y chart t invoice 1 12 months price vs bond price

Associated Articles: y chart t invoice 1 12 months price vs bond price

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to y chart t invoice 1 12 months price vs bond price. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Navigating the Yield Curve: A Deep Dive into 1-12 months Treasury Invoice Charges vs. Bond Charges

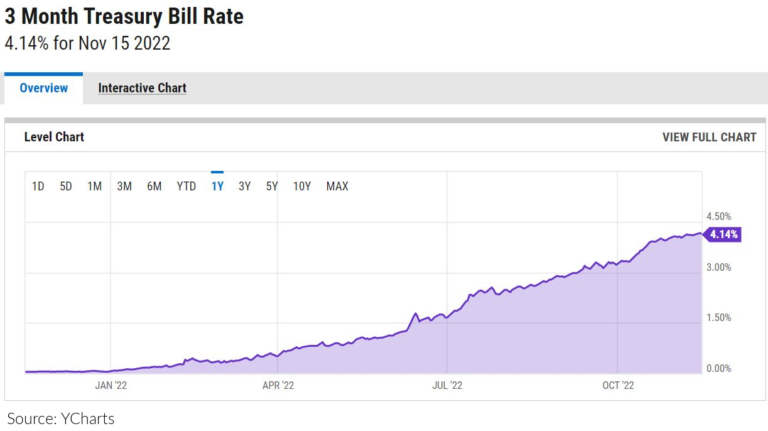

The yield curve, a graphical illustration of rates of interest throughout completely different maturities of comparable debt devices, is an important indicator of financial well being and future market expectations. A key phase of this curve compares the yields of short-term Treasury payments (particularly, 1-year T-bills) towards longer-term Treasury bonds. Understanding the connection between these two charges – the 1-year T-bill price and the longer-term bond price – supplies worthwhile insights into investor sentiment, inflation forecasts, and the potential course of rates of interest. This text will delve into the intricacies of this comparability, inspecting the elements that affect every price, their historic relationship, and the implications for buyers.

Understanding the Gamers: 1-12 months Treasury Payments and Treasury Bonds

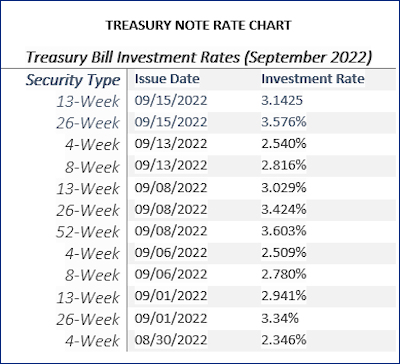

Earlier than evaluating the charges, let’s outline the devices concerned. United States Treasury payments (T-bills) are short-term debt securities issued by the U.S. authorities. They’re offered at a reduction to their face worth and mature at par, which means the investor receives the complete face worth at maturity. 1-year T-bills, because the title suggests, have a maturity of 1 12 months. They’re thought-about just about risk-free investments because of the backing of the U.S. authorities. Their yield is set by market forces of provide and demand, reflecting the prevailing short-term rate of interest surroundings.

Treasury bonds, alternatively, are long-term debt securities issued by the U.S. authorities with maturities starting from 10 to 30 years. Like T-bills, they’re thought-about very low-risk investments. Nonetheless, their longer maturities expose them to larger rate of interest threat – the chance that rates of interest will rise, decreasing the worth of the bond earlier than maturity. The yield on a Treasury bond displays the market’s expectations for future rates of interest over the bond’s total life, incorporating elements like inflation expectations, financial progress projections, and the general threat surroundings.

Elements Influencing 1-12 months T-Invoice Charges

A number of elements affect the yield on 1-year T-bills:

-

Federal Reserve Coverage: The Federal Reserve (the Fed), the central financial institution of the USA, performs a dominant function in setting short-term rates of interest. By means of its financial coverage instruments, primarily the federal funds price (the goal price for in a single day lending between banks), the Fed influences the general value of borrowing, instantly impacting the yield on T-bills. A tightening financial coverage (elevating rates of interest) usually results in larger T-bill yields, whereas an easing coverage (reducing charges) results in decrease yields.

-

Inflation Expectations: Inflation erodes the buying energy of cash. Traders demand a better yield on T-bills (and all investments) to compensate for the anticipated lack of buying energy attributable to inflation. Larger inflation expectations sometimes result in larger T-bill yields.

-

Financial Development: Robust financial progress typically results in elevated demand for credit score, pushing up rates of interest, together with T-bill yields. Conversely, weak financial progress can suppress demand and decrease yields.

