are much like the double backside.

5. Cup and Deal with:

This sample resembles a cup with a deal with. The "cup" is a U-shaped value curve representing a interval of consolidation, whereas the "deal with" is a short-term downward correction. A breakout above the deal with’s resistance degree confirms the sample, suggesting additional upward motion. The goal value is usually estimated by measuring the depth of the cup and including it to the breakout level.

6. Ascending Triangle:

This sample is characterised by a sequence of upper highs and constantly horizontal resistance ranges. The value consolidates inside an upward-sloping triangle. A breakout above the resistance line confirms the sample and predicts additional value appreciation.

7. Rising Wedge:

This sample is fashioned by two upward-sloping trendlines converging upwards. Whereas technically a continuation sample, it may be thought of bullish if it happens inside a longtime uptrend. A breakout above the higher trendline confirms the sample, however it’s essential to notice that rising wedges are sometimes adopted by value corrections.

8. Bullish Flag:

This sample consists of a robust upward transfer (the "flagpole") adopted by a interval of consolidation (the "flag"). The consolidation sometimes happens inside parallel trendlines with a slight downward slope. A breakout above the higher trendline of the flag confirms the sample and suggests a continuation of the upward pattern.

9. Bullish Pennant:

Just like the bullish flag, however the consolidation part kinds a triangular form reasonably than parallel traces. A breakout above the higher trendline confirms the sample and suggests a continuation of the upward pattern.

Affirmation and Danger Administration:

Whereas these patterns recommend potential bullish strikes, affirmation is essential earlier than getting into a commerce. This consists of:

- Quantity: Excessive quantity accompanying the breakout strengthens the sign.

- Technical Indicators: RSI, MACD, and different indicators may also help affirm the bullish sign.

- Basic Evaluation: Contemplate the underlying fundamentals of the asset.

Danger administration is paramount. At all times use stop-loss orders to restrict potential losses. Place sizing is essential; by no means danger greater than you possibly can afford to lose.

Pitfalls and Limitations:

It’s important to acknowledge the restrictions of chart patterns:

- Subjectivity: Figuring out patterns might be subjective, resulting in differing interpretations.

- False Breakouts: Breakouts might be false, resulting in losses.

- Context Issues: Patterns must be analyzed inside the broader market context.

Conclusion:

Bullish chart patterns present helpful insights into potential value actions, however they aren’t foolproof predictors. Profitable buying and selling requires a mixture of sample recognition, affirmation methods, danger administration, and a deep understanding of market dynamics. By combining chart sample evaluation with different technical and basic indicators, merchants can enhance their decision-making course of and improve their buying and selling efficiency. Keep in mind that steady studying, follow, and self-discipline are important for fulfillment within the dynamic world of monetary markets. At all times conduct thorough analysis and contemplate consulting with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has supplied helpful insights into Deciphering the Bullish Indicators: A Complete Information to Chart Patterns. We respect your consideration to our article. See you in our subsequent article!