Decoding the US GDP Chart: A Quarterly Evaluation

Associated Articles: Decoding the US GDP Chart: A Quarterly Evaluation

Introduction

With enthusiasm, let’s navigate by the intriguing matter associated to Decoding the US GDP Chart: A Quarterly Evaluation. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the US GDP Chart: A Quarterly Evaluation

America’ Gross Home Product (GDP) is essentially the most complete measure of the nation’s financial output. Monitoring its quarterly efficiency offers essential insights into the well being of the financial system, revealing traits in shopper spending, enterprise funding, authorities exercise, and web exports. This text delves into the intricacies of the US GDP chart, exploring its parts, historic traits, influencing components, and the importance of decoding its fluctuations.

Understanding the GDP Chart:

The US GDP chart usually presents quarterly information, visually representing the nominal or actual GDP progress price over time. Nominal GDP displays the present market worth of all items and companies produced, whereas actual GDP adjusts for inflation, offering a clearer image of precise financial progress. The chart typically makes use of a line graph, with the x-axis representing time (quarters) and the y-axis representing the GDP progress price (typically expressed as a proportion change from the earlier quarter or yr). Constructive progress signifies growth, whereas unfavorable progress signifies contraction (recession). Key options to look at embrace:

- Progress Fee: The slope of the road signifies the speed of financial progress. A steeper constructive slope signifies quicker progress, whereas a flatter slope signifies slower progress. A unfavorable slope signifies a contraction.

- Turning Factors: Peaks and troughs signify vital shifts within the financial cycle. Peaks mark the top of an expansionary part, whereas troughs mark the top of a recession.

- Pattern Line: A development line might be added to the chart to visualise the long-term progress trajectory of the financial system, smoothing out short-term fluctuations.

- Information Revisions: It is essential to keep in mind that GDP information is topic to revisions. Preliminary estimates are sometimes revised as extra full information turns into out there.

Parts of GDP:

Understanding the parts of GDP is important for decoding the chart. The US GDP is calculated utilizing the expenditure strategy, which sums the next parts:

- Consumption (C): That is the most important part, representing family spending on items and companies. It contains sturdy items (automobiles, home equipment), non-durable items (meals, clothes), and companies (healthcare, training). Fluctuations in shopper confidence and disposable earnings considerably influence consumption.

- Funding (I): This encompasses enterprise spending on capital items (equipment, gear), residential funding (new housing development), and adjustments in inventories. Funding is very delicate to rates of interest, enterprise expectations, and technological developments.

- Authorities Spending (G): This contains spending by federal, state, and native governments on items and companies. It excludes switch funds like Social Safety and unemployment advantages. Authorities spending generally is a highly effective device for exciting or stabilizing the financial system.

- Internet Exports (NX): That is the distinction between exports (items and companies offered to different international locations) and imports (items and companies purchased from different international locations). A constructive web export contributes positively to GDP, whereas a unfavorable web export subtracts from GDP.

Historic Developments and Financial Cycles:

The US GDP chart reveals a sample of cyclical fluctuations, characterised by durations of growth and contraction. Because the early 2000s, the US financial system has skilled a number of vital occasions mirrored within the GDP chart:

- The Dot-com Bubble Burst (early 2000s): This era noticed a pointy decline in funding and a subsequent recession.

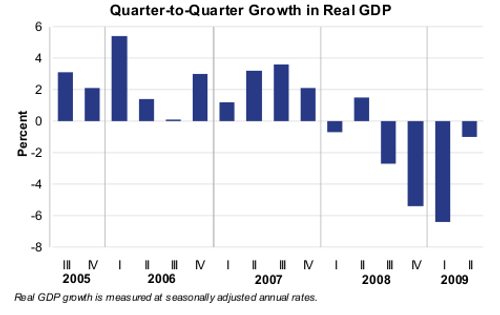

- The Nice Recession (2007-2009): The subprime mortgage disaster triggered a extreme international recession, marked by a dramatic drop in GDP and excessive unemployment. The chart clearly reveals the numerous unfavorable progress throughout this era.

- Put up-Recession Restoration (2010-2019): The financial system skilled a sluggish however regular restoration, with gradual GDP progress. Nonetheless, this restoration was uneven, with some sectors recovering quicker than others.