-

Provide and Demand: Like every asset, the availability and demand for T-bills affect their value and, consequently, their yield. Elevated authorities borrowing (elevated provide) can put downward stress on costs and upward stress on yields, whereas lowered borrowing can have the other impact.

-

International Financial Circumstances: International financial occasions and uncertainties may affect T-bill yields. Intervals of world uncertainty typically lead buyers to hunt the protection of U.S. Treasury securities, rising demand and doubtlessly reducing yields.

Elements Influencing Treasury Bond Charges

The yield on longer-term Treasury bonds is influenced by a broader vary of things than 1-year T-bill charges:

-

Lengthy-Time period Inflation Expectations: Bond yields mirror the market’s expectations for inflation over your entire lifetime of the bond. Larger long-term inflation expectations will result in larger bond yields.

-

Financial Development Projections: Expectations for future financial progress considerably affect bond yields. Robust projected progress typically results in larger yields, reflecting elevated demand for credit score and better inflation expectations.

-

Curiosity Price Danger: Longer-term bonds are extra delicate to rate of interest adjustments than short-term bonds. If rates of interest rise, the worth of present longer-term bonds will fall, making buyers demand larger yields to compensate for this threat.

-

Credit score Danger (though minimal): Whereas thought-about low-risk, Treasury bonds nonetheless carry a small quantity of credit score threat, though that is usually negligible for U.S. authorities debt.

-

Provide and Demand: Much like T-bills, the availability and demand for Treasury bonds considerably affect their yields.

-

International Financial and Political Uncertainty: Geopolitical occasions and international financial instability can affect investor confidence, influencing the demand for safe-haven belongings like Treasury bonds. Elevated uncertainty can result in decrease yields as buyers flock to the perceived security of U.S. authorities debt.

The Relationship Between 1-12 months T-Invoice Charges and Bond Charges: The Yield Curve

