Decoding the USD/MYR Alternate Charge: A Complete Chart Evaluation

Associated Articles: Decoding the USD/MYR Alternate Charge: A Complete Chart Evaluation

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the USD/MYR Alternate Charge: A Complete Chart Evaluation. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the USD/MYR Alternate Charge: A Complete Chart Evaluation

The trade price between the USA greenback (USD) and the Malaysian ringgit (MYR) is a dynamic indicator reflecting the interaction of varied financial, political, and world components. Understanding the historic developments and present fluctuations of this pair is essential for companies, buyers, and people concerned in cross-border transactions or holding belongings denominated in both foreign money. This text delves right into a complete evaluation of the USD/MYR trade price chart, exploring its historic trajectory, key influencing components, and potential future implications.

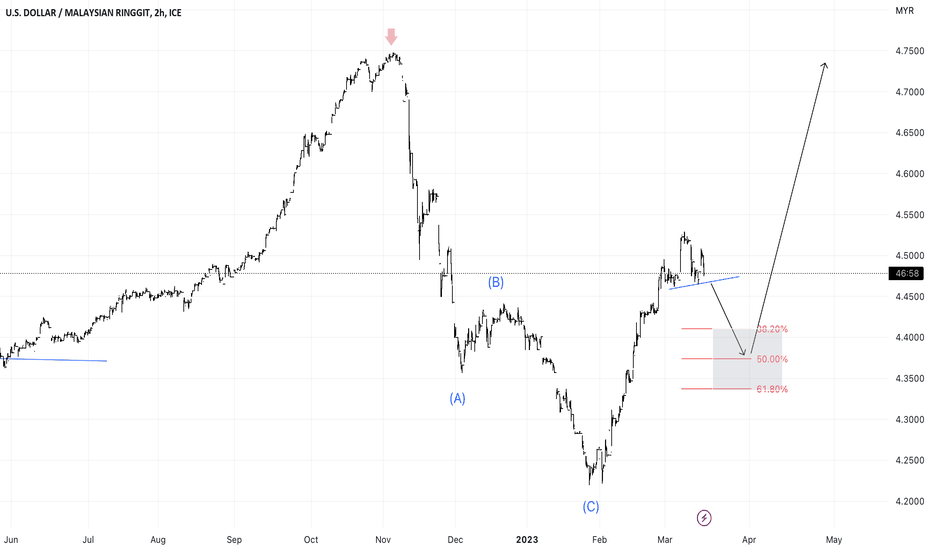

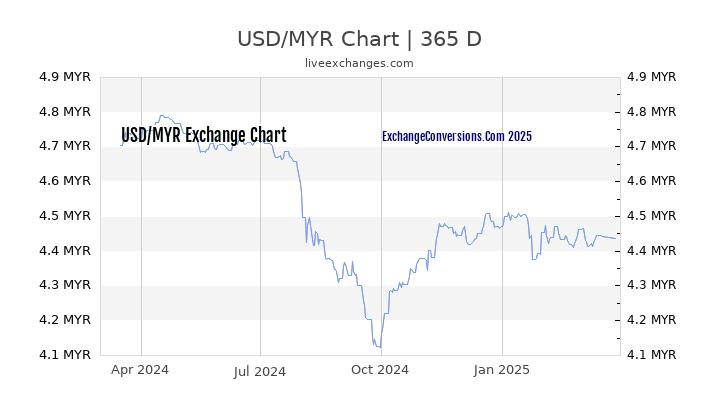

Historic Perspective: A Rollercoaster Trip

A look at a historic USD/MYR trade price chart reveals a captivating narrative. The ringgit’s worth has fluctuated significantly since its introduction in 1967, experiencing durations of relative stability and vital volatility. The interval following the 1997-98 Asian Monetary Disaster is especially instructive. The ringgit underwent a pointy devaluation towards the USD, reflecting the area’s financial turmoil and the following capital flight. This era serves as a stark reminder of the vulnerability of rising market currencies to world financial shocks.

