Decoding the Quarterly GDP Chart: A Deep Dive into Financial Fluctuations

Associated Articles: Decoding the Quarterly GDP Chart: A Deep Dive into Financial Fluctuations

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Quarterly GDP Chart: A Deep Dive into Financial Fluctuations. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Decoding the Quarterly GDP Chart: A Deep Dive into Financial Fluctuations

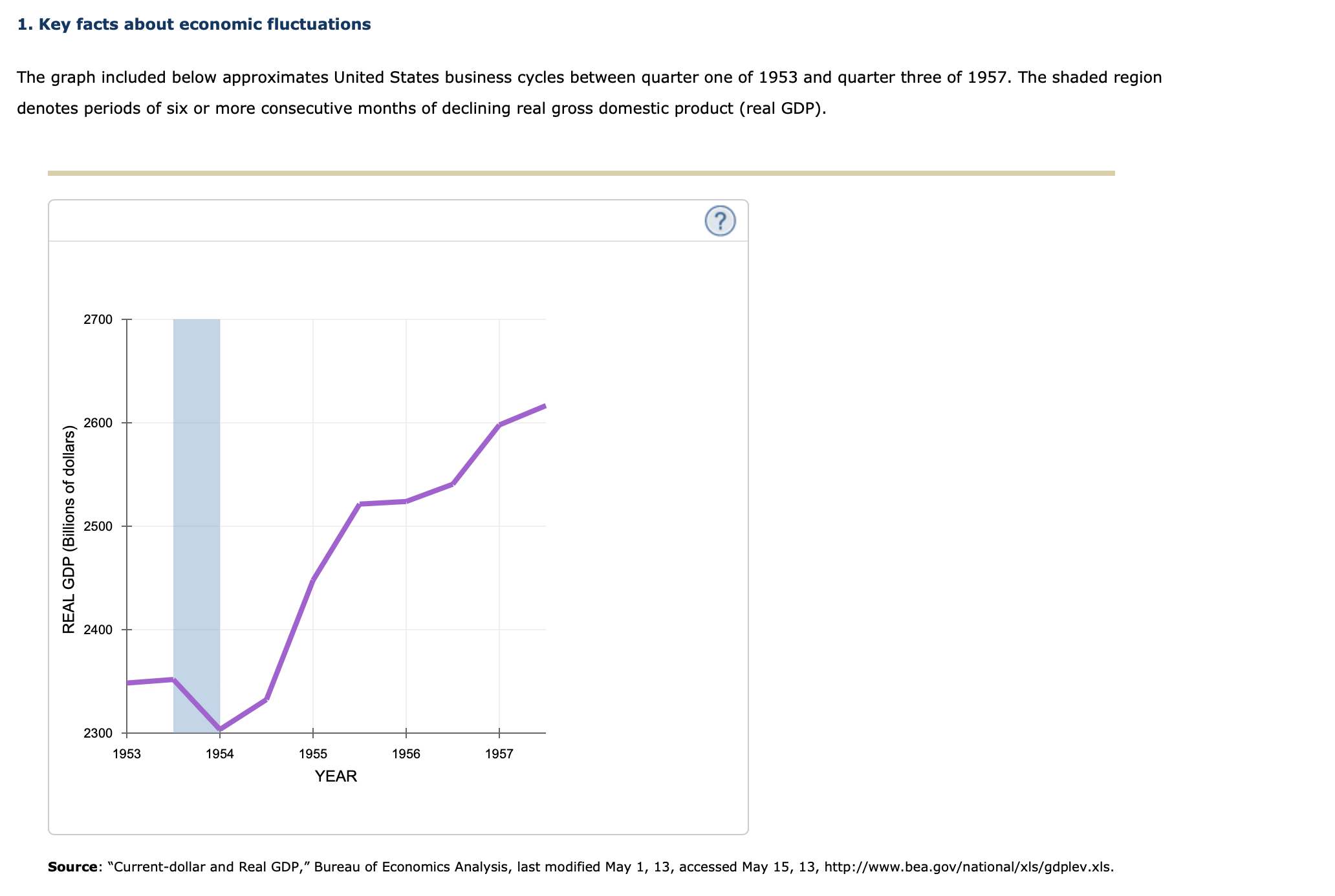

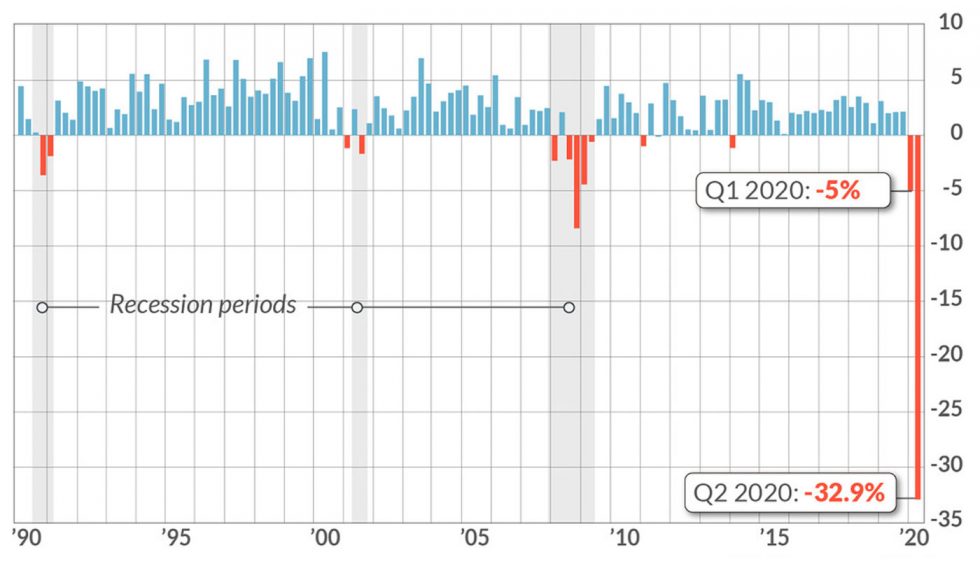

The Gross Home Product (GDP) is the cornerstone of macroeconomic evaluation, representing the overall financial worth of all completed items and companies produced inside a rustic’s borders in a particular interval. Whereas annual GDP figures present a broad overview of financial efficiency, quarterly GDP charts provide a way more granular and well timed image, revealing the ebb and movement of financial exercise all year long. Analyzing these charts permits economists, policymakers, and traders to establish developments, anticipate potential challenges, and make knowledgeable choices. This text will delve into the intricacies of quarterly GDP charts, exploring their development, interpretation, and significance in understanding financial well being and forecasting future efficiency.

Setting up the Quarterly GDP Chart:

The development of a quarterly GDP chart begins with the meticulous assortment of financial information. Authorities statistical companies, just like the Bureau of Financial Evaluation (BEA) in the US or the Workplace for Nationwide Statistics (ONS) in the UK, make use of an enormous community of information sources to compile this info. These sources embrace:

- Enterprise surveys: These surveys accumulate information on manufacturing, gross sales, inventories, and employment from a consultant pattern of companies throughout numerous sectors.

- Authorities expenditure information: This information displays authorities spending on items and companies, infrastructure tasks, and social applications.

- Client spending information: This significant element captures family expenditures on sturdy and non-durable items, in addition to companies.

- Funding information: This contains enterprise funding in gear, software program, and buildings, together with residential funding.

- Web exports: This represents the distinction between the worth of exports and imports, reflecting the contribution of worldwide commerce to the GDP.

This uncooked information is then processed utilizing refined methodologies, typically using strategies like chain-weighting to regulate for value adjustments and guarantee correct comparisons throughout time intervals. The ensuing GDP figures are sometimes introduced in actual phrases, that means they’re adjusted for inflation to mirror adjustments within the quantity of products and companies produced somewhat than merely adjustments in costs.

As soon as the quarterly GDP figures are calculated, they’re plotted on a chart, normally with time (quarters) on the horizontal axis and the GDP worth (typically in billions or trillions of foreign money models) on the vertical axis. The chart sometimes exhibits a line graph, visually representing the expansion or contraction of the economic system over time. Typically, further info, similar to year-over-year development charges or share adjustments from the earlier quarter, is overlaid on the chart to facilitate simpler interpretation.

