T-Chart Accounting: A Complete Information with Sensible Examples

Associated Articles: T-Chart Accounting: A Complete Information with Sensible Examples

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to T-Chart Accounting: A Complete Information with Sensible Examples. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

T-Chart Accounting: A Complete Information with Sensible Examples

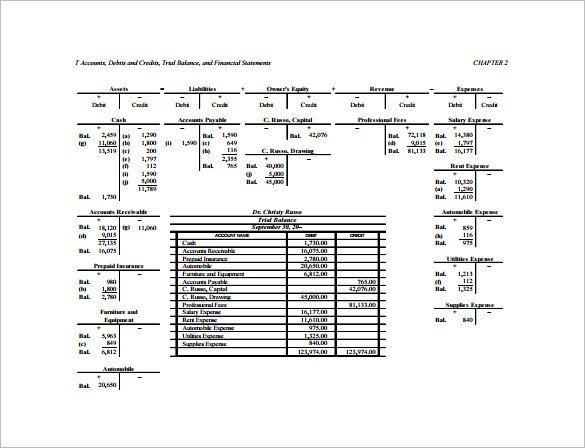

The T-chart, a easy but highly effective accounting software, serves as a foundational component for understanding elementary accounting ideas. Its visible illustration mirrors the essential accounting equation – Property = Liabilities + Fairness – providing a transparent and concise method to observe monetary transactions and preserve a balanced document. Whereas seemingly rudimentary, mastering the T-chart is essential for greedy extra complicated accounting ideas and growing sturdy bookkeeping expertise. This text supplies a complete exploration of T-charts, together with varied sensible examples to solidify your understanding.

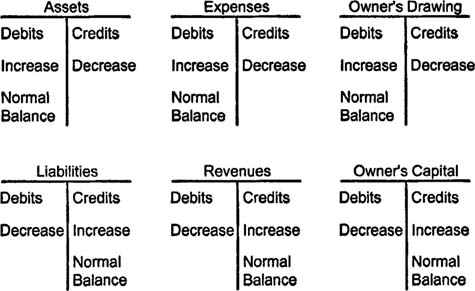

Understanding the T-Chart Construction

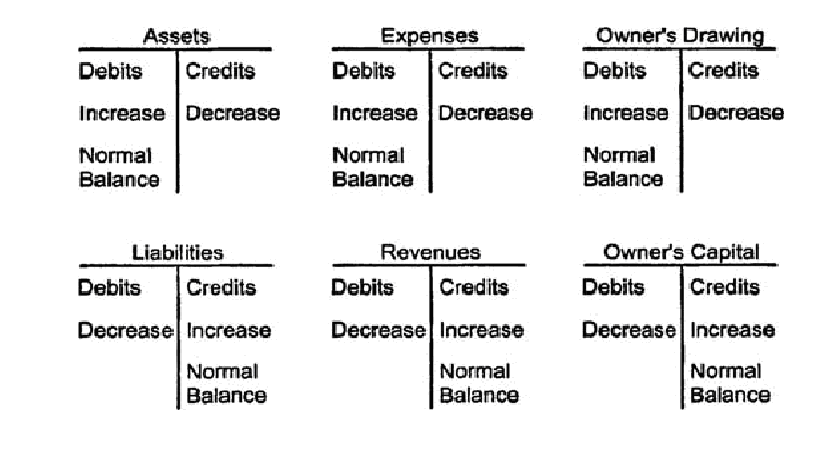

The T-chart derives its identify from its visible resemblance to the letter "T." It is composed of three distinct sections:

-

Debits (Left Aspect): This column information will increase in property and bills, and reduces in liabilities, fairness, and income. Consider debits as representing cash flowing out of the enterprise for bills or into the enterprise as property.

-

Credit (Proper Aspect): This column information will increase in liabilities, fairness, and income, and reduces in property and bills. Credit signify cash flowing into the enterprise as liabilities, fairness, or income, or out of the enterprise as a lower in property.

-

Account Identify: Situated on the prime of the T-chart, this clearly identifies the precise account being tracked (e.g., Money, Accounts Receivable, Accounts Payable, Lease Expense).

