Decoding the Double Prime Sample: A Complete Information for Merchants

Associated Articles: Decoding the Double Prime Sample: A Complete Information for Merchants

Introduction

With enthusiasm, let’s navigate by the intriguing matter associated to Decoding the Double Prime Sample: A Complete Information for Merchants. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the Double Prime Sample: A Complete Information for Merchants

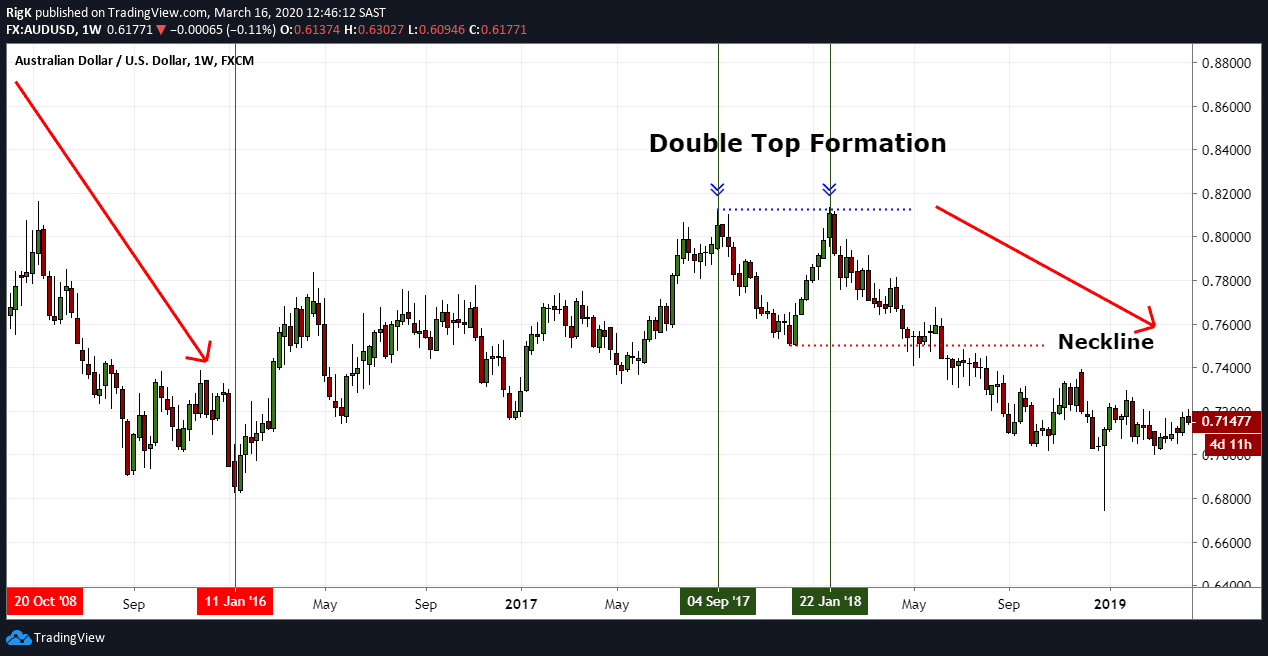

The double prime sample is a well known chart sample in technical evaluation, signaling a possible development reversal from uptrend to downtrend. Its predictable nature makes it a beneficial instrument for merchants in search of to establish opportune entry and exit factors. Nonetheless, understanding its nuances, limitations, and correct context is essential for profitable implementation. This text delves deep into the double prime sample, overlaying its formation, identification, affirmation, buying and selling methods, threat administration, and customary pitfalls.

Understanding the Formation of a Double Prime Sample

The double prime sample is characterised by two distinct worth peaks (the "tops") of roughly equal peak, adopted by a neckline help degree. The formation suggests a weakening of the bullish momentum. Let’s break down its elements:

-

Two Worth Peaks (Tops): These symbolize durations of robust shopping for stress that finally falter. Ideally, these peaks must be comparatively shut in worth, signifying a scarcity of sustained upward momentum. A minor discrepancy (inside a 3-5% vary) is mostly acceptable.

-

Neckline: It is a essential aspect, performing as a help degree throughout the sample’s formation and later as a possible breakout degree. It is sometimes a trendline connecting the lows between the 2 peaks. The neckline could be a horizontal line or a barely sloping line. Its break is commonly thought of the affirmation sign for the sample.

-

Proper Shoulder: The worth motion after the second peak, earlier than the neckline break, is sometimes called the fitting shoulder. It often displays a gradual decline, indicating waning purchaser curiosity.

