Decoding the Depths: A Complete Information to Market Depth Charts

Associated Articles: Decoding the Depths: A Complete Information to Market Depth Charts

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Decoding the Depths: A Complete Information to Market Depth Charts. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Decoding the Depths: A Complete Information to Market Depth Charts

Market depth charts, usually missed by informal traders, supply a robust window into the underlying liquidity and worth dynamics of a monetary instrument. Not like easy worth charts that solely present the present worth and up to date worth historical past, market depth charts present a granular view of the purchase and promote orders ready to be executed at numerous worth ranges. This granular element permits merchants to evaluate the power of assist and resistance ranges, gauge the potential for worth actions, and make extra knowledgeable buying and selling choices. This text will delve into the intricacies of market depth charts, explaining their parts, interpretation methods, and sensible purposes.

Understanding the Fundamentals: What’s Market Depth?

Market depth, merely put, refers back to the variety of purchase and promote orders accessible at completely different worth ranges for a given safety. It is a measure of liquidity – the convenience with which an asset will be purchased or offered with out considerably impacting its worth. A market with excessive depth possesses quite a few purchase and promote orders clustered across the present market worth, indicating a robust capability to soak up giant trades with out substantial worth fluctuations. Conversely, a market with low depth options sparse orders, making it susceptible to cost swings triggered by even comparatively small trades.

Deconstructing the Market Depth Chart:

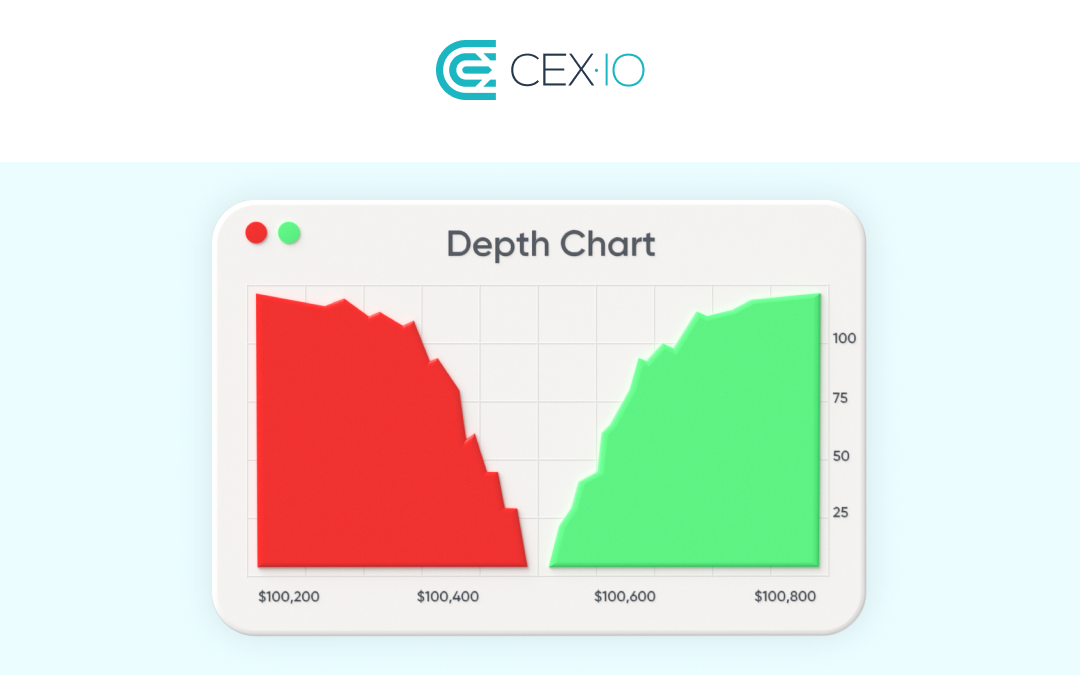

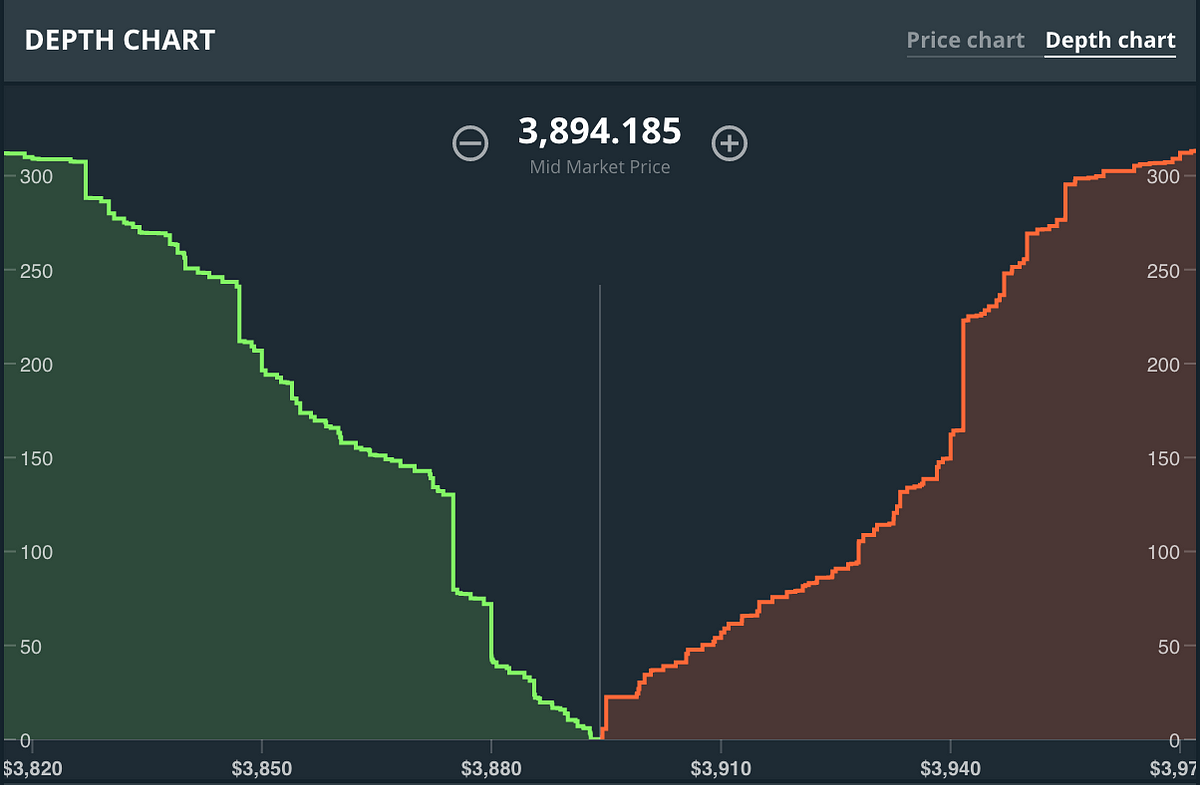

A typical market depth chart, often known as a Stage II market knowledge chart or order ebook, is introduced as a two-sided histogram or a stacked bar chart. One facet represents the bid (purchase) facet, displaying the variety of shares supplied at numerous costs under the present market worth. The opposite facet represents the ask (promote) facet, displaying the variety of shares accessible on the market at costs above the present market worth.

Key parts of a market depth chart embody:

- Bid Value: The very best worth at which a purchaser is prepared to buy a safety.

- Bid Dimension/Quantity: The whole variety of shares consumers are prepared to buy on the bid worth.

- Ask Value: The bottom worth at which a vendor is prepared to promote a safety.

- Ask Dimension/Quantity: The whole variety of shares sellers are prepared to promote on the ask worth.

- Unfold: The distinction between the most effective bid worth and the most effective ask worth. A slender unfold signifies excessive liquidity, whereas a large unfold suggests low liquidity.

- Depth of Market at Every Value Stage: The cumulative quantity of purchase and promote orders at every particular worth degree. That is visually represented by the peak of the bars or the dimensions of the histogram blocks.