The Elementary Accounting Equation and the T-Chart

The T-chart’s effectiveness stems from its direct illustration of the elemental accounting equation:

Property = Liabilities + Fairness

Each transaction impacts not less than two accounts, sustaining the steadiness of this equation. If one facet will increase, the opposite facet should enhance or lower proportionally to maintain the equation in equilibrium. The T-chart visually demonstrates this steadiness. For example, if a enterprise purchases gear with money, the money account (asset) decreases (credit score), and the gear account (asset) will increase (debit). The online impact on the accounting equation stays unchanged.

Examples of T-Chart Functions

Let’s delve into a number of sensible examples demonstrating the appliance of T-charts in varied accounting situations:

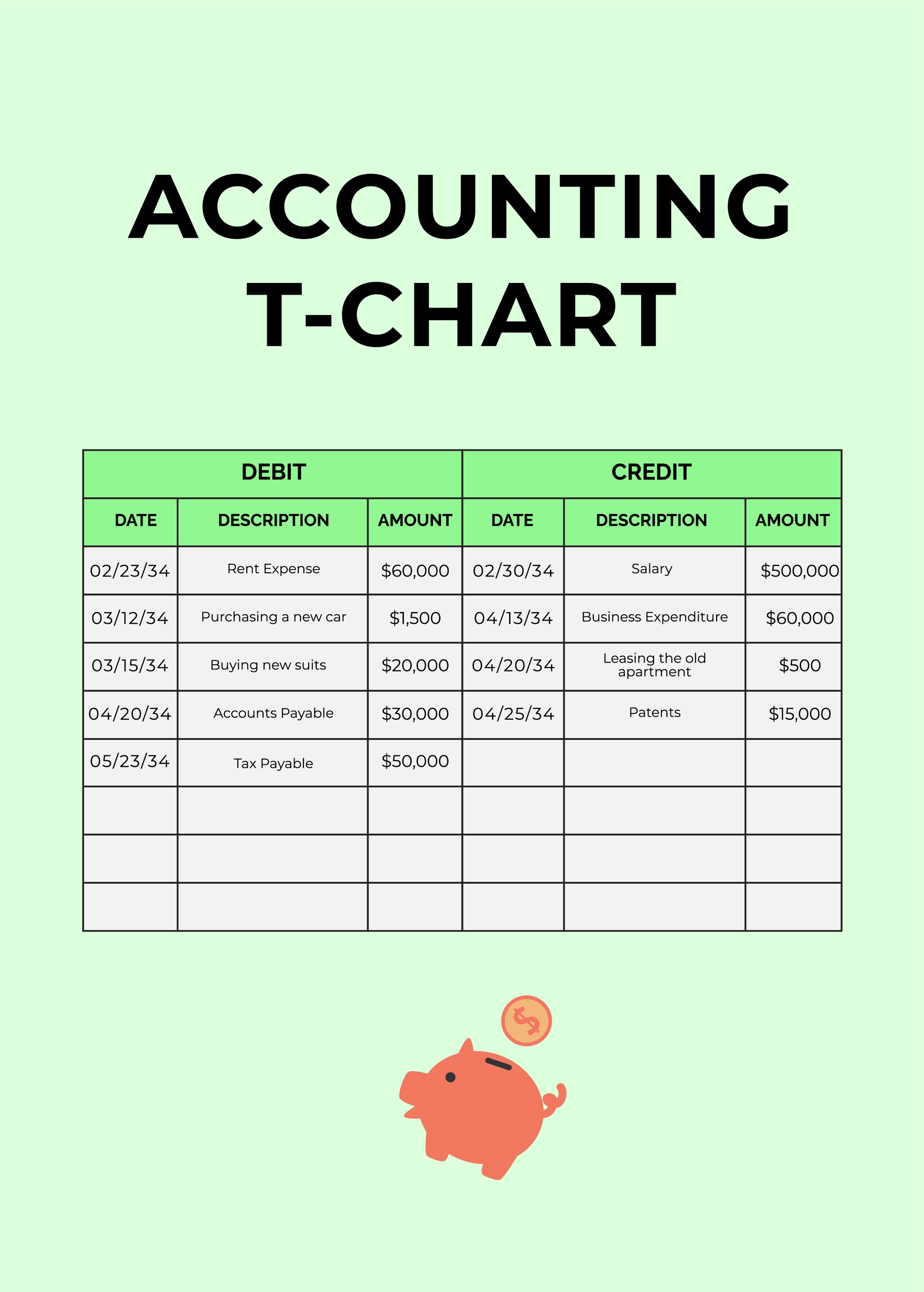

Instance 1: Money Transactions

Think about a small enterprise, "ABC Firm," begins with $10,000 in money. Let’s observe the next transactions:

-

Transaction 1: ABC Firm purchases workplace provides for $500 money.

-

Transaction 2: ABC Firm receives $2,000 money from a buyer for companies rendered.

-

Transaction 3: ABC Firm pays $1,000 hire in money.

Money T-Chart:

| Money | |

|---|---|