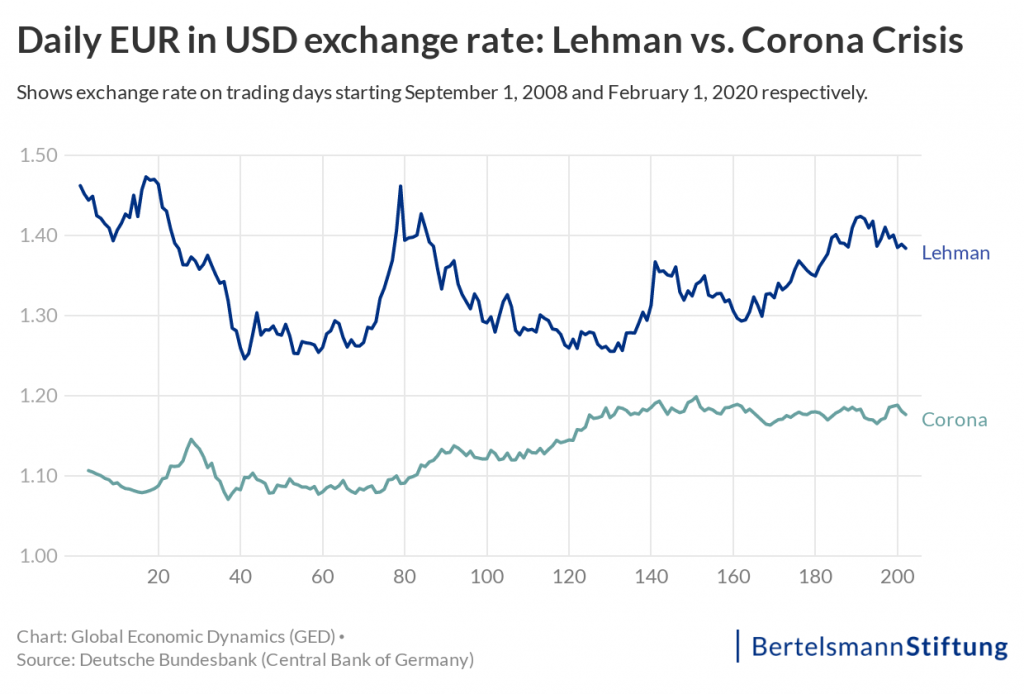

The chart will sometimes present a gradual appreciation of the USD towards the MYR within the years following the disaster, with durations of relative calm interspersed with bouts of uncertainty pushed by components equivalent to world commodity costs (crude oil being significantly related for Malaysia), rate of interest differentials between the US and Malaysia, and political developments each domestically and internationally. The 2008 world monetary disaster additionally left its mark, inflicting additional volatility within the USD/MYR trade price.

Key Elements Influencing the USD/MYR Alternate Charge

A number of interconnected components contribute to the fluctuations noticed within the USD/MYR trade price chart:

-

International Financial Circumstances: International financial progress and recessionary durations considerably impression the worth of each currencies. A powerful US economic system usually strengthens the USD, placing downward strain on the MYR. Conversely, world financial uncertainty typically results in capital flight in the direction of safe-haven currencies just like the USD, additional weakening the MYR.

-

US Financial Coverage: The Federal Reserve’s (Fed) financial coverage choices, significantly rate of interest changes, have a direct impression on the USD’s worth. Rate of interest hikes sometimes strengthen the USD, making it extra engaging to overseas buyers searching for increased returns. Conversely, rate of interest cuts weaken the USD. The chart will typically present a correlation between Fed price adjustments and subsequent actions within the USD/MYR trade price.

-

Malaysian Financial Coverage: Financial institution Negara Malaysia (BNM), the central financial institution of Malaysia, additionally performs an important function in influencing the MYR’s worth by its financial coverage choices. Rate of interest changes, interventions within the overseas trade market, and different coverage measures geared toward managing inflation and sustaining trade price stability all have an effect on the USD/MYR trade price. Intervals of aggressive financial tightening by BNM is perhaps mirrored in a strengthening MYR relative to the USD on the chart.

