Decoding the Cryptic: A Complete Information to Chart Evaluation in Crypto Buying and selling

Associated Articles: Decoding the Cryptic: A Complete Information to Chart Evaluation in Crypto Buying and selling

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Decoding the Cryptic: A Complete Information to Chart Evaluation in Crypto Buying and selling. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the Cryptic: A Complete Information to Chart Evaluation in Crypto Buying and selling

The cryptocurrency market, a unstable and dynamic panorama, presents each immense alternatives and important dangers. Navigating this terrain requires a eager understanding of market developments and worth actions. Whereas basic evaluation focuses on the underlying expertise and adoption price of a cryptocurrency, chart evaluation, also called technical evaluation, offers a strong software for predicting future worth motion based mostly on historic information. This text serves as a complete information to chart evaluation within the crypto area, overlaying key ideas, indicators, and techniques.

Fundamentals of Chart Evaluation:

Chart evaluation depends on the precept that previous worth actions and buying and selling quantity provide clues about future worth conduct. Merchants use charts to establish patterns, developments, and assist and resistance ranges, serving to them make knowledgeable selections about when to purchase, promote, or maintain their crypto belongings. The method entails finding out worth actions over numerous timeframes, from short-term (minutes, hours) to long-term (days, weeks, months, years).

Varieties of Charts:

A number of chart sorts are utilized in crypto chart evaluation, every providing a singular perspective on worth information:

-

Candlestick Charts: These are the preferred selection amongst crypto merchants. Every candlestick represents a selected time interval (e.g., 1 hour, 1 day) and shows the opening worth, closing worth, excessive, and low. The physique of the candlestick exhibits the distinction between the opening and shutting costs, whereas the wicks (shadows) point out the excessive and low costs inside that interval. The colour of the candlestick (sometimes inexperienced for bullish and purple for bearish) additional clarifies the worth motion.

-

Line Charts: Line charts join the closing costs of every interval with a steady line, offering a simplified view of the general worth development. They’re much less detailed than candlestick charts however are helpful for figuring out long-term developments.

-

Bar Charts: Much like candlestick charts, bar charts characterize the opening, closing, excessive, and low costs for a given interval. Nonetheless, as an alternative of a candlestick physique, they use a horizontal bar.