| Debits | Credit |

| $10,000 (Starting Stability) | |

| $500 (Workplace Provides Buy) | |

| $2,000 (Buyer Cost) | |

| $1,000 (Lease Cost) | |

| Ending Stability: $10,500 | Ending Stability: $10,500 |

On this instance, the start steadiness is recorded as a debit. The acquisition of workplace provides decreases money (credit score), whereas receiving buyer funds will increase money (debit). Lease fee additional reduces money (credit score). The ultimate balances on either side are equal, demonstrating the balanced nature of the accounting equation.

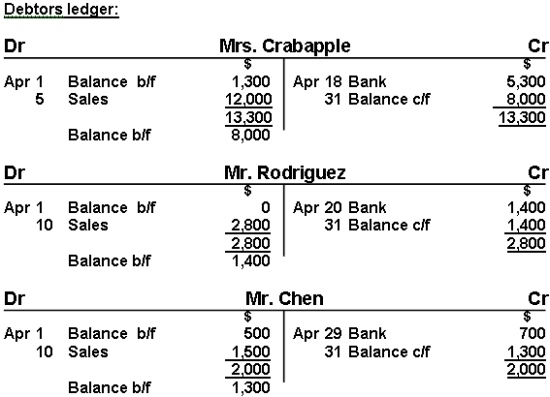

Instance 2: Accounts Receivable and Income

ABC Firm supplies companies to a consumer for $3,000 however would not obtain rapid fee. This creates an account receivable.

Accounts Receivable T-Chart:

| Accounts Receivable | |

|---|---|

| Debits | Credit |

| $3,000 (Providers Rendered) | |

| Ending Stability: $3,000 | Ending Stability: $0 |

Income T-Chart:

| Service Income | |

|---|---|

| Debits | Credit |

| $3,000 (Providers Rendered) | |

| Ending Stability: $0 | Ending Stability: $3,000 |

Right here, the service rendered will increase accounts receivable (debit) as it is a future money influx. Concurrently, it will increase service income (credit score).