-

Commodity Costs: Malaysia is a big exporter of commodities, significantly crude oil and palm oil. Fluctuations in world commodity costs straight impression Malaysia’s export earnings and, consequently, the MYR’s worth. Increased commodity costs usually strengthen the MYR, whereas decrease costs weaken it. The chart will typically present a optimistic correlation between commodity costs and the MYR’s worth towards the USD.

-

Political and Geopolitical Elements: Political stability and financial coverage certainty are essential for attracting overseas funding. Political uncertainty or instability in both the US or Malaysia can result in capital flight and elevated volatility within the USD/MYR trade price. Main geopolitical occasions, equivalent to wars or commerce disputes, also can considerably impression the trade price. Sharp actions on the chart typically coincide with main political or geopolitical developments.

-

Commerce Stability: Malaysia’s commerce stability, the distinction between its exports and imports, additionally influences the MYR’s worth. A commerce surplus, the place exports exceed imports, usually strengthens the MYR, whereas a commerce deficit weakens it. Lengthy-term developments within the commerce stability can be mirrored within the long-term pattern of the USD/MYR trade price on the chart.

-

Investor Sentiment: Market sentiment performs a big function in figuring out the USD/MYR trade price. Optimistic investor sentiment in the direction of Malaysia’s economic system typically results in capital inflows, strengthening the MYR. Conversely, detrimental sentiment results in capital outflows and weakens the MYR. That is typically mirrored in short-term fluctuations on the chart.

Analyzing the USD/MYR Chart: Methods and Interpretations

Analyzing the USD/MYR trade price chart requires understanding numerous technical and elementary evaluation methods. Technical evaluation focuses on figuring out patterns and developments within the chart’s value actions, utilizing indicators equivalent to transferring averages, relative power index (RSI), and assist and resistance ranges. Basic evaluation, then again, considers the underlying financial and political components influencing the trade price.

By combining each approaches, analysts can develop a extra complete understanding of the USD/MYR trade price’s seemingly future trajectory. For instance, observing a constant upward pattern within the chart alongside optimistic financial indicators for the US and detrimental indicators for Malaysia would possibly counsel a continuation of the USD’s appreciation towards the MYR.

Future Outlook and Implications

Predicting future trade price actions is inherently difficult, as quite a few unpredictable components can affect the market. Nevertheless, by fastidiously analyzing the historic developments, present financial circumstances, and anticipated coverage adjustments, one can type an inexpensive outlook. As an illustration, continued rate of interest hikes by the Fed may put additional strain on the MYR, whereas sturdy progress in Malaysia’s export sector may present some assist to the ringgit.

The USD/MYR trade price has vital implications for numerous stakeholders:

-

Companies: Corporations concerned in worldwide commerce must fastidiously handle their publicity to trade price threat. Fluctuations within the USD/MYR trade price can considerably impression their profitability and competitiveness.

-

Traders: Traders holding belongings denominated in both USD or MYR want to know the dangers and alternatives related to trade price actions. Hedging methods is perhaps essential to mitigate potential losses.

-

Vacationers: Vacationers touring between the US and Malaysia will discover that the trade price straight impacts their spending energy. A stronger USD makes journey to Malaysia cheaper for US vacationers, whereas a weaker USD makes it dearer.

Conclusion:

The USD/MYR trade price chart is a fancy and dynamic illustration of the interaction between numerous financial, political, and world components. Understanding the historic developments, key influencing components, and analytical methods is crucial for navigating the complexities of this important trade price. By fastidiously monitoring the chart and staying knowledgeable about related developments, people and companies could make knowledgeable choices and successfully handle their publicity to trade price threat. Whereas predicting future actions with certainty is unattainable, a radical understanding of the components at play permits for a extra knowledgeable and nuanced perspective on the long run trajectory of the USD/MYR trade price.

Closure

Thus, we hope this text has supplied precious insights into Decoding the USD/MYR Alternate Charge: A Complete Chart Evaluation. We hope you discover this text informative and useful. See you in our subsequent article!