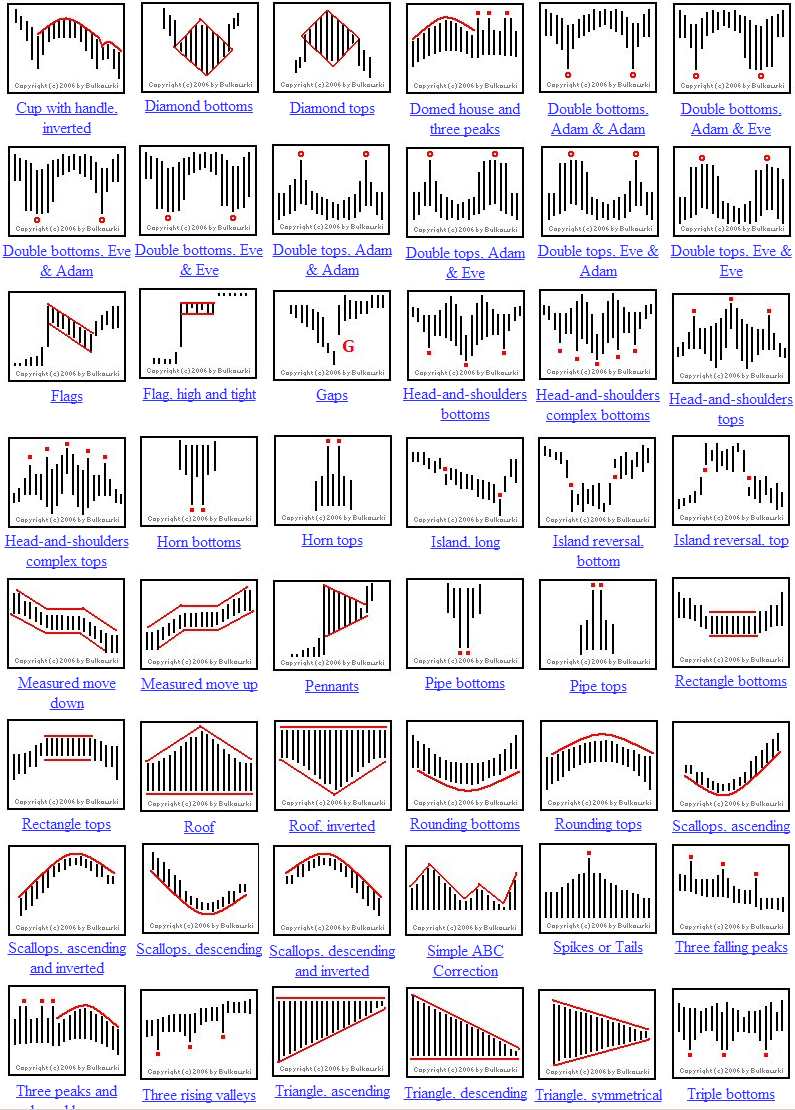

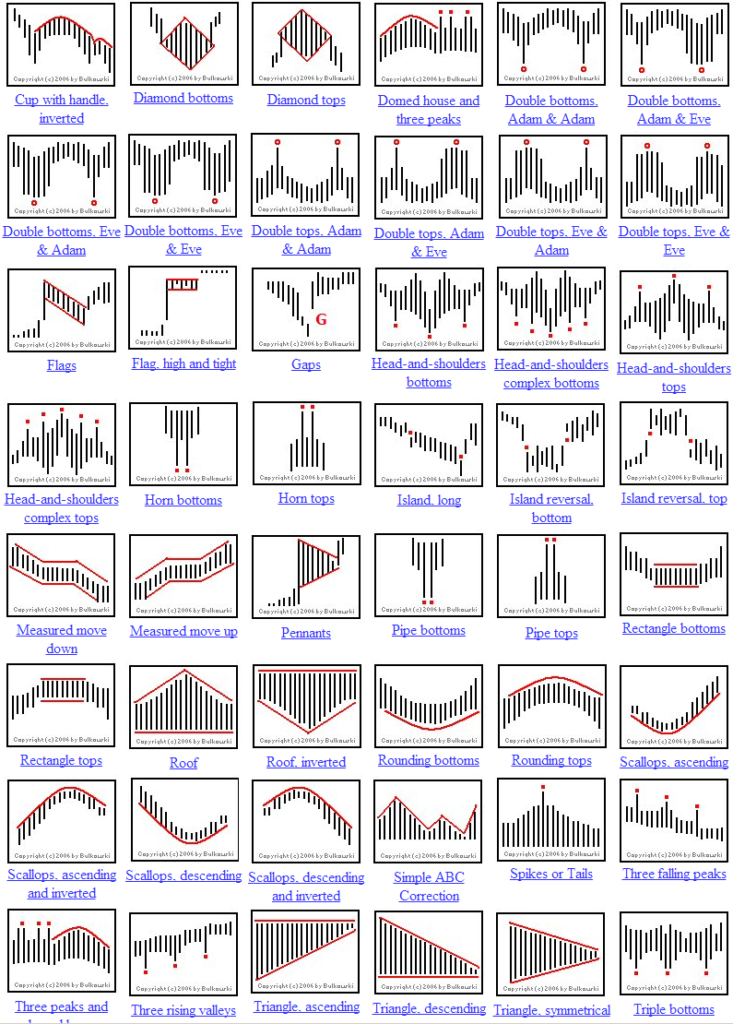

Key Chart Patterns:

Recognizing chart patterns is essential for predicting potential worth reversals or continuations. Some widespread patterns embrace:

-

Head and Shoulders: This reversal sample suggests a possible worth drop after a interval of upward motion. It consists of three peaks (the left shoulder, head, and proper shoulder) with decrease troughs between them.

-

Double High/Backside: These are reversal patterns characterised by two comparable peaks (double prime) or troughs (double backside) adopted by a break under (double prime) or above (double backside) the sample’s neckline.

-

Triangles: These patterns point out a interval of consolidation earlier than a possible breakout. Symmetrical triangles recommend a continuation of the prevailing development, whereas ascending and descending triangles recommend bullish and bearish breakouts, respectively.

-

Flags and Pennants: These are continuation patterns that happen throughout sturdy developments. They’re characterised by a quick interval of consolidation inside a channel earlier than the development resumes.