Decoding Quarterly GDP Charts:

Decoding a quarterly GDP chart requires understanding a number of key features:

- Progress vs. Contraction: An upward-sloping line signifies financial development, whereas a downward-sloping line alerts financial contraction. The steeper the slope, the sooner the speed of development or contraction.

- Seasonality: GDP figures might be influenced by seasonal elements, similar to elevated shopper spending in the course of the vacation season or decreased agricultural output throughout sure instances of the yr. Economists typically use seasonal adjustment strategies to take away these seasonal fluctuations and reveal underlying developments.

- Progress Charge: The share change in GDP from one quarter to the following or from the identical quarter of the earlier yr is a vital indicator of financial momentum. A constantly constructive development price suggests a wholesome economic system, whereas a sustained unfavorable development price signifies a recession.

- Volatility: Quarterly GDP information might be unstable, that means that figures can fluctuate considerably from one quarter to the following. This volatility is commonly on account of short-term elements, similar to sudden climate occasions or momentary disruptions in provide chains. Subsequently, it is important to investigate developments over a number of quarters somewhat than specializing in single information factors.

- Comparability with different indicators: Analyzing the quarterly GDP chart together with different financial indicators, similar to employment information, inflation charges, shopper confidence indices, and industrial manufacturing, offers a extra complete understanding of the financial scenario.

Significance of Quarterly GDP Charts:

Quarterly GDP charts are invaluable instruments for numerous stakeholders:

- Policymakers: Governments use GDP information to observe financial efficiency and inform coverage choices. A slowing economic system would possibly immediate fiscal stimulus measures, whereas speedy inflation would possibly necessitate financial coverage changes.

- Central Banks: Central banks rely closely on GDP information to evaluate the well being of the economic system and make choices about rates of interest. Rate of interest changes goal to affect inflation and employment ranges, finally impacting GDP development.

- Companies: Companies use GDP information to anticipate market demand, plan investments, and make hiring choices. A powerful GDP suggests strong shopper demand, whereas a weak GDP would possibly sign a necessity for cost-cutting measures.

- Buyers: Buyers use GDP information to evaluate the chance and return potential of varied investments. A rising economic system typically helps increased inventory costs and bond yields, whereas a contracting economic system would possibly result in market volatility.

Limitations of Quarterly GDP Charts:

Whereas extremely helpful, quarterly GDP charts have limitations:

- Knowledge Revisions: Preliminary GDP estimates are sometimes revised as extra full information turns into accessible. These revisions can typically be important, highlighting the inherent uncertainty related to financial information.

- Accuracy: GDP measurement is inherently advanced, and inaccuracies can come up on account of information assortment challenges, methodological limitations, and the problem in capturing the worth of the casual economic system.

- Lagging Indicator: GDP information is a lagging indicator, that means it displays previous financial exercise somewhat than offering a real-time snapshot of the present scenario. Different indicators, similar to shopper confidence or manufacturing surveys, present extra well timed insights into present financial circumstances.

- Would not Seize Inequality: GDP figures do not present a whole image of societal well-being. A excessive GDP would possibly masks important earnings inequality or environmental degradation.

Conclusion:

Quarterly GDP charts present an important window into the dynamics of a nation’s economic system. By meticulously analyzing these charts together with different financial indicators and acknowledging their limitations, economists, policymakers, companies, and traders can achieve useful insights into financial developments, anticipate future challenges, and make knowledgeable choices. Understanding the nuances of those charts is essential for navigating the complexities of the fashionable financial panorama and fostering sustainable financial development. The continuing refinement of information assortment strategies and analytical strategies guarantees to additional improve the accuracy and usefulness of quarterly GDP charts within the years to return, making them an indispensable device for understanding and shaping the worldwide economic system.

/bnn/media/media_files/3402357da85ec0765612d61b3192a0fa17b1fd50fafdb5c14abfd5c5a74a3cb9.jpg)

Closure

Thus, we hope this text has offered useful insights into Decoding the Quarterly GDP Chart: A Deep Dive into Financial Fluctuations. We thanks for taking the time to learn this text. See you in our subsequent article!