Figuring out a Double Prime Sample: Key Concerns

Whereas the visible illustration of a double prime is comparatively simple, correct identification requires cautious consideration of a number of elements:

-

Quantity Evaluation: Quantity ought to ideally be increased throughout the formation of the 2 peaks, indicating robust shopping for stress at these ranges. Conversely, quantity ought to lower throughout the formation of the fitting shoulder, confirming waning bullish momentum. A major quantity spike on the neckline breakout additional strengthens the bearish sign.

-

Timeframe: The timeframe on which the sample is recognized issues. A double prime shaped on a every day chart carries extra weight than one shaped on a 5-minute chart. The timeframe ought to align with the dealer’s funding horizon.

-

Worth Motion: The worth motion surrounding the sample supplies beneficial context. Search for indicators of bearish divergence, the place worth makes increased highs, however a corresponding indicator (like RSI or MACD) makes decrease highs. This divergence suggests weakening bullish momentum.

-

Contextual Evaluation: Take into account the broader market surroundings. Is the general market trending upward or downward? A double prime sample inside a powerful uptrend may be a brief pullback somewhat than a big development reversal.

Affirmation of the Double Prime Sample: When to Act

The affirmation of a double prime sample sometimes happens when the worth breaks beneath the neckline. This break must be accompanied by elevated buying and selling quantity, reinforcing the bearish sign. A number of different confirmations can enhance confidence within the commerce setup:

-

Breakout Past the Neckline: A transparent and decisive break beneath the neckline is essential. A minor dip beneath the neckline adopted by a fast restoration may be a false breakout.

-

Elevated Buying and selling Quantity: Larger-than-average quantity on the neckline break confirms the promoting stress and will increase the probability of a sustained downtrend.

-

Affirmation from Technical Indicators: Indicators reminiscent of RSI, MACD, or shifting averages can present extra affirmation. For instance, a bearish crossover within the MACD or an RSI drop beneath oversold ranges can strengthen the bearish sign.

-

Worth Goal: As soon as the neckline is damaged, a standard worth goal is calculated by measuring the space between the very best peak and the neckline and projecting that distance downward from the neckline. This supplies a possible worth goal for the downtrend.

Buying and selling Methods and Danger Administration

As soon as the double prime sample is confirmed, a number of buying and selling methods may be employed:

-

Brief Promoting: The most typical technique is brief promoting the asset after the neckline breakout. This entails borrowing the asset and promoting it, hoping to purchase it again at a cheaper price later.

-

Cease-Loss Order: A vital aspect of threat administration is inserting a stop-loss order above the neckline. This order robotically sells the shorted asset if the worth rises above the neckline, limiting potential losses.

-

Take-Revenue Order: A take-profit order must be positioned on the calculated worth goal, permitting merchants to lock in earnings as soon as the worth reaches that degree.

-

Trailing Cease-Loss: As the worth strikes downwards, a trailing stop-loss order can be utilized to guard earnings whereas permitting the commerce to proceed to profit from additional worth declines.

Frequent Pitfalls and Limitations

Whereas the double prime sample could be a beneficial instrument, it is important to pay attention to its limitations:

-

False Breakouts: The worth would possibly briefly break beneath the neckline however then shortly get better, leading to a false sign. That is why quantity affirmation and different technical indicators are essential.

-

Ambiguous Necklines: In some circumstances, the neckline may be unclear or tough to outline, making it difficult to establish the sample precisely.

-

Sample Failure: The sample would possibly fail to materialize, and the worth would possibly proceed its upward development. This highlights the significance of threat administration and place sizing.

-

Overreliance on a Single Sample: It is unwise to rely solely on the double prime sample for buying and selling selections. Mix it with different technical indicators and basic evaluation for a extra complete strategy.

Conclusion: Integrating the Double Prime Sample into Your Buying and selling Technique

The double prime sample is a robust instrument for figuring out potential development reversals. Nonetheless, its profitable software requires a radical understanding of its formation, affirmation, and limitations. By combining the sample with different technical indicators, quantity evaluation, and sound threat administration practices, merchants can considerably enhance their buying and selling selections and improve their probabilities of success. Bear in mind, no buying and selling technique is foolproof, and steady studying and adaptation are important for long-term success within the dynamic world of economic markets. At all times apply accountable buying and selling and handle your threat appropriately.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the Double Prime Sample: A Complete Information for Merchants. We respect your consideration to our article. See you in our subsequent article!