-

Wedges: Much like triangles, wedges are consolidation patterns that may be ascending or descending, suggesting both a bullish or bearish breakout.

Technical Indicators:

Technical indicators are mathematical calculations utilized to cost and quantity information to generate indicators about potential worth actions. Some widespread indicators embrace:

-

Transferring Averages (MA): MAs easy out worth fluctuations and establish developments. Widespread sorts embrace easy shifting averages (SMA), exponential shifting averages (EMA), and weighted shifting averages (WMA). Crossovers between completely different MAs (e.g., a short-term MA crossing above a long-term MA) usually generate purchase or promote indicators.

-

Relative Power Index (RSI): The RSI measures the magnitude of latest worth adjustments to judge overbought or oversold circumstances. Readings above 70 are sometimes thought-about overbought, whereas readings under 30 are thought-about oversold.

-

MACD (Transferring Common Convergence Divergence): The MACD compares two shifting averages to establish momentum adjustments. Crossovers of the MACD line above its sign line recommend bullish momentum, whereas crossovers under recommend bearish momentum.

-

Bollinger Bands: Bollinger Bands include three traces: a easy shifting common and two commonplace deviation bands above and under it. They assist establish volatility and potential worth reversals. Costs touching or breaking the bands usually point out potential reversals.

-

Quantity: Buying and selling quantity offers essential context for worth actions. Excessive quantity throughout a worth improve confirms the power of the uptrend, whereas excessive quantity throughout a worth lower confirms the power of the downtrend. Low quantity throughout worth actions usually suggests weak spot.

Assist and Resistance Ranges:

Assist ranges characterize worth factors the place shopping for strain is robust sufficient to forestall additional worth declines. Resistance ranges characterize worth factors the place promoting strain is robust sufficient to forestall additional worth will increase. These ranges are sometimes recognized by earlier worth highs and lows. Breakouts above resistance ranges usually sign bullish developments, whereas breakdowns under assist ranges usually sign bearish developments.

Fibonacci Retracements and Extensions:

Fibonacci retracements and extensions are based mostly on the Fibonacci sequence, a mathematical sequence present in nature. These instruments assist establish potential worth reversal or continuation factors based mostly on proportion retracements or extensions of earlier worth actions.

Combining Indicators and Patterns:

Efficient chart evaluation hardly ever depends on a single indicator or sample. Profitable merchants mix a number of indicators and patterns to verify indicators and cut back the chance of false indicators. For example, a bullish crossover of shifting averages confirmed by a breakout above a resistance degree and a constructive RSI studying offers a stronger purchase sign than any single indicator alone.

Threat Administration:

Even with thorough chart evaluation, cryptocurrency buying and selling entails inherent dangers. Efficient danger administration is essential to guard capital. Methods embrace:

-

Place Sizing: By no means make investments greater than you possibly can afford to lose. Decide the suitable quantity to spend money on every commerce based mostly in your danger tolerance.

-

Cease-Loss Orders: Set stop-loss orders to mechanically promote your belongings if the worth drops to a predetermined degree, limiting potential losses.

-

Take-Revenue Orders: Set take-profit orders to mechanically promote your belongings if the worth rises to a predetermined degree, securing earnings.

-

Diversification: Do not put all of your eggs in a single basket. Diversify your investments throughout completely different cryptocurrencies to cut back danger.

Conclusion:

Chart evaluation is a strong software for navigating the complexities of the cryptocurrency market. By understanding the basics of chart patterns, technical indicators, and danger administration, merchants can enhance their decision-making and improve their probabilities of success. Nonetheless, it is essential to do not forget that chart evaluation isn’t a foolproof methodology, and no technique ensures earnings. Steady studying, apply, and adaptation are important for long-term success in crypto buying and selling. Moreover, combining technical evaluation with basic evaluation offers a extra holistic and knowledgeable strategy to funding selections within the dynamic world of cryptocurrencies. At all times conduct thorough analysis and take into account searching for recommendation from certified monetary professionals earlier than making any funding selections.

Closure

Thus, we hope this text has offered beneficial insights into Decoding the Cryptic: A Complete Information to Chart Evaluation in Crypto Buying and selling. We thanks for taking the time to learn this text. See you in our subsequent article!