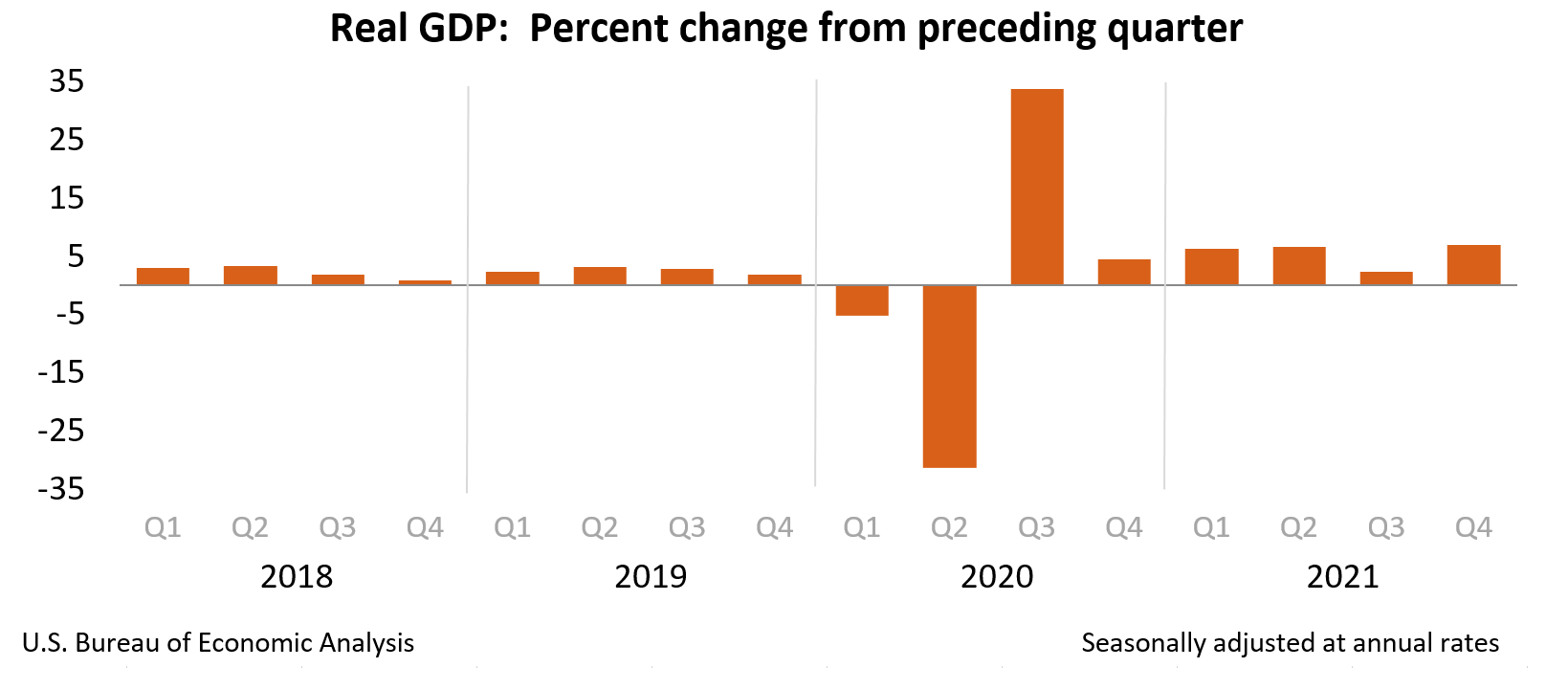

- The COVID-19 Pandemic (2020): The pandemic brought about the sharpest GDP contraction in US historical past, as lockdowns and financial uncertainty severely impacted all parts of GDP.

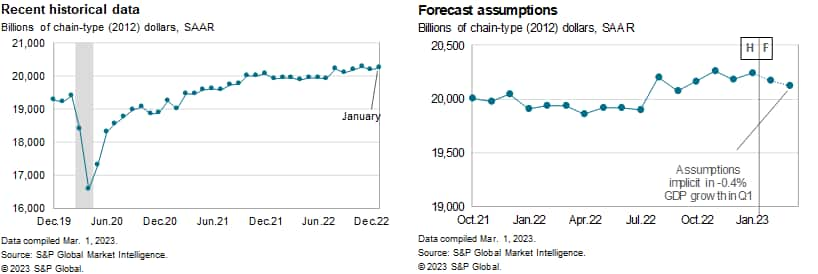

- Put up-Pandemic Restoration and Inflation (2021-Current): The financial system rebounded strongly in 2021, however this restoration was accompanied by vital inflationary pressures. The chart displays this risky interval, with sturdy progress adopted by considerations about overheating.