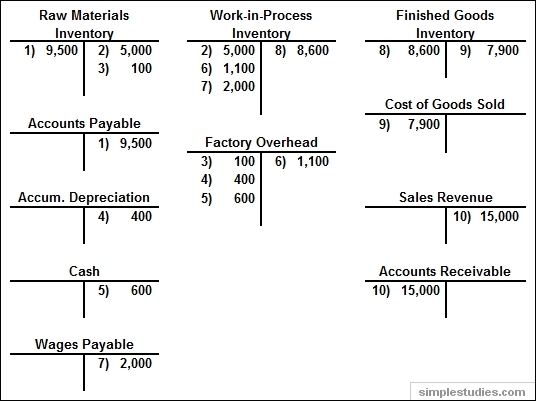

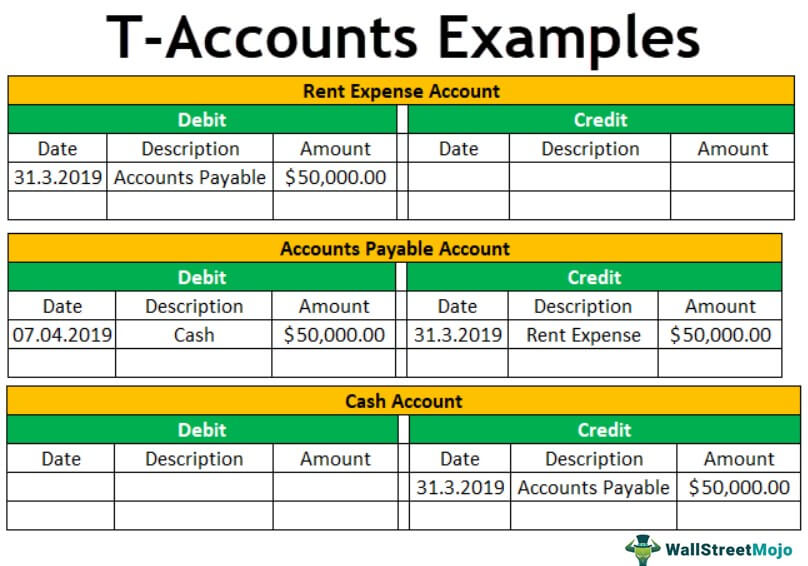

Instance 3: Accounts Payable and Bills

ABC Firm purchases $800 value of stock on credit score.

Accounts Payable T-Chart:

| Accounts Payable | |

|---|---|

| Debits | Credit |

| $800 (Stock Buy) | |

| Ending Stability: $0 | Ending Stability: $800 |

Stock T-Chart:

| Stock | |

|---|---|

| Debits | Credit |

| $800 (Stock Buy) | |

| Ending Stability: $800 | Ending Stability: $0 |

This transaction will increase stock (asset, debit) and accounts payable (legal responsibility, credit score). The acquisition is on credit score, which means ABC Firm owes cash to its provider.

Instance 4: Proprietor’s Fairness

ABC Firm’s proprietor invests a further $5,000 into the enterprise.

Proprietor’s Fairness T-Chart:

| Proprietor’s Fairness | |

|---|---|

| Debits | Credit |

| $5,000 (Proprietor Funding) | |

| Ending Stability: $0 | Ending Stability: $5,000 |

This will increase the proprietor’s fairness (credit score) reflecting a rise within the enterprise’s capital.

Limitations of T-Charts

Whereas T-charts are worthwhile for visualizing fundamental transactions, they’ve limitations:

- Simplicity: They don’t seem to be appropriate for complicated transactions or large-scale bookkeeping.

- Lack of Element: They do not present the extent of element required for complete monetary reporting.

- Handbook Course of: Handbook creation might be time-consuming and vulnerable to errors for quite a few transactions.

Past T-Charts: Accounting Software program and Double-Entry Bookkeeping

For extra superior accounting wants, companies depend on accounting software program and the double-entry bookkeeping system. Double-entry bookkeeping ensures that each transaction is recorded with a debit and a credit score entry, sustaining the elemental accounting equation’s steadiness. Accounting software program automates this course of, considerably lowering the danger of errors and offering detailed stories. Nonetheless, understanding the ideas behind T-charts stays important for greedy the underlying mechanics of double-entry bookkeeping.

Conclusion

T-charts provide a elementary understanding of accounting ideas. Their easy construction helps visualize the influence of transactions on the accounting equation. Whereas they’ve limitations for complicated situations, mastering T-charts supplies a stable basis for comprehending extra subtle accounting strategies and software program. By understanding the debit and credit score guidelines and their influence on property, liabilities, and fairness, you may lay a powerful groundwork in your accounting journey. Do not forget that constant follow with varied transaction examples is vital to solidifying your understanding of this important accounting software.

Closure

Thus, we hope this text has supplied worthwhile insights into T-Chart Accounting: A Complete Information with Sensible Examples. We hope you discover this text informative and helpful. See you in our subsequent article!