Deciphering the QQQ 5-Minute Chart: A Deep Dive into Intraday Buying and selling Alternatives and Dangers

Associated Articles: Deciphering the QQQ 5-Minute Chart: A Deep Dive into Intraday Buying and selling Alternatives and Dangers

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Deciphering the QQQ 5-Minute Chart: A Deep Dive into Intraday Buying and selling Alternatives and Dangers. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Deciphering the QQQ 5-Minute Chart: A Deep Dive into Intraday Buying and selling Alternatives and Dangers

The Invesco QQQ Belief (QQQ) tracks the Nasdaq-100 Index, a technology-heavy benchmark comprising 100 of the biggest non-financial corporations listed on the Nasdaq Inventory Market. Its 5-minute chart, a snapshot of value actions over five-minute intervals, supplies a granular view of short-term value motion, attracting each seasoned day merchants and people in search of to grasp the nuances of intraday market dynamics. This text will delve into the intricacies of decoding the QQQ 5-minute chart, highlighting potential buying and selling alternatives, frequent chart patterns, and the inherent dangers concerned.

Understanding the Information:

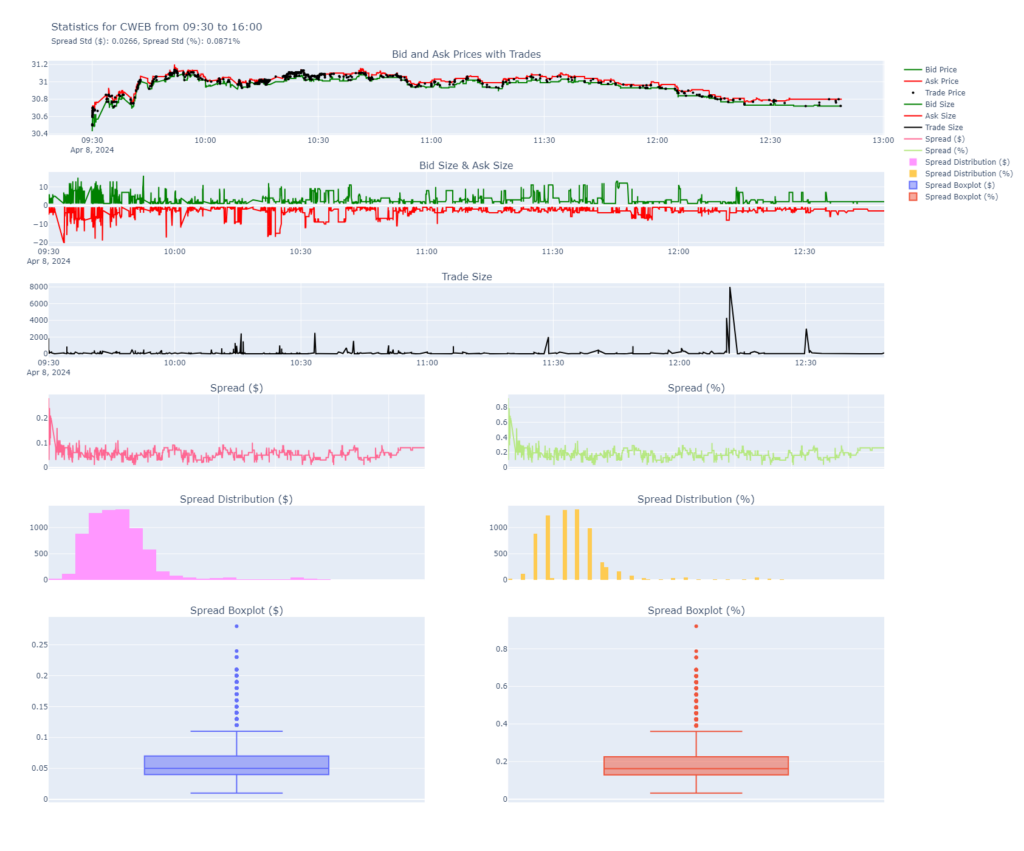

The QQQ 5-minute chart shows the opening, excessive, low, and shutting costs (OHLC) for every five-minute interval. This information, mixed with quantity info, permits merchants to research short-term value fluctuations, establish potential breakouts, and assess the energy of shopping for and promoting strain. Whereas providing a magnified perspective in comparison with each day or hourly charts, it additionally will increase the noise stage, making it essential to make use of acceptable filters and indicators.

Key Indicators and Chart Patterns:

A number of technical indicators and chart patterns show notably helpful when analyzing the QQQ 5-minute chart:

-

Shifting Averages: Quick-moving averages just like the 5-period or 10-period Exponential Shifting Common (EMA) can establish short-term developments and potential help/resistance ranges. A crossover of a quicker EMA above a slower EMA (e.g., 10-period EMA crossing above the 20-period EMA) is usually thought-about a bullish sign, whereas the other suggests bearish sentiment.

