Decoding the Gold Worth Week Chart: A Deep Dive into Latest Market Actions

Associated Articles: Decoding the Gold Worth Week Chart: A Deep Dive into Latest Market Actions

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the Gold Worth Week Chart: A Deep Dive into Latest Market Actions. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the Gold Worth Week Chart: A Deep Dive into Latest Market Actions

:max_bytes(150000):strip_icc()/GOLD_2023-05-17_09-51-04-aea62500f1a249748eb923dbc1b6993b.png)

The gold market, a haven for traders in search of security and diversification, is characterised by its inherent volatility. Understanding the weekly value chart is essential for navigating this dynamic panorama. This text delves into the intricacies of a typical gold value week chart, exploring the elements influencing its fluctuations, deciphering frequent chart patterns, and offering insights into potential buying and selling methods.

Understanding the Parts of a Gold Worth Week Chart:

A typical gold value week chart shows the valuable steel’s value actions over a interval of seven days. It often incorporates the next components:

- Worth Axis (Y-axis): Represents the worth of gold, usually expressed in US {dollars} per troy ounce (USD/oz).

- Time Axis (X-axis): Represents the times of the week, usually ranging from Monday and ending on Friday (relying available on the market’s buying and selling schedule). Some charts could prolong to incorporate weekend value actions if out there from after-hours buying and selling.

- Candlesticks or Line Graphs: These are the visible representations of value motion. Candlesticks present a extra detailed image, displaying the open, excessive, low, and shutting costs for every day. Line graphs merely join the closing costs of every day.

- Quantity: Many charts incorporate quantity indicators, displaying the buying and selling exercise for every day. Excessive quantity usually accompanies important value actions.

- Shifting Averages: These are calculated traces that easy out value fluctuations, offering insights into the general development. Widespread shifting averages embrace the 50-day and 200-day shifting averages.

- Technical Indicators: Numerous technical indicators like Relative Power Index (RSI), Shifting Common Convergence Divergence (MACD), and Bollinger Bands will be overlaid on the chart to offer extra alerts about potential value path and momentum.

Elements Influencing Weekly Gold Worth Actions:

A number of interconnected elements contribute to the weekly fluctuations noticed in gold value charts:

-

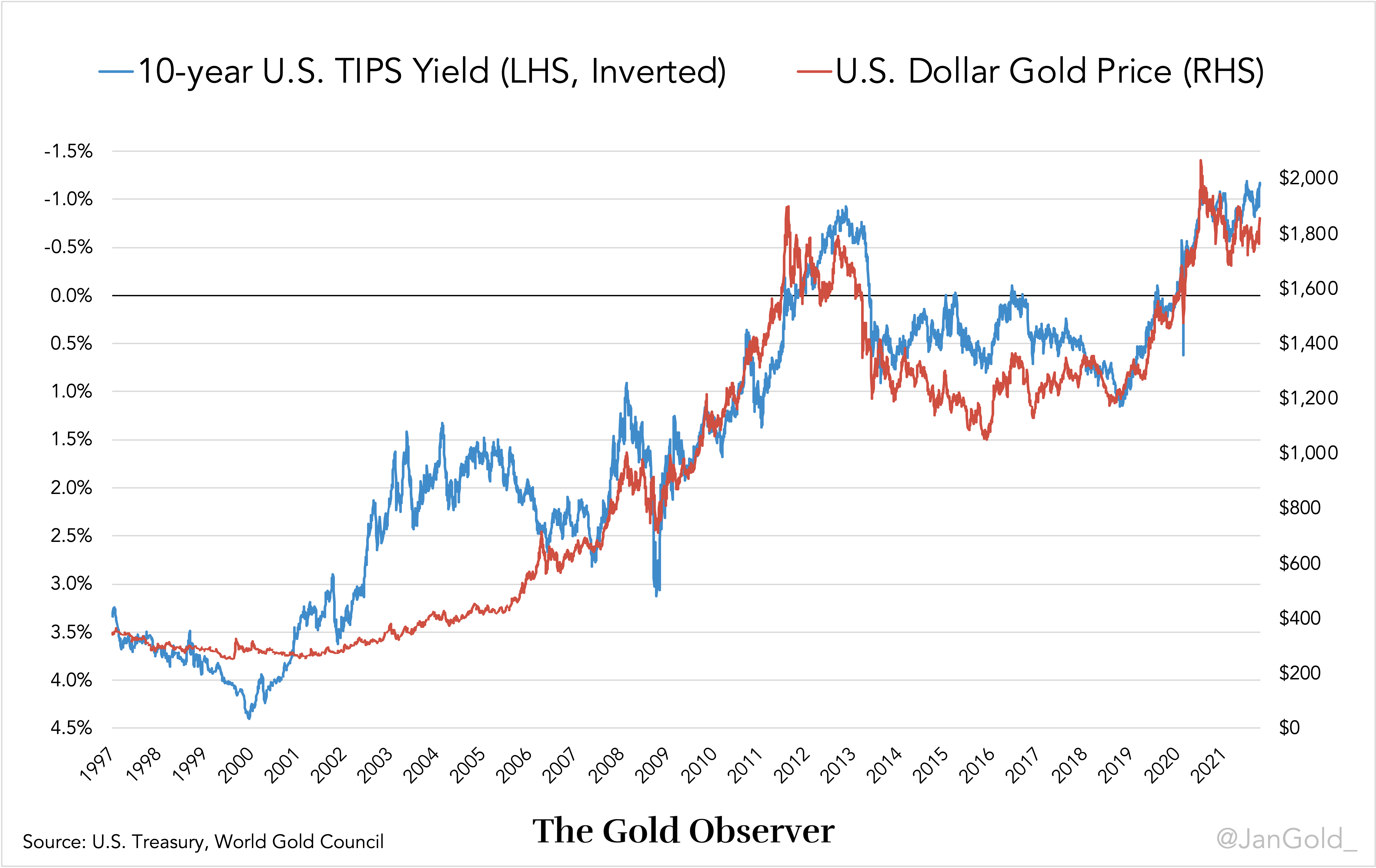

US Greenback Power: Gold is priced in US {dollars}. A stronger greenback usually results in decrease gold costs, because it turns into dearer for holders of different currencies to buy gold. Conversely, a weaker greenback often boosts gold costs. Weekly adjustments within the US Greenback Index (DXY) are intently watched by gold merchants.

-

Curiosity Charges: Larger rates of interest typically exert downward strain on gold costs. It is because larger charges enhance the chance price of holding non-yielding belongings like gold, making bonds and different interest-bearing devices extra enticing. Bulletins from central banks relating to rate of interest choices considerably impression gold’s value.

-

Inflation and Inflation Expectations: Gold is usually seen as a hedge in opposition to inflation. Rising inflation expectations, or precise will increase in inflation, are inclined to push gold costs larger, as traders search to guard their buying energy. Weekly inflation information releases from numerous international locations are intently monitored.

-

Geopolitical Occasions: International political instability and uncertainty usually drive traders in direction of safe-haven belongings like gold. Main geopolitical occasions, resembling wars, political upheavals, or escalating commerce tensions, could cause important gold value spikes.

-

Provide and Demand: The interaction of gold provide and demand influences its value. Adjustments in gold mining manufacturing, central financial institution gold purchases or gross sales, and investor sentiment all contribute to shifts within the supply-demand steadiness. Weekly experiences on gold mining output and ETF holdings present insights into these dynamics.

-

Market Sentiment: Investor sentiment performs an important function. Durations of optimism within the broader monetary markets can result in decrease gold costs as traders shift their focus to riskier belongings. Conversely, pessimism and danger aversion usually drive elevated demand for gold. This sentiment will be gauged via numerous market indicators and information experiences.

Decoding Chart Patterns:

Analyzing weekly gold value charts includes figuring out patterns that may present clues about future value actions. Some frequent patterns embrace:

- Uptrends: A collection of upper highs and better lows suggests a bullish development.

- Downtrends: A collection of decrease highs and decrease lows signifies a bearish development.

- Consolidation: A interval of sideways buying and selling, the place costs fluctuate inside an outlined vary, suggests indecision out there. Breakouts from consolidation patterns will be important buying and selling alerts.

- Head and Shoulders: A reversal sample indicating a possible shift from an uptrend to a downtrend.

- Double Tops/Bottoms: Reversal patterns just like head and shoulders, however less complicated of their formation.

- Triangles: Continuation or reversal patterns that always precede a big value transfer.

Buying and selling Methods Primarily based on Weekly Charts:

Weekly gold value charts are often utilized by merchants to develop numerous methods:

- Development Following: Figuring out the general development (uptrend or downtrend) and buying and selling within the path of that development.

- Breakout Buying and selling: Figuring out consolidation patterns and getting into trades when the worth breaks out of the vary.

- Reversal Buying and selling: Figuring out reversal patterns (like head and shoulders or double tops/bottoms) and getting into trades anticipating a value reversal.

- Assist and Resistance Buying and selling: Figuring out ranges the place the worth has traditionally discovered help (shopping for alternatives) or resistance (promoting alternatives).

- Shifting Common Crossover Methods: Utilizing shifting averages to generate purchase or promote alerts based mostly on their crossovers.

Conclusion:

The weekly gold value chart is a robust device for understanding and navigating the gold market. By rigorously analyzing the chart’s parts, understanding the elements influencing value actions, deciphering chart patterns, and using applicable buying and selling methods, traders and merchants can enhance their decision-making course of and doubtlessly improve their returns. Nonetheless, it is essential to do not forget that no buying and selling technique ensures success, and danger administration is paramount. Thorough analysis, diversification, and a well-defined buying and selling plan are important for navigating the complexities of the gold market. Combining chart evaluation with basic evaluation, contemplating macroeconomic elements, and staying knowledgeable about geopolitical occasions will contribute to a extra complete understanding of the gold market and its weekly value actions. Lastly, consulting with a monetary advisor earlier than making any funding choices is at all times beneficial.

:max_bytes(150000):strip_icc()/Goldchart-997cf958e5b941a79e319b82a078283f.jpg)

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the Gold Worth Week Chart: A Deep Dive into Latest Market Actions. We hope you discover this text informative and useful. See you in our subsequent article!