Influencing Components:

Quite a few components affect the quarterly fluctuations within the US GDP chart:

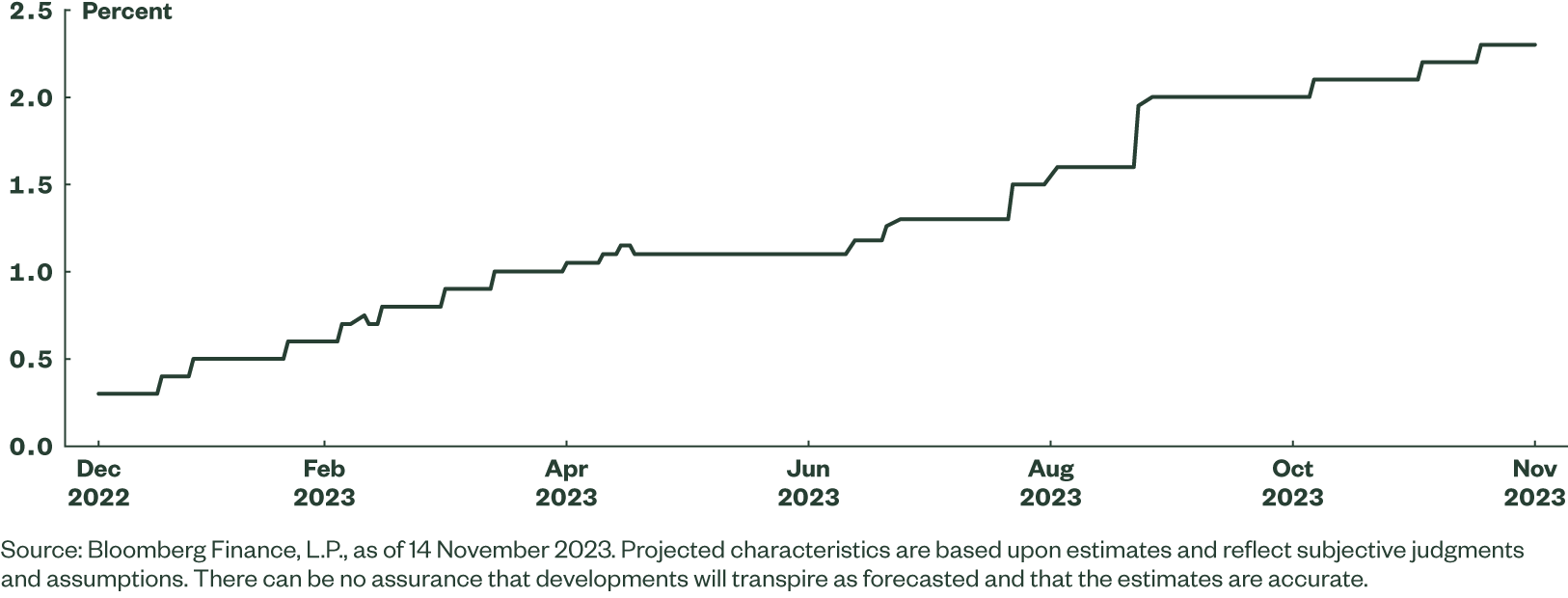

- Financial Coverage: The Federal Reserve’s actions, comparable to adjusting rates of interest and managing the cash provide, considerably influence funding, consumption, and inflation.

- Fiscal Coverage: Authorities spending and taxation insurance policies can stimulate or restrain financial exercise.

- World Financial Circumstances: Worldwide commerce, international monetary markets, and geopolitical occasions can have an effect on US GDP by web exports and funding.

- Technological Innovation: Technological developments can increase productiveness and drive financial progress.

- Client Confidence: Client sentiment and expectations in regards to the future considerably affect consumption.

- Oil Costs: Fluctuations in oil costs can influence manufacturing prices and inflation, affecting numerous sectors of the financial system.

- Labor Market Circumstances: Unemployment charges, wage progress, and labor power participation charges affect consumption and funding.

Deciphering the Chart and its Significance:

Analyzing the US GDP chart requires cautious consideration of assorted components. Merely wanting on the progress price is inadequate. It is essential to grasp:

- The context: Take into account the broader financial surroundings, together with inflation, unemployment, and international circumstances.

- The composition of progress: Study the contributions of every part of GDP (consumption, funding, authorities spending, and web exports) to grasp the drivers of progress or contraction.

- The sustainability of progress: Fast progress won’t be sustainable if it is pushed by unsustainable components like extreme debt or unsustainable consumption.

- The potential for future progress: Take into account components that may affect future GDP progress, comparable to technological innovation, demographics, and coverage adjustments.

The US GDP chart is a crucial device for policymakers, companies, and traders. It offers a complete overview of the nation’s financial well being, enabling knowledgeable decision-making. By understanding the parts of GDP, historic traits, influencing components, and the nuances of interpretation, one can acquire invaluable insights into the present state and future prospects of the US financial system. Usually monitoring the GDP chart, alongside different financial indicators, is essential for navigating the complexities of the financial panorama. Moreover, understanding the revisions and limitations of the information is essential for correct and nuanced evaluation. The GDP chart, whereas a strong device, is just one piece of the puzzle in comprehending the dynamic nature of the US financial system.

Closure

Thus, we hope this text has supplied invaluable insights into Decoding the US GDP Chart: A Quarterly Evaluation. We hope you discover this text informative and helpful. See you in our subsequent article!