-

Relative Energy Index (RSI): The RSI measures the magnitude of latest value adjustments to judge overbought and oversold circumstances. Readings above 70 usually point out an overbought market, probably suggesting a value reversal, whereas readings under 30 recommend an oversold market, hinting at a possible bounce. Nonetheless, it is essential to keep in mind that the RSI can stay in overbought or oversold territory for prolonged intervals, particularly in sturdy developments.

-

Quantity: Analyzing quantity alongside value motion is essential. Robust value actions accompanied by excessive quantity affirm the development’s energy, whereas weak quantity throughout a value surge or decline suggests a scarcity of conviction and a possible reversal.

-

Help and Resistance Ranges: These are value ranges the place the worth has traditionally struggled to interrupt by way of. Help ranges signify areas the place shopping for strain is predicted to outweigh promoting strain, whereas resistance ranges point out the other. Breaks above resistance or under help can sign vital value actions.

-

Candlestick Patterns: Recognizing candlestick patterns like engulfing patterns, hammer, hanging man, doji, and capturing stars can present insights into potential value reversals or continuations. These patterns, when mixed with different indicators, supply a extra strong buying and selling sign.

-

Fibonacci Retracements: These instruments establish potential help and resistance ranges primarily based on Fibonacci ratios. They’re usually used to foretell value pullbacks inside a bigger development.

Buying and selling Methods:

A number of buying and selling methods will be employed utilizing the QQQ 5-minute chart:

-

Scalping: This high-frequency buying and selling technique goals to revenue from small value fluctuations inside a short while body (usually minutes). Scalpers use tight stop-loss orders to attenuate threat and infrequently depend on technical indicators like shifting averages and RSI.

-

Day Buying and selling: Day merchants maintain positions for a single buying and selling day, aiming to capitalize on intraday value swings. They usually use a mix of technical evaluation, chart patterns, and information occasions to establish buying and selling alternatives. Danger administration is paramount in day buying and selling, as losses can shortly accumulate.

-

Swing Buying and selling (Brief-Time period): Whereas usually related to longer timeframes, swing buying and selling may also be utilized to the 5-minute chart for shorter-term swings. This entails figuring out potential value reversals or breakouts and holding positions for just a few hours or a day.

Danger Administration:

Buying and selling the QQQ 5-minute chart carries vital dangers. The excessive frequency of trades and magnified value fluctuations improve the potential for fast losses. Efficient threat administration is essential and may embrace:

-

Cease-Loss Orders: These orders robotically promote a place when the worth falls to a predetermined stage, limiting potential losses.

-

Place Sizing: By no means threat extra capital on a single commerce than you may afford to lose. Correct place sizing ensures that even a number of shedding trades will not wipe out your buying and selling account.

-

Diversification: Do not put all of your eggs in a single basket. Diversifying your buying and selling throughout completely different belongings and techniques reduces total threat.

-

Backtesting: Earlier than implementing any buying and selling technique, it is essential to backtest it utilizing historic information to evaluate its efficiency and refine its parameters.

-

Emotional Self-discipline: Keep away from emotional buying and selling choices. Follow your buying and selling plan and keep away from chasing losses or letting greed dictate your actions.

Challenges and Limitations:

Whereas the QQQ 5-minute chart affords useful insights, it additionally presents challenges:

-

Elevated Noise: The brief timeframe amplifies random value fluctuations, making it tougher to establish real developments.

-

Slippage and Fee Prices: Frequent buying and selling can result in increased slippage (the distinction between the anticipated value and the precise execution value) and fee prices, consuming into income.

-

False Alerts: Technical indicators and chart patterns can generate false indicators, resulting in losses if not interpreted rigorously together with different components.

-

Information and Financial Occasions: Sudden information occasions can considerably impression the worth of QQQ, probably invalidating short-term buying and selling methods.

Conclusion:

The QQQ 5-minute chart affords a dynamic and thrilling buying and selling setting, however it requires a radical understanding of technical evaluation, threat administration, and market dynamics. Profitable buying and selling on this timeframe necessitates self-discipline, persistence, and a well-defined buying and selling plan. Whereas the potential for fast income exists, the dangers are equally substantial. Inexperienced persons ought to method this sort of buying and selling with warning, specializing in schooling, apply (utilizing a demo account), and a gradual improve in threat publicity as their expertise and expertise develop. Do not forget that constant profitability in short-term buying and selling is difficult, and losses are inevitable. The secret is to handle threat successfully and study from each successes and failures.

Closure

Thus, we hope this text has offered useful insights into Deciphering the QQQ 5-Minute Chart: A Deep Dive into Intraday Buying and selling Alternatives and Dangers. We hope you discover this text informative and helpful. See you in our subsequent article!