Decoding Market Depth Charts: A Sensible Strategy

Decoding market depth charts requires observe and a eager understanding of market dynamics. Nonetheless, a number of key indicators may also help merchants glean priceless insights:

-

Excessive Quantity at Particular Value Ranges: Giant volumes clustered round explicit worth ranges recommend sturdy assist (on the bid facet) or resistance (on the ask facet). These ranges are prone to affect worth motion considerably. A big quantity of bids slightly below the present worth signifies sturdy purchaser curiosity and potential assist, whereas a big quantity of asks simply above the present worth signifies sturdy vendor curiosity and potential resistance.

-

Uneven Distribution of Orders: An imbalance between bid and ask volumes can sign potential worth motion. For instance, a considerably bigger quantity of bids than asks suggests a possible upward worth motion, whereas the other signifies a possible downward motion. This imbalance, nonetheless, needs to be thought of together with different market indicators.

-

Unfold Evaluation: A widening unfold usually signifies lowering liquidity, suggesting that it is perhaps tougher to execute trades shortly with out considerably impacting the worth. A narrowing unfold, conversely, suggests rising liquidity.

-

Order E-book Form: The general form of the order ebook can present priceless insights. A steep slope on the bid or ask facet signifies a comparatively skinny market at these worth ranges, making it inclined to cost manipulation or sharp worth actions. A flat or gradual slope suggests a extra sturdy and resilient market.

-

Order Stream Dynamics: Observing how the order ebook adjustments over time can reveal details about the market sentiment and the intentions of market contributors. A sudden inflow of purchase orders, as an illustration, may point out rising purchaser confidence and a possible upward worth motion.

Sensible Functions in Buying and selling:

Market depth charts are invaluable instruments for numerous buying and selling methods:

-

Figuring out Help and Resistance Ranges: As talked about earlier, excessive volumes at particular worth ranges usually point out sturdy assist or resistance. Merchants can use this info to position stop-loss orders or to anticipate potential worth reversals.

-

Assessing Liquidity: Market depth permits merchants to gauge the liquidity of a safety earlier than getting into a commerce. Buying and selling in illiquid markets will be dangerous, because it is perhaps tough to exit a place shortly with out vital worth slippage.

-

Scalping and Day Buying and selling: Market depth charts are significantly helpful for short-term merchants who goal to revenue from small worth fluctuations. They will establish alternatives to purchase on the bid and promote on the ask, making the most of small worth discrepancies.

-

Algorithmic Buying and selling: Many algorithmic buying and selling methods rely closely on market depth knowledge to establish arbitrage alternatives, execute trades effectively, and handle danger.

-

Danger Administration: Understanding market depth helps merchants to handle their danger successfully by anticipating potential worth actions and setting acceptable stop-loss orders.

Limitations and Issues:

Whereas market depth charts supply a wealth of data, it is essential to acknowledge their limitations:

-

Hidden Orders: Not all orders are seen on market depth charts. Giant institutional traders usually use hidden orders (orders that aren’t displayed on the order ebook) to keep away from impacting the market worth.

-

Dynamic Nature: The order ebook is continually altering, reflecting the real-time exercise of consumers and sellers. What’s seen at one second is perhaps completely different the subsequent.

-

Interpretation Challenges: Decoding market depth charts requires expertise and an intensive understanding of market dynamics. Misinterpreting the information can result in poor buying and selling choices.

-

Information Accuracy: The accuracy of market depth knowledge is dependent upon the reliability of the information feed offered by the change.

Conclusion:

Market depth charts are a robust device for discerning merchants, offering a deep perception into the underlying liquidity and worth dynamics of a safety. By understanding the parts of those charts and mastering the methods of interpretation, merchants can improve their capacity to establish buying and selling alternatives, assess danger, and make extra knowledgeable choices. Nonetheless, it’s essential to do not forget that market depth is only one piece of the puzzle. Profitable buying and selling requires combining this info with different technical and basic evaluation strategies, in addition to a sound danger administration technique. By integrating market depth evaluation right into a holistic buying and selling method, traders can considerably enhance their buying and selling efficiency and navigate the complexities of the monetary markets with higher confidence.

Closure

Thus, we hope this text has offered priceless insights into Decoding the Depths: A Complete Information to Market Depth Charts. We hope you discover this text informative and useful. See you in our subsequent article!