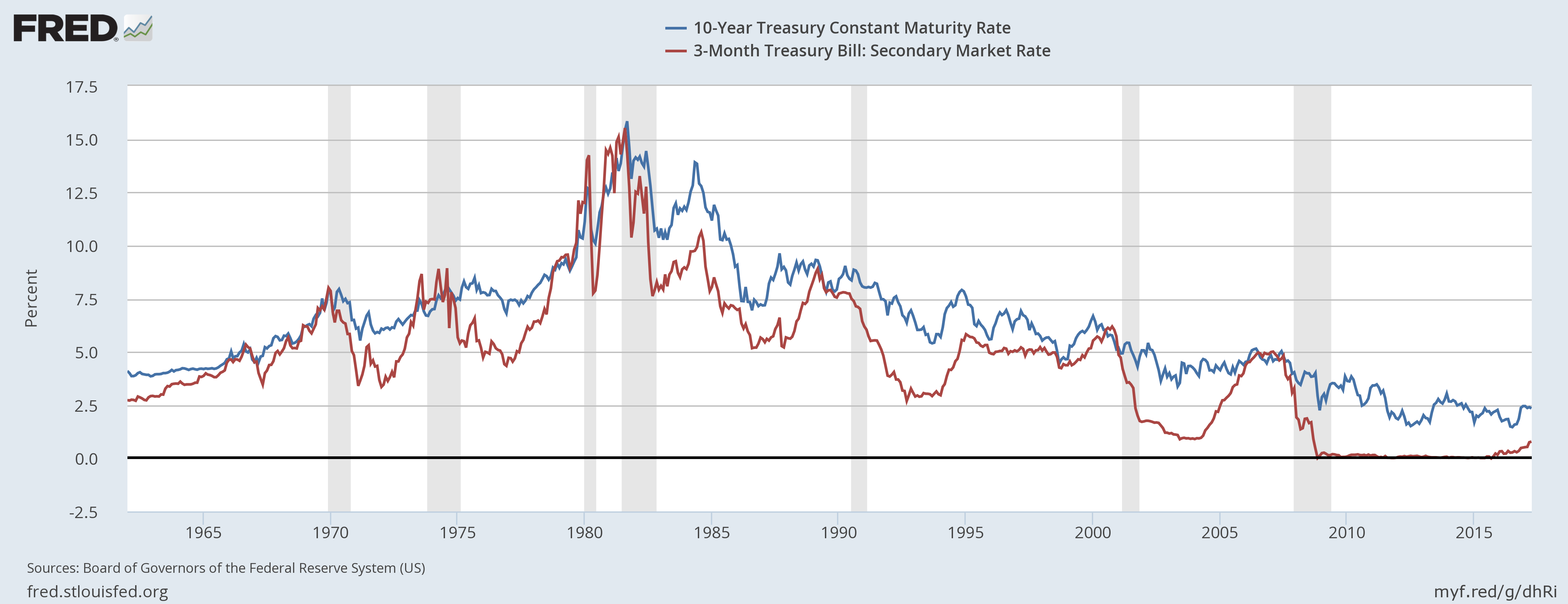

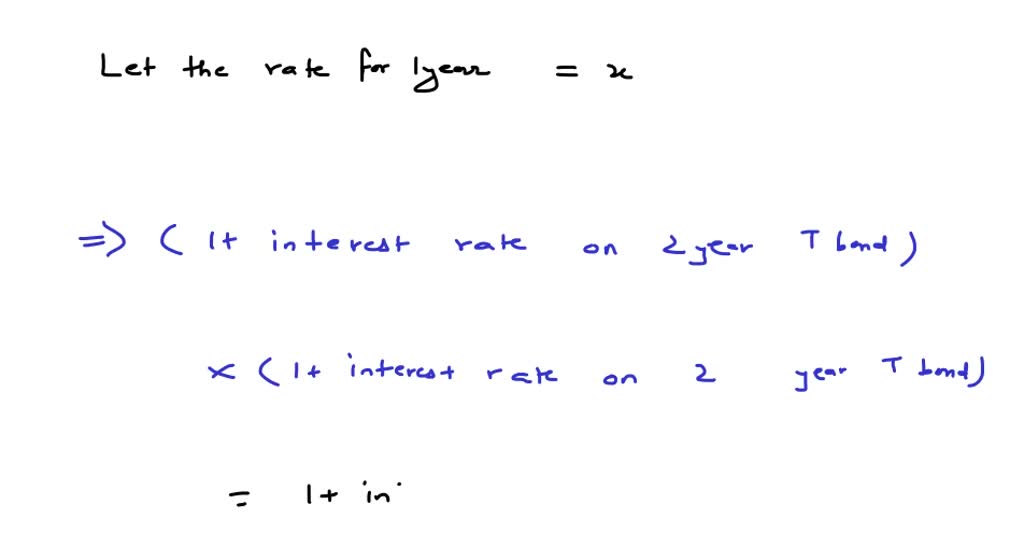

The connection between the 1-year T-bill price and the longer-term Treasury bond price is essential for understanding the form of the yield curve. A traditional yield curve is upward-sloping, which means longer-term bonds provide larger yields than shorter-term T-bills. This sometimes displays market expectations of upper future rates of interest and a optimistic outlook on financial progress.

An inverted yield curve, the place short-term charges exceed long-term charges, is usually thought-about a predictor of an financial recession. This inversion means that buyers anticipate future rate of interest cuts by the Fed, reflecting considerations about slowing financial progress or an impending recession. The market is actually pricing in a future the place short-term charges will fall, resulting in decrease long-term charges.

A flat yield curve, the place short-term and long-term charges are roughly equal, signifies uncertainty out there in regards to the future course of rates of interest.

Implications for Traders

Understanding the connection between 1-year T-bill charges and bond charges is essential for funding choices.

-

Fastened Revenue Traders: The yield curve supplies insights into potential returns and dangers related to completely different maturities. In a standard yield curve, buyers can doubtlessly earn larger returns by investing in longer-term bonds, however in addition they tackle larger rate of interest threat. In an inverted yield curve, the risk-reward trade-off is reversed, with shorter-term investments doubtlessly providing larger yields with much less threat.

-

Central Banks: The form of the yield curve supplies worthwhile data to central banks about market expectations and the effectiveness of their financial coverage. An inverted yield curve, for example, would possibly sign the necessity for extra aggressive easing measures.

-

Companies: Companies use the yield curve to evaluate the price of borrowing and make funding choices. A steep upward-sloping curve would possibly encourage companies to borrow at decrease short-term charges and spend money on long-term tasks.

Conclusion

The connection between 1-year Treasury invoice charges and longer-term Treasury bond charges, as mirrored within the yield curve, is a strong indicator of financial well being and market sentiment. By analyzing the elements influencing every price and understanding the completely different shapes the yield curve can take, buyers, central banks, and companies can acquire worthwhile insights into the present financial surroundings and make knowledgeable choices. Whereas the yield curve is just not an ideal predictor of future financial occasions, its evaluation stays an important software for navigating the complexities of the monetary markets. Steady monitoring of this relationship, coupled with a broader understanding of macroeconomic elements, is essential for profitable funding methods and knowledgeable financial policymaking.

Closure

Thus, we hope this text has supplied worthwhile insights into y chart t invoice 1 12 months price vs bond price. We thanks for taking the time to learn this text. See you in our subsequent article!